LONDON (dpa-AFX) - Taste & nutrition company Kerry Group plc (KYGA.L) reported Wednesday higher profit in its first half with increased revenues. Further, the firm maintained fiscal 2025 outlook.

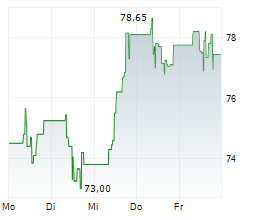

On the London Stock Exchange, Kerry shares were trading at 86.25 euros, down 0.86%.

In the first half, profit after taxation was 303.1 million euros, higher than prior year's 291.5 million euros. Profit attributable to equity holders of the parent - continuing operations was 302.8 million euros, compared to 271.6 million euros a year ago.

Basic earnings per share grew 9.4 percent to 182.4 euro cents from 166.7 euro cents last year. Adjusted earnings per share were 209.2 euro cents, compared to 194.1 euro cents last year.

EBITDA increased 7.5 percent from last year to 556 million euros, with EBITDA margin increasing by 100 basis points to 16.1 percent, driven mainly by benefits from the Accelerate Operational Excellence programme.

Group revenue increased 1.3 percent to 3.46 billion euros from last year's 3.42 billion euros. The results reflected volume growth of 3 percent and pricing of 0.2 percent.

In the first half, volume growth was led by a strong performance in the Americas, with Europe in line with expectations, and growth in APMEA reflective of variable market dynamics.

Further, the Board has declared an interim dividend of 42.0 cent per share, compared to the prior year interim dividend of 38.1 cent, payable on November 7 to shareholders on the record date October 10.

Looking ahead for fiscal 2025, Kerry continues to expect constant currency earnings per share guidance growth of 7 percent to 11 percent.

For the remainder of the year, the company projects volume growth and strong margin expansion while recognising a heightened level of market uncertainty.

Kerry announced the intention of Gerry Behan to retire from his position at Kerry Group plc and as an Executive Board Director as of December 31, and over the coming months will be transitioning his responsibilities

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News