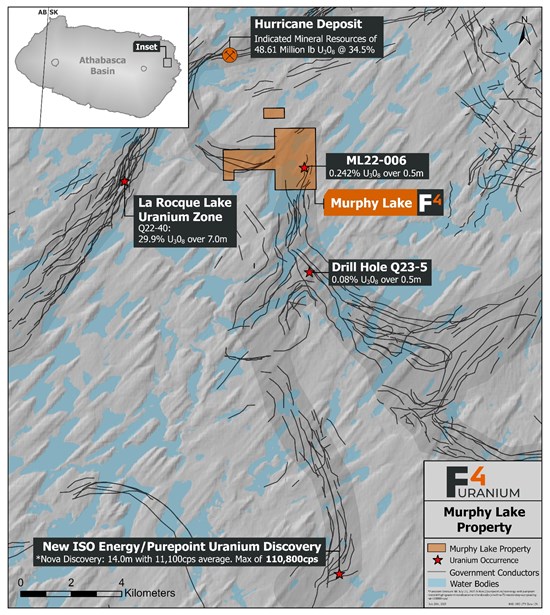

Kelowna, British Columbia--(Newsfile Corp. - July 29, 2025) - F4 Uranium Corp. (TSXV: FFU) (OTCQB: FFUCF) (the "Company" or "F4") is pleased to announce that it has entered into an option agreement, dated July 29, 2025, (the "Option Agreement") with Stearman Resources Inc. ("Stearman") pursuant to which the Company has granted Stearman the exclusive option to acquire up to a 70% interest in the Company's Murphy Lake uranium property in Saskatchewan (the "Property"). The Property is located in the northeastern Athabasca Basin, 5 km south of ISOEnergy's Hurricane Uranium Deposit, 15 km north of Purepoint Uranium and Iso Energy's Nova Discovery, and 4 km east of Cameco's La Rocque Lake Uranium Zone.

Ray Ashley, Chief Executive Officer of F4 commented:

"We are very pleased to have reached this new exclusive option agreement with Stearman. The agreement is considered as an arms length transaction. This strategic partnership marks a significant step forward in advancing F4's flagship uranium asset with a dedicated partner, leveraging F4's technical expertise and Stearman's financial commitment. This new deal reflects F4's focused strategy to unlock the project's potential through a committed partnership and establishes a clear path forward for exploration and development at Murphy Lake."

Pursuant to the terms of the Option Agreement:

Stearman shall pay to F4 a non-refundable cash payment in the amount of $50,000 on July 28, 2025 (the "Initial Payment Date").

F4 has granted to Stearman the option (the "Initial Option") to acquire a 50% interest in the Property by:

Paying to F4 an aggregate of $750,000 in cash over a period of twenty-four (24) months from the Initial Payment Date in accordance with the following schedule:

$150,000 on or before the date that is forty-five (45) days after the Initial Payment Date;

$150,000 on or before the date that is six (6) months after the Initial Payment Date;

$150,000 on or before the date that is twelve (12) months after the Initial Payment Date;

$150,000 on or before the date that is eighteen (18) months after the Initial Payment Date; and

$150,000 on or before the date that is twenty-four (24) months after the Initial Payment Date;

Funding a total of $10,000,000 of exploration expenditures on the Property ("Expenditures") over a period of forty-two (42) months from the Initial Payment Date in accordance with the following schedule:

$1,500,000 of Expenditures on or before the date that is twelve (12) months after the Initial Payment Date;

$1,500,000 of Expenditures on or before the date that is twenty-four (24) months after the Initial Payment Date; and

$7,000,000 of Expenditures on or before the date that is forty-two (42) months after the Initial Payment Date; and

Stearman shall complete one or more equity financings to raise aggregate gross proceeds totaling at least $3,000,000 on or before such that that is six (6) months after the Initial Payment Date, on completion of which Stearman shall issue to F4 such number of common shares of Stearman ("Stearman Shares") equal to 9.9% of the total number of issued and outstanding Stearman Shares as of such issuance date.

