Adjusted Single-Digit YoY CARR Growth Guidance for Full Year

Reaffirmed Monthly Cash EBITDA Positive Position Starting from End of 2025

Regulatory News:

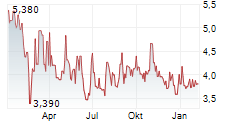

MotorK PLC (AMS: MTRK) ("MotorK", the "Group" or the "Company"), a leading SaaS provider to the automotive retail industry in the EMEA region, today announced its financial results for the first six months of the year ended on 30 June 2025 ("H1 25").

H1 25 Financial Highlights:

- Committed Annual Recurring Revenue (CARR1 €35.8 million in H1 25. New additions to CARR were at double digits (€3.9 million) compared to FY 24, offset by churn mostly related to phase-out of non-core retail customers, in line with the Company's strategic focus on high-value segments.

- Recurring Billings2: €15.8 million in the first six months of 2025, representing 78% share of total revenue and demonstrating the strength of the Group's recurring revenue model.

- Cost Efficiency: 3% year-on-year cost base reduction to €19.2 million, driven by platform consolidation and streamlined operations.

- Cash EBITDA improvement: a 46% year-on-year improvement, reaching negative €2.6 million in the first half, reflecting ongoing margin expansion and disciplined execution on the path to sustained profitability.

- Operating Free Cashflow: €1.7 million compared to negative €2.6 million in H1 24, driven by the abovementioned initiatives to positive territory for the first time.

- Acquired Business Integration: acceleration of the migration of legacy platform's customers to the Group's solutions, enabling full alignment to the core product suite and phasing out of non-strategic tools.

- Net Borrowing Position: negative €15.6 million at 30 June 2025.

COMMENTS ON H1 25 RESULTS FROM AMIR ROSENTULER, CHAIRMAN AND INTERIM CEO

The first half of 2025 was marked by continued volatility in the European automotive sector, as OEMs faced tariff-related uncertainty and supply chain disruptions, prompting a reassessment of production plans. At the same time, dealer sentiment remained cautious amid subdued consumer demand and elevated vehicle prices across key markets.

Against this backdrop, MotorK has taken deliberate and disciplined action to strengthen its business model and accelerate the path to profitability. We have sharpened our strategic focus on scalable, high-value customer segments, optimized our product delivery infrastructure, and exited non-core, low-margin contracts. These initiatives, though impacting short-term revenue, have materially improved our operational efficiency and cost base. We are now operating with greater agility, clearer priorities, and a stronger foundation for sustainable, high-margin growth in the periods ahead.

STRATEGIC AND OPERATIONAL HIGHLIGHTS

CARR stood at €35.8 million in H1 2025, down from €36.6 million in December 2024, reflecting the impact of two opposing dynamics.

Firstly, the new additions to CARR were at €3.9 million in the first six months of 2025, fueled by both enterprise and retail new opportunities won. However, throughout H1 2025, MotorK executed a diversified strategy aimed at increasing operational efficiency and focusing commercial efforts on core segments that align with the Company's long-term SaaS model. Following the completion of several migration programs related to previously acquired businesses, MotorK has exited legacy and highly customized contracts that no longer meet the Company's profitability or scalability criteria. This strategic realignment resulted in a temporary increase in churn that completely offset the H1 25 additional CARR achievements.

The Company is now better positioned to serve scalable, high-value customer cohorts and concentrate on markets and products that deliver consistent, high-margin recurring revenue.

FINANCIAL PERFORMANCE AND COST OPTIMIZATION

While external pressures and the impact of strategic portfolio optimization affected the top-line growth, the Group progressed in its path to profitability.

Recurring billings for the first half were €15.8 million, compared to €15.6 million in the same period last year. This result underscores the stability and predictability of the business model.

Organizational streamlining efforts continued, with a carefully managed reduction in headcount and Other costs, leading to a 9% and 10% improvement respectively. Overall, the Company reduced its operating cost base by 3% compared to the same period in 2024. All these initiatives translated into a €1 million Adjusted EBITDA for H1 2025, compared to €0.1 million in H1 24, an almost break-even EBITDA of negative €0.1 million, and an improved margin profile. More importantly, Cash EBITDA came in at negative €2.6 million, compared to negative €4.8 million last year, and the Operating Free Cash-Flow turned positive for the first time, continuing the Company's trajectory toward profitability and efficiency.

COMMERCIAL MOMENTUM

MotorK's commercial performance in the first half of 2025 reflects the early impact of the Company's strategic portfolio refocus. While net CARR has been temporarily affected by the exit of non-core customers, gross bookings in H1 remained strong, supported by ongoing demand for digital transformation, particularly from large enterprise accounts.

