Orosur Mining Inc - Pepas moving into Mineral Resource Estimate drilling within wider exploration programme

Orosur moving to parallel streams - exploration and resource drilling.

Rig now infill drilling Pepas as precursor to MRE.

Decision based on positive conceptual studies.

Geological consultants on site to develop required geological models for both Pepas and APTA.

LONDON, UK / ACCESS Newswire / July 14, 2025 / Orosur Mining Inc. ("Orosur" or the "Company") (TSXV:OMI)(AIM:OMI), is pleased to announce an update on the progress of exploration activities at the Company's flagship Anzá Project ("Project") in Colombia.

The Company announces that it has taken the formal decision to begin a work program that, if successful, is designed to allow a Mineral Resource Estimate (MRE) to be calculated at its Pepas gold prospect, within the Anzá gold project area in Colombia.

This decision has been taken on the basis of external conceptual studies that suggest the location and physical characteristics of the gold mineralisation so far defined at Pepas, in the context of record high gold prices, may offer potential nearer term production opportunities.

This decision does not stop exploration at Pepas, the wider Anzá project or the Company's El Pantano project in Argentina. The Company is confident that both exploration and resource definition streams can be run in parallel within the limits of the Company's financial, human and technical resources. The primary impact is that the single drill rig currently employed on the Project has been diverted toward infill drilling within the current boundary of known high grade gold mineralisation at Pepas. During this time, geological studies and additional surface field work will be undertaken at Pepas and other prospects so that targets are ready for the rig to move back to regional exploration once the resource infill is completed.

Colombia - ANZÁ Project

The Anzá Project is now 100% owned by the Company following completion of a Share Purchase Agreement ("SPA"), announced 28th November 2024, whereby the Company purchased all of the shares of its previous JV partner; Minera Monte Aguila ("MMA").

The Project, which is located 50km west of Medellin, is easily accessible and boasts excellent infrastructure including water, power and communications as well as a large exploration camp.

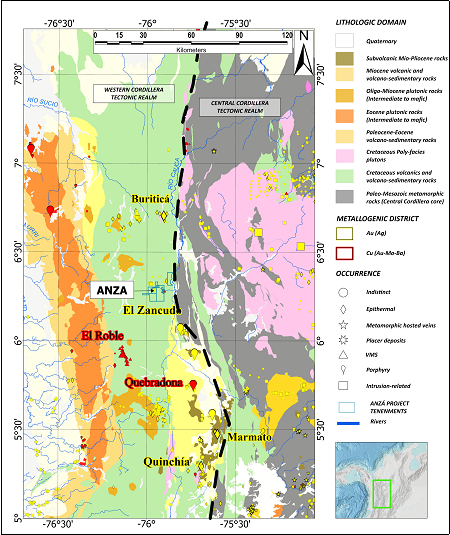

The Project sits within the prolific mid-Cauca belt, Colombia's primary gold belt, and is located along strike between several world class gold/copper deposits including Buritica, Quebradona and Guayabales/Marmato (Figure 1).

From September 2018 to November 2024, the Anzá Project was under the control of its previous JV partner MMA, itself a 50/50 venture between the world's two largest gold miners, Agnico Eagle Mines and Newmont Mining.

Figure 1. Mid-Cauca Belt

Prospects

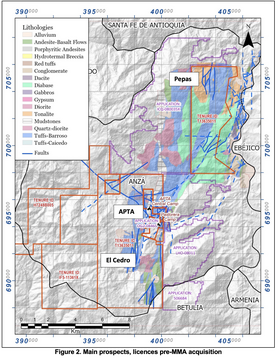

The Company is currently focussed on three prospects within the Anzá Project - Pepas, APTA and El Cedro. All three prospects are within the same granted exploration title that is broken into two non-contiguous pieces (Figure 2).

Drilling is currently being undertaken at the Pepas prospect in the northern extent of the Anzá Project (pre-acquisition) over 10km north of the central base camp at APTA. In parallel, mapping and sampling is being undertaken over the El Cedro porphyry system in the south of the project area.

Pepas and North Pepas Prospects

The Pepas prospect is in the far north of the Anzá project and was discovered by the Company's previous JV partners, MMA, in late 2021 by BLEG sampling and geological mapping, followed by 11 diamond drill holes in 2022 (PEP001 to PEP011).

After completion of the transaction to buy MMA, the Company restarted drilling at Pepas in late-November 2024.

Drilling commenced with hole PEP012, which was positioned to confirm previous high-grade results in holes PEP001, PEP005 and PEP007 drilled in 2022.

