Vancouver, British Columbia--(Newsfile Corp. - July 22, 2025) - Sanatana Resources Inc. (TSXV: STA) ("Sanatana" or the "Company") provides an update on its definitive agreement dated July 1, 2025 (the "Definitive Agreement") to acquire the Gold Strike One Project (Yukon) and the Abitibi Property (Quebec) (the "Proposed Acquisition") from LIRECA Resources Inc. ("LIRECA") and LIRECA's affiliate, Florin Resources Inc. ("Florin" and together with LIRECA, the "Florin Group"), as initially announced on July 3, 2025. The Proposed Acquisition is a non-arm's length "Reverse Takeover" for Sanatana, as such term is defined in TSX Venture Exchange ("TSX-V") Policy 5.2 - Change of Business and Reverse Takeovers (the "RTO").

The Company resulting from the Proposed Acquisition (the "Resulting Issuer") will carry on the business of Sanatana. It is expected that the Resulting Issuer will be classified as a Tier 2 Mining Issuer.

Resumption of Trading

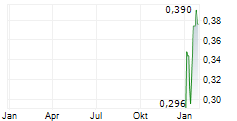

Sanatana's common shares were halted by the TSX-V on July 3, 2025 pursuant to the TSX-V's policy regarding RTOs. The Company has been advised by the TSX-V that trading of Sanatana's common shares will resume as of market open on Thursday, July 24, 2025.

Board of Directors and Management of the Resulting Issuer

The Company confirms that upon completion of the Proposed Acquisition, the board of directors of the Resulting Issuer will consist of the same directors currently comprising the board of directors of Sanatana (the "Board"). Peter Miles will continue to act as the Chief Executive Officer of the Resulting Issuer and Simon Anderson will continue to act as the Chief Financial Officer of the Resulting Issuer.

As disclosed in the Company's news release dated May 5, 2025, announcing the Company's previously closed Gold Strike Two Project acquisition, LIRECA was given a right, but not the obligation, to nominate one director to the Board. Pursuant to the terms of the Definitive Agreement, LIRECA has been given the right, but not the obligation, to designate its nominee to act as the chair of the Board. As of the date of this news release, LIRECA has not exercised its right to nominate a director and is not expected to do so prior to closing the Proposed Acquisition.

For further details on the names and backgrounds of all persons who are expected to constitute principals or insiders of the Resulting Issuer, see "Board of Directors and Management of the Resulting Issuer - Further Details" below.

Update on Private Placements

In connection with the Proposed Acquisition, Sanatana previously announced two non-brokered private placements for cumulative gross proceeds of up to $5,280,000 from the sale up to 3,000,000 common shares of the Company ("Common Shares") and up to 5,800,000 units of the Company (each, a "Unit") at a price of $0.60 per Common Share or Unit, respectively. 3,000,000 Common Shares were offered under a Listed Issuer Financing Exemption (the "LIFE Offering") and 5,800,000 Units were offered under a concurrent private placement offering (the "Concurrent Offering").

The Company has determined to increase the size of the Concurrent Financing and to cancel the LIFE Offering. Accordingly, the re-sized Concurrent Offering will consist of up to 8,800,000 Units, for gross proceeds of up to $5,280,000, subject to an over-allotment right pursuant to which the Company can increase the size of the Concurrent Financing (the "Over-allotment") by 15% (i.e. up to an additional $792,000 through the sale of up to 1,320,000 Units, for aggregate gross proceeds of $6,072,000).

The Company confirms that it must raise a minimum of $4,100,000 in gross proceeds through the Concurrent Financing to satisfy TSX-V listing requirements for the Proposed Acquisition.

Further details on the Concurrent Offering, including the terms of the securities offered thereunder, can be found in the Company's news release dated July 3, 2025.

The Company may revisit the LIFE Offering at a later date; however, the terms of such LIFE Offering, if any, will be determined at a later date and after trading resumes.