Following the exercise of the Initial Option, Stearman shall have the option (the "Bump-Up Option") to acquire an additional 20% interest in the Property (for a total interest in the Property of 70%) by:

Paying to F4 an aggregate of $500,000 in cash over a period of thirty-six (36) months from the Initial Payment Date in accordance with the following schedule:

$250,000 on or before the date that is thirty (30) months after the Initial Payment Date; and

$250,000 on or before the date that is thirty-six (36) months after the Initial Payment Date; and

Funding additional Expenditures totaling $8,000,000 on or before the date that is sixty (60) months from the Initial Payment Date.

Following the exercise by Stearman of the Initial Option, Stearman shall grant to F4 a 2.0% net smelter returns royalty in respect of the Property (the "NSR Royalty") payable to F4 upon commencement of commercial production at the Property.

On the earlier of such date as Stearman (i) exercises the Bump-Up Option; (ii) elects not to exercise the Bump-Up Option; and (iii) sixty (60) months from the Initial Payment Date, F4 and Stearman will form a joint venture pursuant to which the parties will agree to the terms which shall apply to the further exploration and development of the Property.

The transactions contemplated under the Option Agreement remain subject to the approval of the TSX Venture Exchange and the Canadian Securities Exchange.

The Option Agreement between the Company and Stearman supersedes the previous option agreement dated May 29, 2024, as amended October 21, 2024, to which the Property was previously subject, and which was terminated on July 27, 2025.

Figure 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10832/260496_c759e04064e5ebf5_002full.jpg

About the Murphy Lake Property

F4's 609-hectare Murphy Lake Property is located in the north-eastern corner of the Athabasca Basin, 30 km northwest of Orano's McLean Lake deposits, 5 km south of ISOEnergy's Hurricane Uranium Deposit and 4 km east of Cameco's La Rocque Lake Uranium Zone where drill hole Q22-040 intersected 29.9% U3O8 over 7.0 m. The 2022 maiden drill program at the Murphy Lake Property consisted of 14 completed drillholes totaling 6,850m; scintillometer results from hole ML22-006 intersected a peak of 2,300 cps (see NR August 10, 2022), which resulted in assay results of 0.065% U3O8 over 2.5m from 322.5m to 324.5m, including 0.242% U3O8 over 0.5m.1

Qualified Person

The technical information in this news release has been reviewed and approved on behalf of the Company by Sam Hartmann, P.Geo., President & Chief Operation Officer of F4, and a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About F4 Uranium Corp:

F4 Uranium is a Canadian uranium exploration company focused on the Athabasca Basin in northern Saskatchewan, and the latest uranium explorer, lead by the same management and exploration team with a legacy of discovery successes. The project portfolio includes 17 wholly owned properties totaling roughly 157,000 ha, many of which are near uranium deposits including Paladin's Triple R, Nexgen Energy's Arrow and IsoEnergy's Hurricane. The assets were spun out of F3 Uranium in 2024, where the technical and management team made their third, and more recently fourth uranium discoveries at Patterson Lake North and Broach Lake. F4's core focus will be split between the west and east sides of the Athabasca Basin as the Company is establishing itself as an explorer and project generator providing shareholders renewed exposure at an early stage.

Contact Information

F4 Uranium Corp.

750-1620 Dickson Avenue

Kelowna, BC V1Y9Y2

Investor Relations

Telephone: 778 484 8030

Email: ir@f4uranium.com

On Behalf of the Board.

"Ray Ashley"

Raymond Ashley, CEO

F4 Uranium Corp.

Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release relate to, among other things: the completion of the transactions contemplated by the Option Agreement and the expected benefits therefrom; and the Company's future focus and strategic plans.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; the historical basis for current estimates of potential quantities and grades of target zones; the availability of skilled labour and no labour related disruptions at any of the Company's operations; no unplanned delays or interruptions in scheduled activities; all necessary permits, licenses and regulatory approvals for operations are received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data; general market and industry conditions; and those factors identified under the caption "Risks Factors" in the Company's Listing Application on Form 2B. The Company cautions the reader that results and mineralization on neighbouring properties are not necessarily indicative of mineralization on the Companies properties.

Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 See news release of F3 Uranium Corp. dated August 10, 2022 and the technical report entitled "Technical Report for the Murphy Lake Property, NE Athabasca Basin, Saskatchewan, Canada" dated effective February 12, 2025 available on the Company's SEDAR+ profile at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/260496

SOURCE: F4 Uranium Corp.