Vancouver, British Columbia--(Newsfile Corp. - July 18, 2025) - Roberto Resources Inc. (CSE: RBTO) ("Roberto" or the "Company") is pleased to announce that it has completed the acquisition of the Claudia silver and gold project (the "Project") located in the historic El Papantón mining district in Durango State, Mexico (the "Acquisition"), pursuant to the binding Letter Agreement previously announced on June 30, 2025. In conjunction with closing of the Acquisition, the Company has changed its name to Pacifica Silver Corp. to better reflect its overall business strategy to acquire and advance highly prospective precious metals projects in the Americas.

"The closing of this acquisition marks the first time Claudia has been held as a standalone project within a public vehicle and the beginning of a transformative journey for our shareholders," stated Todd Anthony, President and CEO. "Located in the prolific Sierra Madre Occidental in Mexico near numerous active and historical mines, the Project boasts multiple outcropping vein structures across approximately 30 kilometres where previous drilling in 2007 and 2021 has confirmed high-grade silver and gold mineralization. With 146 permitted drill sites, low-cost drilling, year-round access, and a renewed surface access agreement with the local community in place, we are excited to embark on comprehensive exploration programs to begin unlocking the Project's full potential."

Claudia Project Overview

The Claudia Project encompasses a land package of 11,876 hectares hosting high-grade silver and gold mineralization in quartz-adularia veins and breccias emplaced along multiple northwest-striking structures forming an 11-kilometre-long horsetail structural complex. The Project includes several previously identified mineralized zones such as Santiaguera, Mina de Oro, Mina Vieja, El Grullo, Noche Buena, Tres Reyes, Aguilareña, Guadalupana, La Concepción, Don Cose, El Cristo, and Lizeth vein swarms. One of these structures, the Aguilareña vein, was previously explored by a former operator who developed a 90-metre-deep shaft and three levels of vein excavation at approximately 40, 60, and 90 metres below surface. The second and most extensive level extends roughly 770 metres in length.

Drilling completed in 2007 and 2021 confirmed the presence of gold-silver mineralization adjacent to the previous workings and tested approximately 2 km of strike length along the Aguilareña vein and part of the nearby Guadalupana vein to the east.

In 2021, a private operator conducted a confirmation drilling campaign, totaling 7,900 metres across 34 drill holes, focused on portions of the Aguilareña and Guadalupana veins. Four holes intersected material grading over 10 grams per tonne ("gpt") gold equivalent ("AuEq"), using an 80:1 silver-to-gold ratio. Six holes encountered mineralization of over 5 gpt AuEq, and 13 holes intersected mineralization over 2 gpt AuEq. Notably, 24 holes (representing 70% of the total number of holes drilled), intersected mineralization over 1 gpt AuEq. Additional results from the 2021 drill campaign can be found in the Company's press release of June 30, 2025.

Drilling to date has tested less than 10% of the total mapped strike length of the large vein array on the Project. Surface mapping and trenching by previous operators, coupled with multiple small-scale historical mine workings, suggest strong potential for additional high-grade gold-silver discoveries along both the Aguilareña and Guadalupana veins, and across at least 10 other untested structures in the vein array.

The Project is drill-ready, with environmental permits (Informe Preventivo) granted on August 30, 2021, by the Secretaría de Medio Ambiente y Recursos Naturales, authorizing 146 drill sites with minimal surface impact, ideal for track-mounted or man-portable diamond core drills. These permits remain valid for five years from the issuance date.

Pacifica plans to undertake an 8,000-metre, 25-hole initial drill program in the second half of 2025 to begin testing various targets.

Acquisition of the Claudia Project

Under the terms of the Letter Agreement, the Company entered into a share purchase agreement ("SPA") on July 17, 2025, with Durango Gold Corp., an arms-length private company ("Durango"); Cielo Azul Resources, S.A. de C.V. ("Azul"), a subsidiary of Durango; and Fernando Berdegue de Cima, whereby the Company purchased all of the issued and outstanding shares of Azul from Durango. Azul holds the surface concessions of the Claudia Project.

Under the terms of the SPA, the Company has acquired all of the issued and outstanding shares of Azul. In consideration for Azul, the Company:

(a) Paid Durango US$10,000 cash (the "Closing Cash Payment"), being the closing payment of US$25,000 less the US$15,000 previously advanced to Durango (see news from June 30, 2025);

(b) Issued to Durango 10 million common shares (the "Consideration Shares"), subject to a restriction on resale for a period of 12 months (the "Restriction Period");

(c) Assumed US$651,453 in current accounts payables associated with holding the Project, which includes payroll costs of US$25,940, third-party costs of US$156,236, and mineral concession payments of US$469,277; and

(d) Assumed the obligation to make bonus payments to Silverstone Resources, S.A. de C.V. ("Silverstone"), the previous vendor of the Claudia Project to Durango, contingent on the future disclosure of National Instrument 43-101-compliant Measured and Indicated resources at the Project. The payment structure is as follows:

(i) For 1 to 500,000 ounces of gold or gold equivalent defined, a payment of US$7.0 million.