The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements. This news release will not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Name Change and Update on new Stock Symbol

Concurrent with closing the Proposed Acquisition, Sanatana expects to change its name to Gold Strike Resources Corp. to better reflect the Company's mineral properties in Yukon and British Columbia. The Company is pleased to confirm that it has reserved the ticker symbol "GSR" for the Resulting Issuer. The stock symbol is expected to be changed concurrent with the closing of the Proposed Acquisition. For trading prior to closing the Proposed Acquisition, the Company's stock symbol will remain as "STA".

Additional Details on the Proposed Acquisition

The Company confirms that historical expenditures by the Florin Group in respect of the Gold Strike One Project have exceeded $350,000, inclusive of staking, exploration work and other related expenses. For additional details on such historical exploration work, please refer to the Company's news release dated July 3, 2025.

The Company is in the process of finalizing a TSX-V Filing Statement for the Proposed Transaction which will include any additional applicable disclosure for the Proposed Acquisition and the related transactions.

Board of Directors and Management of the Resulting Issuer - Further Details

The names and backgrounds of all persons who will constitute principals or insiders of the Resulting Issuer are included below.

Peter Miles - Chief Executive Officer and Director

Mr. Miles has a Bachelor of Commerce from the University of British Columbia. He has more than 25 years' experience in finance and was formerly a Vice President of Midland Doherty Inc., Dean Witter Reynolds, and CIBC World Markets. Prior to becoming CEO of Sanatana, Mr. Miles was an advisor to a number of public and private companies, primarily in the natural resource sector including Roughrider Uranium Inc. At a private stage, Mr. Miles financed Roughrider Uranium Inc. and was later instrumental in Hathor Exploration Inc.'s acquisition of Roughrider. Hathor was acquired by Rio Tinto plc in 2011 for $654 million. Mr. Miles is a Director of Gamehost Inc., and is the founder of Sanatana. Mr. Miles is a commercial pilot with some 3000 hours pilot in command of over 15 different types of aircraft.

Buddy Doyle - President and Director

Mr. Doyle has a degree in Geology, from the Queensland University of Technology, graduating in 1981. Since graduation he has been engaged in the mineral exploration industry. Highlights include being involved in the discovery and evaluation of the Lihir Gold Mine in Papua New Guinea and the Diavik Diamond mine in Canada, both while working for Rio Tinto PLC. In 2004 he received the Hugo Dummitt award for Excellence in diamond exploration for his involvement in the Diavik discovery. Since 2004 Mr. Doyle has been involved in creating and operating mining exploration start-ups listing on the TSX-V and the AIM London Exchange.

As CEO of Amarillo gold from 2004 to 2017 he oversaw a near production gold project in Brazil and he was founder and a director of Western Potash from 2007-2017, which discovered and developed the now in production Milestone Potash Project in Saskatchewan. Additionally, Mr, Doyle is a long standing Member of the AUSIMM (since 1994) a professional association. From 1999 to 2004, he was the Vice Chairman of the MRDU, (Mineral Research development Unit) at the University of British Columbia, a group designed to focus on industry needs and seek in kind funding. Mr. Doyle is the founder and current director of Stratus Aeronautics Inc., a private company, that pioneered the use of robotic aircraft.

Anthony Dutton - Non-Executive Director

Mr. Dutton is a seasoned business executive and entrepreneur with a successful track record as an early-stage investor and business founder. He was most recently co-founder, CEO and director of Cannex Capital Holdings Inc., a pioneering US cannabis company, before its acquisition of 4Front Holdings Ltd. to create 4Front Ventures Corp., a large multi-state cannabis operator. Prior to Cannex Capital Holdings Inc., he was co-founder, CEO and director of IBC Advanced Alloys Corp., a manufacturer of high-performance alloys serving advanced manufacturing and aerospace contractors globally. He currently serves on the board of Value Capital Trust. Mr. Dutton has a BA (Econ) from UBC, a M. Architecture from Dalhousie and a joint MBA from the Cranfield School of Management, UK and the École Supérieure de Commerce in Lyon, France.

