Hillerstorp 18th of July 2025, 12:30 CET

APRIL - JUNE

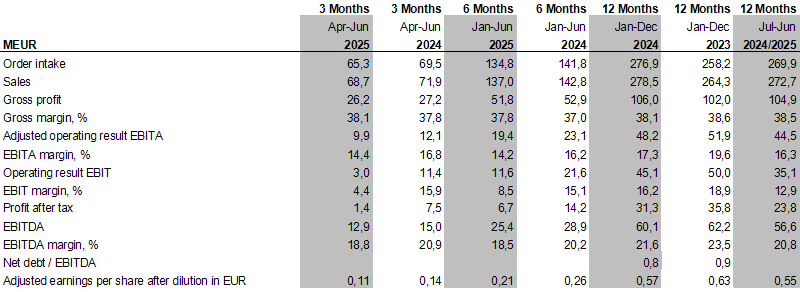

- Order intake in the quarter decreased by 6 percent compared with the same period last year and amounted to 65,3 (69,6) MEUR. Adjusted for currency and acquisitions the order intake decreased by 6 percent.

- Sales in the quarter decreased by 4 percent compared with the same period last year and amounted to 68,7 (71,9) MEUR. Adjusted for currency and acquisitions sales decreased by 5 percent.

- In the second quarter, Troax initiated a cost optimization program, with restructuring-related expenses estimated at approximately 6 MEUR. This one-off cost has been recognized as an item affecting comparability in the income statement for the second quarter. The program is estimated to provide an annual cost saving of approximately 10 MEUR.

- Operating profit before amortizations (EBITA) decreased to 9,9 (12,1) MEUR.

- Operating margin before amortizations (EBITA margin) decreased to 14,4 (16,8) percent.

- Financial net was -1,1 (-1,5) MEUR.

- Profit after tax decreased to 1,4 (7,5) MEUR.

- Adjusted earnings per share after dilution amounted to 0,11 (0,14) EUR.

- Earnings per share after dilution amounted to 0,02 (0,13) EUR.

JANUARY - JUNE

- Order intake in the period decreased by 5 percent compared with the same period last year and amounted to 134,8 (141,8) MEUR. Adjusted for currency and acquisitions the order intake decreased by 6 percent.

- Sales in the period decreased by 4 percent compared with the same period last year and amounted to 137,0 (142,8) MEUR. Adjusted for currency and acquisitions sales decreased by 5 percent.

- Operating profit before amortizations (EBITA) decreased to 19,4 (23,1) MEUR.

- Operating margin before amortizations (EBITA margin) decreased to 14,2 (16,2) percent.

- Financial net was -2,7 (-2,8) MEUR.

- Profit after tax decreased to 6,7 (14,2) MEUR.

- Adjusted earnings per share after dilution amounted to 0,21 (0,26) EUR.

- Earnings per share after dilution amounted to 0,11 (0,24) EUR

TROAX GROUP FIGURES

COMMENTS FROM THE PRESIDENT AND CEO

When I summarize the second quarter of 2025, I can say that it has been another eventful quarter. The pattern in market demand continues to be similar to the first quarter with the exception that Americas has become somewhat more cautious in the wake of 'liberation day'. Market demand continued to be mixed in Europe, with slightly lower order intake in the storage segment and the automotive segment but slightly higher in the general industry and process segment. However, we note a slightly higher activity for feasibility studies in the storage segment in Europe, which bodes well for 2026 and beyond. In general, uncertainty remains regarding the timing of our customers' decision-making processes. APAC continued to grow slightly in local currency, but this was neutralized by currency effects and the APAC region therefore entered at an unchanged level compared to the comparison quarter in 2024.

