April - June 2025 (compared with April - June 2024)

- Rental income amounted to EUR 41.3 million (30.5).

- Net operating income totalled EUR 39.1 million (30.5).

- Profit from property management was EUR 19.5 million (10.3). Profit from property management, excluding non-recurring items and exchange rate effects, amounted to EUR 20.0 million.

- Earnings after tax amounted to EUR 13.7 million (2.2), corresponding to EUR 0.17 (0.03) per share.

- Unrealised changes in value affected by EUR 2.7 million (-8.4) on properties and by EUR -6.7 million (-0.3) on interest rate derivatives.

January - June 2025 (compared with January - June 2024)

- Rental income amounted to EUR 80.4 million (61.0).

- Net operating income totalled EUR 75.7 million (58.6).

- Profit from property management was EUR 57.5 million (22.6). Profit from property management includes a non-recurring income item of EUR 20.5 million regarding negative goodwill in connection with the acquisition of Forum Estates, as well as non-recurring costs and currency effects of EUR -1.3 million. Profit from property management, excluding non-recurring items and exchange rate effects, amounted to EUR 38.3 million.

- Earnings after tax amounted to EUR 44.7 million (-1.8), corresponding to EUR 0.58 (-0.05) per share.

- Unrealised changes in value affected by EUR -4.6 million (-30.7) on properties and by EUR -8.0 million (3.6) on interest rate derivatives.

- EPRA NRV amounted to EUR 1,054.4 million (675.9) corresponding to EUR 12.8 (11.8) per share.

"An active quarter with steadily increasing earnings, a focus on increasing and fine-tuning the portfolio, reduced financing costs and a new share issue to be able to act on business opportunities."

- Christian Fredrixon, CEO

Key figure¹ | Q2 | Q2 | Jan-jun | Jan-jun |

Rental income | 41.3 | 30.5 | 80.4 | 61.0 |

Net operating income | 39.1 | 30.5 | 75.7 | 58.6 |

Profit from property management | 19.5 | 10.3 | 57.5 | 22.6 |

Unrealised changes in property values | 2.7 | -8.4 | -4.6 | -30.7 |

Earnings after tax | 13.7 | 2.2 | 44.7 | -1.8 |

Market value of investment properties | 2,427 | 1,768 | 2,427 | 1,768 |

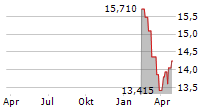

EPRA NRV/share, EUR | 12.8 | 11.8 | 12.8 | 11.8 |

Number of properties with solar panels | 73 | 48 | 73 | 48 |

Net operating income, current earnings capacity | 156.3 | 114.7 | 156.3 | 114.7 |

Net debt LTV ratio, % | 55.0 | 58.9 | 55.0 | 58.9 |

Debt ratio (Net debt/EBITDA), multiple | 11.1 | 9.8 | 11.1 | 9.8 |

Run rate debt ratio (Net debt/EBITDA), multiple | 9.4 | 9.8 | 9.4 | 9.8 |

Interest coverage ratio, multiple | 2.3 | 2.2 | 2.3 | 2.2 |

1Refer to the full report for alternative performance measures and definitions.

17 July 2025

For further information, please contact

Christian Fredrixon, CEO

christian.fredrixon@cibusnordic.com

+46 (0)8 12 439 100

Pia-Lena Olofsson, CFO

pia-lena.olofsson@cibusnordic.com

+46 (0)8 12 439 100

Link to the report archive:

https://www.cibusnordic.com/investors/financial-reports/

About Cibus Nordic Real Estate

Cibus is a real estate company listed on Nasdaq Stockholm Mid Cap. The company's business idea is to acquire, develop and manage high-quality properties in Europe with grocery retail chains as anchor tenants. The company currently owns approximately 640 properties in Europe. The largest tenants are Kesko, Tokmanni, Coop Sweden, S Group, Rema 1000, Lidl and Dagrofa.

This information is information that Cibus Nordic Real Estate AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted for publication, through the agency of the contact person set out above, at 08:00 CEST on 17 July 2025.