Utenos Trikotažas Posts Profit in Q2, Group Results Near Break-Even

After the first half of 2025, the SBA textile company Utenos Trikotažas achieved a significant financial breakthrough - for the first time in a long time, the company was profitable. This is an important strategic shift, achieved a quarter earlier than planned.

"One of the main objectives of our transformation was to restore operating profitability. Through strict cost control, strategic focus on high-margin products, and efficient production processes with subcontractors, we've achieved this goal ahead of schedule. The first two quarters of the year are typically slower for the textile industry, with the peak season still to come - that makes this result a clear signal that our decisions are delivering the intended outcomes," says Nomeda Kaucikiene, CEO of Utenos Trikotažas.

Revenue Surged by Nearly One-Third

In the first half of 2025, the Utenos Trikotažas group generated €9.7 million in revenue - up 30.9% year-over-year. Exports accounted for 80.8% of total sales. The company's contract manufacturing sales rose by 45.2% to €7.6 million, while sales of own brands remained stable at €1.1 million.

Nomeda Kaucikiene notes that the strong sales momentum was also driven by rising demand for high value-added products, especially those made from wool, eco-friendly, and functional materials. "We're seeing increasing customer engagement in these segments - which confirms our strategic direction is aligned with market demand. We will continue to strengthen our competitive edge in this category."

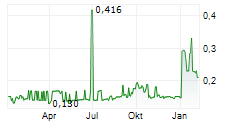

During the first half of 2025, Utenos Trikotažas earned EUR 418,000 in EBITDA, compared to a negative EUR 1.3 million a year earlier. The company's pre-tax profit turned positive after a long time and amounted to EUR 136 thousand.

The results at the group level also improved significantly. The group's EBITDA for the first half of 2025 amounted to EUR 114,000, compared to a negative figure of EUR 1.6 million in 2024. The group's consolidated losses decreased by 78% compared to the same period last year, from EUR 2.3 million to EUR 0.5 million.

One negative impact on the results came from the group's sewing services subsidiary, Šatrija, which ceased operations as of July 21. The decision was based on sustained financial losses and the fact that Šatrija's operations are not related to the main company's activities. Therefore, its closure has no impact on the implementation of Utenos Trikotažas' restructuring plan.

The results for the first half of the year show that the restructuring plan for Utenos Trikotažas, approved at the end of 2024, is beginning to yield tangible results. In the second quarter of this year, the company successfully sold a portion of unused real estate in Utena - the proceeds were used to settle obligations with the primary creditor.

"We will continue to implement the restructuring plan with discipline, aiming to sustain growth momentum and ensure long-term business stability," adds Kaucikiene.

Current order volumes for the second half of 2025 provide confidence that the company can maintain its revenue growth trajectory and further strengthen operational profitability. In addition to Utenos Trikotažas, the Utenos Trikotažas group of companies includes Utenoswear, Gotija, Šatrija, and Mrija (Ukraine).

About Utenos Trikotažas

Utenos Trikotažas is one of the largest and sustainable knitwear manufacturers in Central and Eastern Europe. Its specialized focus lies in on-demand ready-to-wear production and jersey fabric development for leading international brands.

Utenos Trikotažas group operates three factories - Utenos Trikotažas (Lithuania), Šatrija (Lithuania) and OAO Mrija (Ukraine). Environmental and social responsibility commitments cover all areas of Utenos Trikotažas' production and operations - from organically farmed natural fibers, the use of chemicals in production, to fair pay for employees and absolute transparency in production processes. Utenos Trikotažas is part of the SBA group.

Additional information is available from Aurimas Likus, CFO, tel. No. +370 618 07809.

Nomeda Kaucikiene, CEO of AB Utenos trikotažas