During the quarter, we have worked intensively to adapt the organization to the prevailing demand situation and to define our future product portfolio and factory structure. At the end of June, we announced a number of actions that will contribute to a simpler and more cost-effective production structure. As a result, we have reduced the number of employees by approximately 100 during the quarter as an adjustment to market demand. Furthermore, we have also announced that we will relocate and close production in Poland during the second half of the year, affecting approximately additional 125 employees. Overall, this represents a significant cost reduction of approximately 10 MEUR at an annualized rate. The extraordinary one-off costs arising in connection with this amount to approximately 6 MEUR and are charged to the second quarter as a one-off cost. In parallel with the efficiency improvements in Europe, our factory investment in North America continues according to plan to increase capacity and improve cost efficiency starting in 2026.

Demand continues to be subdued, and we report a total order intake decrease of six (6) percent driven by Northern Europe and Americas. The weak demand continues in the construction and warehouse segments and has also eased somewhat in the automotive industry during the quarter. In the general industry and process segments in Europe, the situation has improved somewhat sequentially.

Sales decreased by four (4) percent during the quarter. Europe developed weaker as a result of lower order intake in previous quarters, while Americas and APAC grew compared to the previous year.

Despite the low volumes, our gross margin is at a good level and in line with our informal target. With continued price discipline, stable relatively low material costs and adjustments in our supply chain, we are compensating for the lion's share of the under-absorption effects arising from the lower volumes in Europe.

Just as in the first quarter, our selling and administrative expenses continue to be too high relative to our sales. During the quarter, we have therefore reviewed our organization and, starting in the third quarter, these costs will be reduced. The personnel reduction has been implemented in such a way that our strategic priorities are not significantly affected, but the development of a stronger sales organization, increased digitalization, and expansion into new markets and segments remains intact. I am convinced that we will be rewarded with these targeted investments in the future and that as a result we will see both higher sales and sales efficiency increased.

Despite good results in many of our operations, I am not satisfied with our EBITA margin, which landed at 14.4% compared to 16.8% last year (excluding non-recurring items affecting comparability). The result continues to be affected by low volumes but also by increasing negative FX effects. Excluding effect from FX losses, the EBITA margin in the quarter is 15.1% compared to 16.5% in the second quarter of 2024. This thus means a sequential improvement compared to the first quarter's 14.0%.

Our net debt to EBITDA ratio remained low at 1,1 (1,1). Overall, the Group continues to have a stable and strong financial position that enables further investments in profitable organic and acquired growth. In the current macro environment, this may well mean increased opportunities for good acquisitions.

Our new, more decentralized organization is starting to take shape, and I see good progress in our speed in meeting customer requirements and adapting to local and regional conditions. The work to modernize and digitize the Group has also progressed well. Troax Group is the largest player in our niche and the only global player that can serve customers with regional sales and a supply chain to global standards. With an even more streamlined decentralized organization, we will be even better prepared to grow and gain market share in the future.

With the aim of a safer and more productive everyday life,

Martin Nyström, President and CEO

TEAMS WEBINAR

Invitation to presentation of the latest quarter result:

Martin Nyström, CEO, and Anders Eklöf, CFO, will present the results at a Teams webinar on the 18th of July 2025 at 14:00 CET. The conference will be held in English. For more information, please refer tohttps://www.troax.com/investors/press-releases/

For additional information, please contact:

Martin Nyström

President and CEO

martin.nystrom@troax.com

Tel: +46 370 828 31

Anders Eklöf

CFO

anders.eklof@troax.com

Tel +46 370 828 25

This information is information that Troax Group AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014 and the Securities Markets Act (2007:528). The information was submitted for publication, through the agency of the contact person set out above, at 12:30 CET on the 18th of July 2025.

ABOUT TROAX

Troax Group is the leading global supplier of indoor perimeter protection for manufacturing and warehousing environments.

Troax develops high quality and innovative safety solutions to protect people, property and processes.

Troax Group AB (publ), Reg. No. 556916-4030, is a global company with a strong sales force and efficient supply chain. With local presence we offer excellent customer service and quick deliveries. We are represented in 42 countries and employ roughly 1200 people. The Company's head office is located in Hillerstorp, Sweden and our sales amounted to 279 MEUR (2024)