Geographically, Italy continued to represent the Company's largest and most resilient market, delivering €13.5 million in Revenue, up 4% year-on-year. Spain also posted solid growth of 5%, reflecting increasing traction with dealer groups and OEM partners. France and Germany experienced temporary declines of 8% and 9% respectively, largely driven by the planned phase-out of legacy, heavily customized client engagements. These exits are consistent with MotorK's strategy to streamline operations and focus on scalable, product-led deployments. Benelux delivered stable growth of 2%, contributing €1.2 million in Revenue.

Overall, despite the selective contraction of the customer base, Revenues rose modestly by 1.4% compared to the prior year. This underscores the underlying strength of the core regions and validates the Company's decision to concentrate on strategic markets with strong product-market fit.

As of 30 June 2025, MotorK carried forward a qualified pipeline of €12.7 million, comprising €4.7 million in enterprise opportunities and €8 million in retail. Several high-value enterprise contracts are currently in final negotiation stages. Management maintains a high degree of visibility and confidence around their expected conversion during the second half of the year.

OUTLOOK

Looking ahead to the second half of the year, the Company anticipates its realigned commercial engine to deliver improved retention and progressively rebuild CARR growth from a higher quality base.

Management expects CARR to resume sequential growth beginning in Q4 2025, supported by new bookings and improved retention dynamics. To reflect the impact of the abovementioned uncertainty in the market and the incurred churn in the first half of 2025, the management reviewed the guideline on CARR, previously estimated to grow by a low double digit, and now expected to increase at a low single digit rate on a full-year basis.

The business enters H2 with a leaner, more focused customer base and a more streamlined cost structure, with the latter further expected to reduce by approximately 10% on a full-year basis. Cash EBITDA, in line with previous estimates, is expected to turn positive on a monthly basis towards the end of 2025.

While the macroeconomic environment remains unpredictable, MotorK's strategic choices over the past 18 months have created a more agile, profitable, and resilient operating model. MotorK remains confident in its long-term outlook and its ability to deliver sustainable value creation through disciplined execution and a clear focus on product-led growth.