(ii) For 500,001 to 1 million ounces of gold or gold equivalent, an additional payment of US$10.0 million.

(iii) For 1,000,001 to 1.5 million ounces of gold or gold equivalent, a further payment of US$2.0 million.

The agreement allows for the gold discovery payments to be paid 50% in company shares and 50% in cash. If the Company is unable to publish a Technical Report disclosing Measured or Indicated resources by December 31, 2029, the Project must be returned to Silverstone.

The Company believes that Durango intends to distribute the Consideration Shares in a proportional manner to its shareholders subject to applicable securities laws. If the Consideration Shares are distributed to Durango shareholders prior to the end of the Restriction Period, the Consideration Shares held by Durango shareholders will continue to be subject to the Restriction Period.

The Company will also be required to assume the obligation to carry out a minimum of 50,000 metres of drilling at the Project until December 31, 2029. Silverstone will also be permitted to explore and mine up to 130,000 tons of material located in the shaft known as "Aguilareña" at the Project.

Name Change to Pacifica Silver Corp.

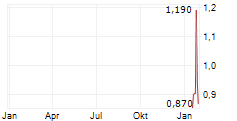

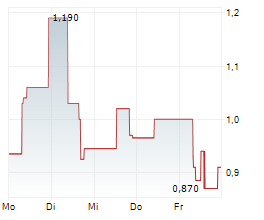

In conjunction with the Acquisition, the Company has changed its name from "Roberto Resources Inc." to "Pacifica Silver Corp." (the "Name Change"). Accordingly, it is anticipated that the Company's common shares will commence trading under the new name and new stock ticker symbol "PSIL" at the start of trading on July 21, 2025, on the Canadian Securities Exchange.

The Name Change is being proposed to better reflect the Company's projects and focus on a specific critical metal, silver. Management believes that the Name Change is in the best interest of shareholders and in line with the Company's overall business strategy to pursue and advance precious metals projects in stable jurisdictions.

In connection with the Name Change, the following new ISIN CA6951041095 numbers have been assigned to the common shares of the Company. No action is required to be taken by shareholders with respect to the name change. Outstanding common share and warrant certificates bearing the old name of the Company are still valid and are not affected by the name and ticker symbol change.

Patrick Loury, AIPG, CPG, Vice President of Exploration for Durango, is a Qualified Person for the purposes of National Instrument 43-101, and has reviewed and approved the technical content in this news release.

About Pacifica Silver Corp.

Pacifica Silver Corp. ("Pacifica") a Canadian resource company led by a proven management team with decades of mining and exploration experience in Mexico. The company is focused on its 100% owned Claudia Project located in Durango, Mexico. Spanning 11,876 hectares, the Project encompasses most of the historic El Papantón Mining District where at least nine small mines operated throughout the 20th century. Since 1990, sampling and drilling within have returned high-grade silver and gold intercepts across multiple vein systems, with only 10% of over 30 kilometres of known veins having been drilled. Today, the project is a prime target for modern exploration and holds exceptional potential for new high-grade discoveries.

The Company also holds an option to acquire a 100% interest in the Janampalla Property located in the Huancavalica Province of Central Perú. Pacifica is focused on continuing exploration work that has indicated widespread, high-grade copper-gold mineralization hosted within Manto style veins and disseminations.

Signed,

Todd Anthony

President and CEO

FOR FURTHER INFORMATION PLEASE CONTACT:

Todd Anthony

T:604-416-1719

Email: todd@pacificasilver.com

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding the perceived merit of the Project, the terms and conditions of the proposed Transaction, potential quantity and/or grade of minerals, the potential size of the mineralized zone, metallurgical recoveries, the completion of the Concurrent Financing and the Transaction and satisfaction of any obligations thereunder, the requisite approvals with respect to the Transaction being obtained. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold and silver; the accuracy of mineral resource estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of mineral resource estimates, including but not limited to changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, the ongoing war in the Ukraine, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral resources; and risks associated with executing the Company's objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, available on www.sedar.com. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259241

SOURCE: Roberto Resources Inc.