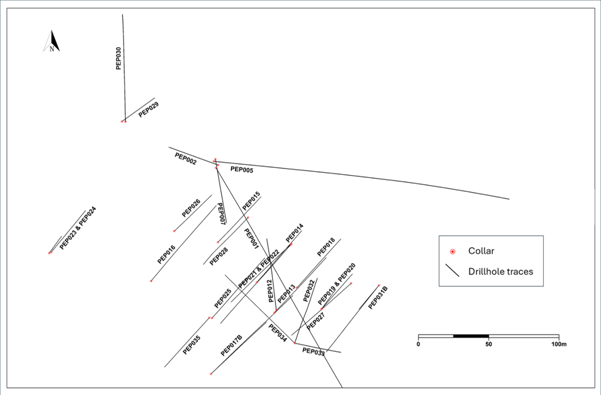

Since reassuming control of the Project in December 2024, the Company has released assay results from 26 holes (PEP012 to PEP037), most of which were concentrated in and around the central core of near-surface high-grade gold mineralisation.

Figure 3. Plan of holes, core Pepas zone.

This small, but thick and high-grade zone of mineralisation has developed very quickly since the Company reassumed control, and while the surrounding areas remain largely unexplored, the Company feels that what has thus far been defined is worthy of economic study, especially in the current gold price environment.

Geological Modelling and Economic Studies

As previously announced, encouraged by the exceptional results at the Pepas prospect, the Company has begun the process of geological modelling and preliminary economic assessment at Pepas.

The characteristics of Pepas that encouraged the Company to begin the process of conceptual study are its high grade, surficial nature, thickness, availability of power to site, proximity to the main regional highway without having to pass through villages, and the existence of numerous nearby mines and processing facilities that might offer the opportunity for third party toll treating.

The Company carried out its own internal geological resource models and high-level concept studies, the results of which the Company felt were sufficiently positive that it then engaged an external mineral consulting firm to model preliminary pit shells in order to assess if Pepas warranted further study. The results of this high-level conceptual study were positive and have led to the Company making the formal decision to examine Pepas in more detail, with the ultimate objective of determining if a near term production option can be developed at Pepas in its current form.

Resource Drilling

The first stage in this process is the creation of a Mineral Resource Estimate (MRE) at Pepas, that can then be used as the basis for later economic evaluation. To that end, one of the outputs of recent work was the development of an infill drilling plan that, if successful, could be sufficient to allow an MRE to be calculated. Ultimately, the amount of drilling required to develop an MRE will be subject to results and may be modified during the infill drilling process. However, at this preliminary stage, the Company feels that between 1,500m and 2,000m of additional drilling should be sufficient.

The single drill rig that the Company has on site at Anzá, has been moved back to infill drilling at Pepas. On current production rates, it is expected that this plan should be completed in November 2025, assuming no major modifications being necessary following analysis of results.

Once completed, subject to results and the availability of consultants for the required QAQC visits to the Project, the Company is targeting December 2025 for completion of this process and publishing of an MRE at Pepas.

Geological Assessment

In addition to drilling information, an MRE, in accordance with NI43-101, also requires a robust and defensible geological model to underpin the interpolation and extrapolation of information between and beyond drill holes. To date, the Company has not been able to develop such a model at Pepas due to the speed with which drilling and results have progressed since the Company reassumed control in December 2024. Drilling thus far has focussed on defining a shallow, potentially economic orebody, with Company drilling since December 2024 limited to some 80m vertical depth.

To satisfy this MRE requirement, an external geological consultant, specialising in structural geology and metamorphic petrology, has travelled to the Anzá project to spend several weeks with Company geological staff examining all of the historical drilling undertaken at Pepas and APTA since the Company acquired the project in late 2014.

The objectives of this visit and program are three-fold:

1. Develop a geological model to underpin a potential MRE at Pepas.

2. Understand the wider Pepas epithermal system, and in particular, define the litho-structural controls upon the exceptionally high-grade mineralised zone at Pepas and plan a targeting methodology to guide exploration toward finding repetitions and source feeder zones.

3. Develop a geological model to explain the controls upon the very high-grade mineralisation historically defined at the APTA deposit at Anzá to facilitate an MRE being defined at APTA.

APTA

The APTA deposit lies in the centre of the Anzá project and has been the subject of most exploration activity on the project, with some 38,000 metres of drilling having been completed.