Rose Zanic - Director

Ms. Zanic has over 25 years' of capital markets and corporate finance expertise. She is a self-employed corporate finance professional with significant experience advising Canadian public companies with financing and M&A transactions and providing public company administration. She previously spent 19 years with Wolverton Securities Ltd. where she was Senior Vice-President, Corporate Finance in charge of that firm's corporate finance and syndication departments.

Ms. Zanic holds a CPA, CA designation and received a Bachelor of Commerce degree in finance from the University of British Columbia. She currently is a director of several Canadian publicly listed companies, including serving as audit committee chair. Ms. Zanic is also a member of the TSX-V BC Local Advisory Committee.

Simon J. Anderson - Chief Financial Officer and Corporate Secretary

Simon is a Chartered Professional Accountant with a broad range of public company experience in Canadian and US markets. For the more than ten years, he has worked in the financial management of public companies, ensuring that public disclosure meets current standards and planning and implementing acquisitions and divestitures. Previously, Simon was a partner with an international accounting and consulting firm practicing in the areas of business valuation and mergers and acquisitions.

The Florin Group

As disclosed in the Company's news release dated July 3, 2025, the issuance of the 24,745,620 Common Shares to LIRECA in connection with the Definitive Agreement is expected to result in the creation of a new "Control Person" of the Company pursuant to the policies of the TSX-V.

The Florin Group, led by its principal John Fiorino, has been in mineral exploration and project generation in excess of 20 years. With notable discoveries and projects advancements. The Florin Group is a mining project generator with a portfolio of projects across Canada, with a primary focus on projects in Yukon. The Florin Group's mandate is to generate projects that have geological settings, potential historic data, geochemistry, geophysics and importantly an active mining camp ideally within 1-2 km of a discovery or active drilling.

Both LIRECA and Florin are private companies (non-reporting issuers) incorporated pursuant to the Business Corporations Act (British Columbia).

About the Company

Sanatana Resources Inc. is a mineral exploration and development company focused on high-impact properties in Canada. With an award-winning technical team and experienced management and board of directors, Sanatana is based in Vancouver and is listed on the TSX Venture Exchange (TSXV: STA).

(signed) "Peter Miles"

Peter Miles

Chief Executive Officer

For additional information on the Company, please contact Mr. Peter Miles, Chief Executive Officer at (604) 408-6680 or email investor@sanatanaresources.com.

To be added to the email distribution list, please email ir@sanatanaresources.com with "Sanatana" in the subject line.

Completion of the Proposed Acquisition is subject to a number of conditions, including but not limited to, TSX-V acceptance and, if applicable, pursuant to the requirements of the TSX-V and disinterested shareholder approval. Where applicable, the Proposed Acquisition cannot close until any required shareholder approvals are obtained. There can be no assurance that the Proposed Acquisition will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Proposed Acquisition, any information released or received with respect to the Proposed Acquisition may not be accurate or complete and should not be relied upon. Trading in the securities of Sanatana Resources Inc. should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the Proposed Acquisition and has neither approved nor disapproved the contents of this news release.

Cautionary Statements and "Forward-Looking" Information

This news release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward-looking statements. In particular, this news release contains forward-looking statements concerning the Definitive Agreement, the resumption of trading of the Company's common shares, the LIFE Offering, the Concurrent Offering, the completion of the Concurrent Offering, the filing of the Filing Statement, the closing of the Proposed Acquisition, and the anticipated board of directors and management of the Resulting Issuer.

Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward-looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with mineral exploration generally and results from anticipated and proposed exploration programs, conditions in the equity financing markets, and assumptions and risks regarding receipt of regulatory and shareholder approvals.

Management has provided the above summary of risks and assumptions related to forward-looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259582

SOURCE: Sanatana Resources Inc.