Original-Research: GFT Technologies SE - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to GFT Technologies SE

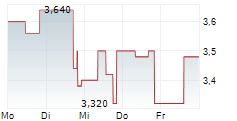

Mixed picture but mid-term targets remain intact On July 23, GFT Technologies released its preliminary H1 2025 results and lowered its guidance for 2025. Revenue growth was weak (+2.8% yoy) and 2.0% below our expectation. The increase was mainly driven by organic growth (+6.0% yoy) and supported by strong demand in the Americas and APAC, particularly in Brazil, USA, Canada and Colombia, as well as by solid performance in the Insurance sector (+20.0% yoy) and Industry & Others (+11.0% yoy). Additional drivers included the expansion of the GenAI product Wynxx and the recent acquisition of Megawork. However, adverse currency effects (-4.0%), weak performance in Europe (-6.0% yoy) and especially the UK (-19.0% yoy), and a slight decline in the Banking sector (-2.0% yoy) weighed on revenues. The EBT margin declined from 7.0% to 4.3%, below our estimate of 5.4%. The margin decrease was mainly driven by FX headwinds, the absence of last year's one-off gain, and restructuring measures in the UK and at GFT Software Solutions. The company lowered its revenue guidance to EUR 885m (previously: EUR 930m), 4.8% below our estimate, and now expects an adjusted EBIT of EUR 65m and EBT of EUR 45m, implying an EBT margin of 5.1% versus our estimate of 6.5%. The downgrade reflects FX headwinds and restructuring measures, while growth should be supported by AI initiatives, the Megawork acquisition and expansion in high-value services. We view the reaffirmed 2029 targets as supportive for the long-term investment case despite near-term challenges. We decrease our target price to EUR 32 (previously EUR 38) and confirm our Buy recommendation. You can download the research here: GFT_TECHNOLOGIES_SE_20250728 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2175504 28.07.2025 CET/CEST

© 2025 EQS Group