APTA is thought to be a hybrid mineralised system with an earlier VMS system being overprinted by later epithermal events. However, most historical work at APTA has been undertaken either by the Company's predecessor (Waymar Resources) or by its previous JV partner (MMA), both of which focussed on drilling, with minimal geological interpretation.

Numerous thick, high-grade gold intersections have been recorded at APTA (Table 2), that have defined several distinct high-grade ore pods, separated by lower grade halo material. Internal and external modelling have suggested that a NI43-101 MRE could potentially be possible at APTA as it stands now, but with limited understanding of the controls upon these high-grade pods, any MRE would be conservative. Therefore, one of the objectives of the current geological site visit by, is to work with internal geological teams to better understand these high-grade zones and so allow any future MRE to better reflect the impact of these zones.

An outcome of this geological study may be the recommendation for more drilling to underpin this new geological model, and as such any move toward an MRE will be dependent upon outcomes of this study and any subsequent work programs.

Wider Exploration Work

As noted, moving Pepas toward an MRE is not a fundamental shift in the Company's direction, but rather a temporary adjustment to drilling priorities for several months. While this process is underway, field mapping and sampling will continue at other prospects in readiness for the rig moving back to exploration once the infill is complete.

Drilling at Pepas North and elsewhere in the Pepas region has indicated that Pepas is part of a much larger epithermal system consisting of wider scale low grade halo mineralisation and at least one discrete high-grade pod. One stated outcome of the current geological visit is to derive an understanding of the controls upon the high-grade zones, and as importantly, the likely source feeder zones. The outcome of this study will likely be a work program of surface sampling and mapping that may provide drill targets around Pepas.

As announced, soil sampling at the El Cedro porphyry system at Anzá has been delayed due to seasonal rains and road access issues. Sampling will recommence once access has been reestablished.

The Company's early stage El Pantano gold exploration project in Argentina is drill ready. The Company is currently negotiating with local drill companies and examining options for camps, with a view to commencing drilling before the end of the calendar year.

Best drill intersections at Pepas - previously announced

26 holes have been drilled at Pepas since the MMA transaction in November 2024.

Assay results are tabulated below.

Hole Number | From (m) | To (m) | Interval (m) | Au (g/t) |

PEP001 | 0 | 150 | 150 | 3 |

PEP005 | 0 | 36.85 | 36.85 | 2.13 |

PEP007 | 0 | 80.3 | 80.3 | 3.05 |

PEP012 | 0 | 66.75 | 66.75 | 5.64 |

PEP013 | 0 | 77.30 | 77.30 | 7.68 |

PEP014 | 0 | 75.1 | 75.1 | 5.58 |

PEP015 | 23.5 | 63.7 | 40.2 | 3.75 |

PEP016 | 61.6 | 105.3 | 43.7 | 3.13 |

PEP017 | 56.1 | 96.3 | 40.2 | 2.06 |

PEP018 | 0 | 54.1 | 54.1 | 6.01 |

PEP019 | 0 | 44.3 | 44.3 | 1.63 |

PEP020 | 0 | 54.65 | 54.65 | 1.94 |

PEP021 | 0 | 107.05 | 107.05 | 6.22 |

PEP022 | 0 | 76.3 | 76.3 | 7.24 |

PEP023 | 0 | 15 | 15 | 1.7 |

PEP024 | 9.24 | 15.6 | 6.35 | 1.99 |

PEP025 | 0 | 10.1 | 10.1 | 1.45 |

| 16.5 | 79 | 62.5 | 5.4 |

PEP026 | 0 | 14.8 | 14.8 | 0.57 |

| 43.6 | 72 | 28.4 | 2.52 |

PEP027 | 1 | 80.15 | 79.15 | 2.0 |

PEP028 | 29.5 | 60.85 | 31.35 | 1.61 |

PEP029 | 0 | 30.7 | 30.7 | 0.31 |

PEP030 | 0 | 77.9 | 77.9 | 0.32 |

| 115.6 | 122.6 | 7 | 0.31 |

PEP031B | 28.15 | 41.1 | 12.95 | 0.73 |

| 74.1 | 95.9 | 20.8 | 0.3 |

PEP032 | 0 | 92 | 92 | 1.68 |

PEP033 | 0 | 21.3 | 21.3 | 5.88 |

PEP034 | 36 | 95 | 59 | 10.15 |

PEP035 | 0 | 11.4 | 11.4 | 2.71 |

PEP036B | 0 | 40.45 | 40.45 | 0.62 |

PEP037 | 0 | 3 | 3 | 0.65 |

| 97.4 | 111.7 | 14.3 | 0.32 |

Table 1. Best drill intersections, Pepas.

