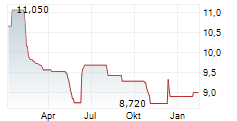

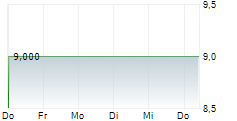

ABEO, a leading global supplier of sports and leisure equipment, today announces its revenue and order intake for the first quarter of its 2025/26 financial year (from 1 April to 30 June 2025).

| €m Unaudited | 2025/2026 | 2024/2025 | Change | Change (LFL1) |

| Sports | 30.1 | 30.7 | -2.0% | -4.6% |

| Sportainment & Climbing | 13.7 | 9.3 | +46.8% | +30.4% |

| Changing Rooms | 17.0 | 16.5 | +2.7% | +2.7% |

| Q1 revenue | 60.8 | 56.6 | +7.4% | +3.3% |

| Q1 order intake3 | 72,9 | 68.6 | +6.3% | +3.1% |

- change in revenue over a comparable period and at constant consolidation scope, excluding the impact of currency movements

- non-financial data - to measure the sales momentum of its business activities, the Group uses, among other things, the quantified amount of its order intake over a given period. The sales momentum indicator represents the aggregate value of all orders booked over the relevant period, as compared to the same period for the previous financial year.

ABEO began the financial year with a 7.4% increase in revenues to €60.8m in Q1 2025/26. This performance includes organic growth of 3.3% and a positive contribution from recent acquisitions of 4.9%, while the period was impacted by an unfavourable currency impact of 0.8%.

The Sports division posted revenue of €30.1m in Q1 2025/26, down 2.0% (-4.6% like-for-like). The positive performance of the Gymnastics business largely offset the slowdown observed in the Benelux countries. Business was temporarily impacted in the Netherlands by the switch to a new ERP system, which caused operational disruptions (a catch-up is expected in the second quarter). In addition, the Belgian public sector market contracted in a particularly tight budgetary environment. Finally, the division benefited from the positive contribution of Sodex, consolidated over one month, which performed in line with expectations.

The Sportainment & Climbing division confirmed the positive momentum built up in the previous financial year, posting revenue up 46.8% to €13.7m (+30.4% like-for-like) in Q1 2025/26. This growth reflects the confirmed rebound in Fun Spot's activities and the return to growth in recreational and sports climbing wall businesses, driven by the efficiency measures implemented. Finally, ELI Play's business, which contributed over one month, were in line with expectations.

The Changing Rooms division posted a 2.7% increase in revenue in the Q1 2025/26, despite a French market impacted by a still unfavourable environment in terms of public funding and investment.

Trends and outlook

Business activity at the start of the financial year remains buoyant, with order intake of €72.9m, up 6.3% compared to Q1 2024/25.

The Group is confident that this positive momentum will continue throughout the financial year, driven in particular by the integration of the latest acquisitions.

Proposed voluntary public offer by ABEO for VOGO shares

ABEO's Combined Annual Shareholders' Meeting held on 15 July approved the resolution authorising a capital increase without shareholders' preferential subscription rights, intended to remunerate contributions as part of the Offer.

The planned timetable therefore remains unchanged: ABEO's draft offer document and VOGO's draft response document (including the reasoned opinion of the Board of Directors and the independent expert's report) are expected to be filed with the AMF by the end of July. Subject to the AMF's compliance declaration, the Offer is expected to open in September 2025.

Upcoming events

4 November 2025 - H1 2025/26 revenue (after close of trading)

9 December 2025 - H1 2025/26 results (after close of trading)

Find more at www.abeo-bourse.com

| About ABEO |

| ABEO is a major player in the sports and leisure market. The Group posted revenue of €248.7 million for the year ended 31 March 2025, 75% of which was generated outside France, and has 1,443 employees. ABEO is a designer, manufacturer and distributor of sports and leisure equipment. It also provides assistance in implementing projects for professional customers in the following sectors: specialised sports halls and clubs, leisure centres, education, local authorities, construction professionals, etc. ABEO has a unique global offering, and operates in a wide variety of market segments, including gymnastics apparatus and landing mats, team sports equipment, physical education, climbing walls, leisure equipment and changing room fittings. The Group has a portfolio of strong brands which partner sports federations and are featured at major sporting events, including the Olympic Games. ABEO (ISIN code: FR0013185857, ABEO) is listed on Euronext Paris - Compartment C. |

Contacts

For any questions relating to this press release or the ABEO Group, please contact ACTUS finance & communication

Investor relations - Corinne Puissant investor@beo.fr Tel: +33 (0)1 53 67 36 77

Press relations - Serena Boni presse@beo.fr Tel: +33 (0)4 72 18 04 92

- SECURITY MASTER Key: mnBrkZVmZ2ucyW1qZJ6Zm5dmZmpjm5aZbGrLxWWeYp/Ha5qUlpdnmpfHZnJklWtp

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-93063-17072025_abeo_t1_25_26_vdef_uk.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free