| HY 2025 UNAUDITED CONSOLIDATED PROFIT AND LOSS | ||

| In k€ | Jun-25 | Jun-24 restated |

| Revenues | 20,259 | 19,977 |

| Costs for customers media services | (3,993) | (4,034) |

| Personnel costs | (12,621) | (13,854) |

| R&D capitalization | 3,590 | 4,859 |

| Other costs | (6,220) | (6,868) |

| Total costs | (19,244) | (19,897) |

| EBITDA Adjusted | 1,015 | 80 |

| Exceptional income/(costs) | (793) | (1,097) |

| Stock Option Plan costs | (179) | (573) |

| EBITDA | 43 | (1,590) |

| Depreciation Amortization | (4,157) | (5,133) |

| EBIT | (4,114) | (6,723) |

| Finance costs (net of finance income) | (1,233) | (1,129) |

| Profit/(Loss) before tax | (5,347) | (7,852) |

| Corporate income tax | (118) | (118) |

| Profit/(Loss) for the period | (5,465) | (7,970) |

| HY 2025 UNAUDITED CASH FLOW STATEMENT | ||

| In k€ | Jun-25 | Jun-24 restated |

| Cash Beginning of the period | 3,362 | 3,509 |

| EBITDA Adjusted | 1,015 | 80 |

| Decrease (increase) in working capital | 691 | (2,642) |

| Operating free cash-flow | 1,706 | (2,562) |

| Taxes collected (paid) | (164) | 104 |

| Cash flow from investing activities tangible assets | (5) | (3) |

| Cash flow from investing activities R&D | (3,728) | (4,880) |

| Free cash-flow | (2,191) | (7,341) |

| Exceptional items | (833) | (897) |

| Cash inflow/(outflow) for investing activities | 3,279 | (4,302) |

| Cash inflow/(outflow) for financing activities | (3,912) | 2,122 |

| Cash inflow from equity movements | 5,456 | 14,095 |

| Others | (208) | (83) |

| Net increase in cash | 1,591 | 3,594 |

| Cash End of the period | 4,953 | 7,103 |

HY 2025 UNAUDITED STATEMENT OF FINANCIAL POSITION | ||

| In k€ | Jun-25 | Dec-24 |

| Tangible assets | 2,717 | 3,379 |

| Intangible assets | 46,573 | 46,335 |

| Investment in associates companies | 0 | 3,538 |

| Fixed assets | 49,290 | 53,252 |

| Net working capital | (1,840) | (1,108) |

| Deferred tax liabilities | (1,403) | (1,533) |

| Employees benefit liabilities | (2,192) | (2,310) |

| Provisions | (92) | (121) |

| Total invested capital | 43,763 | 48,180 |

| Cash and cash equivalents | 4,953 | 3,362 |

| Financial assets | 257 | 242 |

| Financial liabilities | (20,736) | (23,764) |

| Net borrowing position | (15,526) | (20,160) |

| Net equity | 28,237 | 28,020 |

| HY 2025 UNAUDITED REVENUES BY PRODUCT AND SERVICES LINE | |||

| In k€ | Jun-25 | Jun-24 restated | y.o.y. change |

| SaaS platform | 15,585 | 14,620 | 7% |

| Digital Marketing | 4,020 | 4,559 | -12% |

| Other | 654 | 798 | -18% |

| Revenues | 20,259 | 19,977 | 1% |

| HY 2025 UNAUDITED RECURRING AND NON RECURRING REVENUES | |||

| In k€ | Jun-25 | Jun-24 restated | y.o.y. change |

| SaaS Recurring | 15,291 | 14,593 | 5% |

| Other recurring | 502 | 984 | -49% |

| Recurring revenues | 15,793 | 15,577 | 1% |

| % Recurring on Revenues | 78% | 78% | 0% |

| Contract start-up | 293 | 62 | 373% |

| Digital | 3,533 | 3,888 | -9% |

| Other | 640 | 450 | 42% |

| Non Recurring revenues | 4,466 | 4,400 | 2% |

| Revenues | 20,259 | 19,977 | 1% |

| HY 2025 UNAUDITED REVENUES BY GEOGRAPHY* | |||

| In k€ | Jun-25 | Jun-24 restated | y.o.y. change |

| Italy | 13,464 | 12,956 | 4% |

| Spain | 1,854 | 1,760 | 5% |

| France | 2,702 | 2,943 | -8% |

| Germany | 1,026 | 1,132 | -9% |

| Benelux | 1,213 | 1,186 | 2% |

| Revenues | 20,259 | 19,977 | 1% |

| HY 2025 UNAUDITED RECURRING AND NON RECURRING REVENUES | |||

| In k€ | Jun-25 | Jun-24 restated | y.o.y. change |

| SaaS Recurring | 15,291 | 14,593 | 5% |

| Other recurring | 502 | 984 | -49% |

| Recurring revenues | 15,793 | 15,577 | 1% |

| % Recurring on Revenues | 78% | 78% | 0% |

| Contract start-up | 293 | 62 | 373% |

| Digital | 3,533 | 3,888 | -9% |

| Other | 640 | 450 | 42% |

| Non Recurring revenues | 4,466 | 4,400 | 2% |

| Revenues | 20,259 | 19,977 | 1% |

It represents Revenues broken down by the countries in which the legal entities are established, independently of the geographical location of the customers. | |||

| HY 2025 UNAUDITED CASH EBITDA | |||

| In k€ | Jun-25 | Jun-24 restated | y.o.y. change |

| EBITDA Adjusted | 1,015 | 80 | 1169% |

| R&D Capitalization | (3,590) | (4,859) | -26% |

| Cash EBITDA | (2,575) | (4,779) | -46% |

NEXT PUBLICATION: Q3 25 TRADING UPDATE, 23 OCTOBER 2025

Forward-looking information and disclaimer

This press release may include forward-looking statements. Other than reported financial results and historical information, all statements included in this press release, including, without limitation, those regarding our financial position, business strategy and management plans and objectives for future operations, may be deemed to be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words "targets", "plans", "believes", "expects", "aims", "intends", "anticipates", "estimates", "projects", "will", "may", "would", "could" or "should", or words or terms of similar substance or the negative thereof, are forward-looking statements. These forward-looking statements are based on our current expectations, projections and key assumptions about future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond MotorK's ability to control or estimate precisely, such as future market conditions, the behavior of other market participants and the actions of governmental regulators. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release and are subject to change without notice. Other than as required by applicable law or the applicable rules of any exchange on which our securities may be traded, we expressly disclaim any obligation or undertaking to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise.

Important information

This press release contains information within the meaning of Article 7(1) of the Market Abuse Regulation (596/2014).

ABOUT MOTORK PLC

MotorK (AMS: MTRK) is a leading software as a service ("SaaS") provider for the automotive retail industry in the EMEA region, with approximately 350 employees and in eight countries (Italy, Spain, France, Germany, Belgium, the Netherlands, the UK, and Israel). MotorK empowers car manufacturers and dealers to improve their customer experience through a broad suite of fully integrated digital products and services. MotorK provides its customers with an innovative combination of digital solutions, SaaS cloud products and the largest R&D department in the automotive digital sales and marketing industry in Europe. MotorK is a company registered in England and Wales. Registered office: 5th Floor One New Change, London, England, EC4M 9AF Company Registration: 9259000. For more information: www.motork.io or investors.motork.io.

____________________ 1 Committed ARR ("CARR") includes ARR and Committed Recurring Revenues ("CRR"). CRR refers to signed contracts to be delivered and billed. 2 Following the Group's restatement to IFRS 15 over time revenue recognition, Recurring billings are equivalent to Recurring revenues. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20250724639029/en/

Contacts:

FOR FURTHER INFORMATION

MotorK Investor Relations

Boaz Zilberman

boaz.zilberman@motork.io

+972 532 819 810