Best drill intersections at APTA - previously announced.

Hole Number | From (m) | To (m) | Interval (m) | Au (g/t) |

MAP011 | 213 | 219 | 6 | 18.26 |

MAP020 | 145 | 186 | 41 | 18.26 |

MAP021 | 224 | 242 | 18 | 14.14 |

MAP033 | 157 | 179 | 22 | 10.42 |

MAP036 | 198 | 227 | 29 | 3.88 |

MAP038 | 172 | 212 | 40 | 14.09 |

MAP048 | 181 | 195 | 14 | 40.37 |

MAP054 | 41 | 59 | 18 | 2.96 |

| 97 | 110 | 13 | 4.36 |

| 144 | 149 | 5 | 17.76 |

MAP055 | 177 | 190 | 13 | 4.36 |

MAP060 | 217 | 240 | 23 | 5 |

MAP062 | 217 | 233 | 12 | 5.28 |

MAP070 | 221 | 233 | 12 | 5.28 |

| 284 | 298 | 14 | 5.02 |

| 286 | 292 | 6 | 9.62 |

MAP072 | 184 | 255 | 71 | 3.53 |

MAP073 | 271 | 293 | 22 | 6.02 |

MAP076 | 228 | 240 | 12 | 5.39 |

MAP079 | 270 | 294 | 24 | 17.4 |

MAP082 | 227 | 256 | 29 | 2.5 |

MAP086 | 179 | 183 | 4 | 6.12 |

| 215 | 234 | 19 | 2.85 |

MAP089 | 275 | 334 | 59 | 9.61 |

MAP090 | 180 | 186 | 6 | 9.91 |

MAP091 | 222 | 284 | 62 | 2.05 |

Table 2. Best intersections, APTA

Orosur CEO Brad George commented:

"The Company has made huge strides in the seven months since reassuming ownership and control of Anzá. To be now able to consider moving to a MRE and thence into feasibility in such a short space of time is unheard of, and testament to the tremendous work by our team on the ground."

For further information, visit www.orosur.ca, follow on X @orosurm or please contact:

Orosur Mining Inc

Louis Castro, Chairman,

Brad George, CEO

info@orosur.ca

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Joint Broker

Jeff Keating / Jen Clarke / Devik Mehta

Tel: +44 (0) 20 3470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker/James Pope

Tel: +44 (0)20 3657 0050

Flagstaff Communications and Investor Communications

Tim Thompson

Mark Edwards

Fergus Mellon

orosur@flagstaffcomms.com

Tel: +44 (0)207 129 1474

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has been incorporated into UK law by the European Union (Withdrawal) Act 2018. Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Drill Hole Details - Pepas prospect 2022/2024 Programme*

Hole ID | Easting (m) | Northing (m) | Elevation asl (m) | Dip (°) | Azimuth (°) |

PEP-001 | 403384 | 705000 | 1001 | -50 | 150 |

PEP-002 | 403384 | 705000 | 1001 | -60 | 290 |

PEP-003 | 403240 | 705142 | 1001 | -49.60 | 95.2 |

PEP-004 | 403508 | 705671 | 838 | -59.8 | 99.8 |

PEP-005 | 403373 | 704990 | 1008 | -49.8 | 94.6 |

PEP-007 | 403374 | 704990 | 1008 | -69.9 | 170 |

PEP-008 | 403232 | 704803 | 971 | -50 | 60 |

PEP-009 | 403032 | 705057 | 1055 | -50 | 80 |

PEP-010 | 403375 | 705106 | 982 | -50.31 | 190.4 |

PEP-011 | 403573 | 704939 | 1001 | -50.3 | 255 |

PEP-012 | 403415 | 704890 | 997 | -56 | 352 |

PEP-013 | 403413 | 704887 | 997 | -50 | 43 |

PEP-014 | 403400 | 704910 | 1007 | -50 | 43 |

PEP-015 | 403375 | 704938 | 1017 | -50 | 43 |

PEP-016 | 403326 | 704912 | 999 | -50 | 43 |

PEP-017 | 403365 | 704848 | 976 | -40 | 47 |

PEP-018 | 403345 | 704851 | 977 | -45 | 43 |

PEP-019 | 403446 | 704890 | 991 | -45 | 43 |

PEP-020 | 403446 | 704890 | 991 | -75 | 43 |

PEP-021 | 403424 | 704935 | 1012 | -62 | 223 |

PEP-022 | 403424 | 704935 | 1012 | -42 | 223 |

PEP-023 | 403245 | 704927 | 969 | -50 | 43 |

PEP-024 | 403245 | 704927 | 969 | -78 | 43 |

PEP-025 | 403369 | 704888 | 1001 | -45 | 43 |

PEP-026 | 403339 | 704955 | 1008 | -63 | 50 |

PEP-027 | 403468 | 704909 | 1003 | -46 | 228 |

PEP-028 | 403398 | 704957 | 1012 | -58 | 223 |

PEP-029 | 403311 | 705018 | 1011 | -50 | 50 |

PEP-030 | 403311 | 705018 | 1011 | -50 | 000 |

PEP-031B | 403486 | 704901 | 998 | -52 | 220 |

PEP-032 | 403431 | 704861 | 982 | -60 | 15 |

PEP-033 | 403431 | 704861 | 982 | -65 | 100 |

PEP-034 | 403431 | 704861 | 982 | -45 | 315 |

PEP-035 | 403369 | 704882 | 996 | -45 | 223 |

PEP-036 | 403311 | 705152 | 989 | -45 | 30 |

PEP-037 | 403354 | 705227 | 958 | -50 | 210 |

* Coordinates WGS84, UTM Zone 18

About Orosur Mining Inc.

Orosur Mining Inc. (TSXV: OMI; AIM: OMI) is a minerals explorer and developer currently operating in Colombia, Argentina and Nigeria.

About the Anzá Project

Anzá is a gold exploration project, comprising three exploration licences, several small exploitation permits and a large number of licence applications, totalling 399km2, in the prolific Mid-Cauca belt of Colombia.

The Anzá Project is currently wholly owned by Orosur via its subsidiaries, Minera Anzá S.A. and Minera Monte Aquila S.A.S.

The project is located 50km west of Medellin and is easily accessible by all-weather roads and boasts excellent infrastructure including water, power, communications and large exploration camp.

Qualified Persons Statement

The information in this news release was compiled, reviewed, verified and approved by Mr. Brad George, BSc Hons (Geology and Geophysics), MBA, Member of the Australian Institute of Geoscientists (MAIG), CEO of Orosur Mining Inc. and a qualified person as defined by National Instrument 43-101.

Orosur Mining Inc. staff follow standard operating and quality assurance procedures to ensure that sampling techniques and sample results meet international reporting standards.

Drill core is split in half over widths that vary between 0.3m and 2m, depending upon the geological domain. One half is kept on site in the Minera Anzá core storage facility, with the other sent for assay.

Industry standard QAQC protocols are put in place with approximately 10% of total submitted samples being blanks, repeats or Certified Reference Materials (CRMs).

Samples for holes PEP-001 to PEP-011 were sent to the Medellin preparation facility of ALS Colombia Ltd, and then to the ISO 9001 certified ALS Chemex laboratory in Lima, Peru.

Samples from PEP-012 onwards are sent to Medellin laboratory of Actlabs for preparation and assay.

30 gram nominal weight samples are then subject to fire assay and AAS analysis for gold with gravimetric re-finish for overlimit assays of >5 g/t. ICP-MS Ultra-Trace level multi-element four-acid digest analyses may also undertaken for such elements as silver, copper, lead and zinc, etc.

Gold intersections are reported using a lower cut-off of 0.3g/t Au over 3m.

Forward Looking Statements

All statements, other than statements of historical fact, contained in this news release constitute "forward looking statements" within the meaning of applicable securities laws, including but not limited to the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and are based on expectations estimates and projections as of the date of this news release.

Forward-looking statements include, without limitation, the continuing focus on the Pepas prospect, the exploration plans in Colombia and the funding of those plans, and other events or conditions that may occur in the future. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such forward-looking statements. Such statements are subject to significant risks and uncertainties including, but not limited to, those described in the Section "Risks Factors" of the Company's MD&A for the year ended May 31, 2024. The Company's continuance as a going concern is dependent upon its ability to obtain adequate financing, to reach profitable levels of operations and to reach a satisfactory closure of the Creditor's Agreement in Uruguay. These material uncertainties may cast significant doubt upon the Company's ability to realize its assets and discharge its liabilities in the normal course of business and accordingly the appropriateness of the use of accounting principles applicable to a going concern. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events and such forward-looking statements, except to the extent required by applicable law.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Orosur Mining Inc

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/orosur-mining-inc-announces-pepas-moving-into-mre-drilling-programme-1048271