Completed Merger with GlycoMimetics and Previously Announced $200 Million Private Financing Supporting Pipeline of Next Generation Therapeutics for Solid Tumors

Recent Leadership Appointments Bring Deep Experience in Oncology Drug Development, Clinical Operations and Building Biotechnology Companies

On Track to Submit IND Application for CR-001, a PD-1 x VEGF Bispecific Antibody, in Fourth Quarter of 2025, with Proof-of-Concept Clinical Data Expected in Second Half of 2026

WALTHAM, Mass., July 31, 2025 (GLOBE NEWSWIRE) -- Crescent Biopharma, Inc. ("Crescent" or the "Company") (Nasdaq: CBIO), a biotechnology company dedicated to rapidly advancing the next wave of therapies for cancer patients, today announced financial results for the second quarter ended June 30, 2025, and recent business highlights.

"The second quarter of 2025 was momentous for Crescent. We bolstered our leadership team, completed our merger and began trading on Nasdaq while also closing a substantial financing with a premier group of healthcare investors that will support the advancement of our portfolio of next generation therapeutics for solid tumors to important inflection points," said Joshua Brumm, chief executive officer of Crescent. "Our lead program, CR-001, a PD-1 x VEGF bispecific antibody, is designed to transform the immuno-oncology standard of care, and we are on track to submit an IND by the end of 2025. This would enable dosing the first patients in our global Phase 1 trial in early 2026, with proof-of-concept data expected later that year. In addition, we expect the first of our two ADCs to enter the clinic in mid-2026. We have a tremendous opportunity ahead of us, and we remain focused on rapidly advancing our programs as we work toward delivering the next wave of treatments to those living with cancer."

Recent Business Highlights & Upcoming Milestones

Corporate

- Crescent appointed new leadership bringing experience in oncology drug development, clinical operations and building biotech companies, including Joshua Brumm as chief executive officer and member of the board of directors; Jonathan McNeill, M.D., as president and chief operating officer; Ellie Im, M.D., as chief medical officer; Rick Scalzo, MBA, as chief financial officer; Jan Pinkas, Ph.D., as chief scientific officer; Amy Reilly as chief communications officer; and Tanya Sengupta, MBA, as executive vice president, chief of strategy and operations.

- The Company appointed David Lubner to Crescent's board of directors.

- Crescent completed its merger with GlycoMimetics, Inc. and began trading on the Nasdaq Capital Market on June 16, 2025, under the ticker symbol "CBIO." The Company also closed a previously announced private financing of $200 million in gross proceeds.

Pipeline

CR-001, a PD-1 x VEGF bispecific antibody

- Crescent's lead program, CR-001, is a tetravalent PD-1 x VEGF bispecific antibody intentionally designed to replicate the cooperative pharmacology of ivonescimab, which demonstrated superior efficacy compared to the current market leader, pembrolizumab, in a large third-party Phase 3 trial in non-small cell lung cancer.1 Crescent remains on track to submit an Investigational New Drug (IND) application in the fourth quarter of 2025 and expects to report proof-of-concept clinical data from a global Phase 1 trial in patients with solid tumors in the second half of 2026.

CR-002 and CR-003, novel antibody-drug conjugates (ADCs)

- CR-002 and CR-003 are novel ADCs with topoisomerase inhibitor payloads that are being developed as single agents and in combination with CR-001. Crescent expects to submit an IND application for CR-002 in mid-2026.

Second Quarter 2025 Financial Results

Cash position: Cash was $152.6 million as of June 30, 2025, which is anticipated to fund operations through 2027.

Research and development (R&D) expenses: R&D expenses were $12.1 million for the three months ended June 30, 2025.

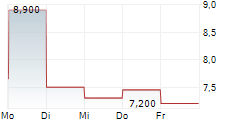

General and administrative (G&A) expenses: G&A expenses were $8.9 million for the three months ended June 30, 2025.

Net loss: Net loss was $21.8 million, or $4.93 per basic and diluted share, for the three months ended June 30, 2025.

About Crescent Biopharma

Crescent Biopharma's vision is to build a world leading oncology company bringing the next wave of therapies for cancer patients. The Company's pipeline includes its lead program, a PD-1 x VEGF bispecific antibody, as well as novel antibody-drug conjugates. By leveraging multiple modalities and established targets, Crescent aims to rapidly advance potentially transformative therapies either as single agents or as part of combination regimens to treat a range of solid tumors. For more information, visit www.crescentbiopharma.com and follow the Company on LinkedIn and X.

Forward-Looking Statements

Certain statements in this press release, other than purely historical information, may constitute "forward-looking statements" within the meaning of the federal securities laws, including for purposes of the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, express or implied statements relating to Crescent's expectations, hopes, beliefs, intentions or strategies regarding the future of its pipeline and business including, without limitation, Crescent's ability to achieve the expected benefits or opportunities with respect to CR-001, CR-002 and CR-003, including the expected timelines of regulatory filings for CR-001 and CR-002 and initial clinical data for CR-001, the potential for CR-001 to replicate the cooperative pharmacology of ivonescimab in clinical trials, the potential for CR-002 and CR-003 to act as single agents and in combination with CR-001, the anticipated benefits of the management and board of directors changes, and Crescent's anticipated cash runway. The words "opportunity," "potential," "milestones," "pipeline," "can," "goal," "strategy," "target," "anticipate," "achieve," "believe," "contemplate," "continue," "could," "estimate," "expect," "intends," "may," "plan," "possible," "project," "should," "will," "would" and similar expressions (including the negatives of these terms or variations of them) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting Crescent will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond Crescent's control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, risks related to those uncertainties and factors more fully described in Crescent's most recent filings with the Securities and Exchange Commission (including its Quarterly Report on Form 10-Q and registration statement on Form S-4, most recently amended on May 12, 2025 and declared effective by the SEC on May 14, 2025), as well as risk factors associated with companies, such as Crescent, that operate in the biopharma industry. Should one or more of these risks or uncertainties materialize, or should any of Crescent's assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this press release, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Crescent does not undertake or accept any duty to release publicly any updates or revisions to any forward-looking statements. This press release does not purport to summarize all of the conditions, risks and other attributes of an investment in Crescent.

| Crescent Biopharma, Inc. Condensed Consolidated Statement of Operations (in thousands, except share and per share data) (Unaudited) | ||||||||

| Three Months Ended June 30, 2025 | Six Months Ended June 30, 2025 | |||||||

| Operating expenses | ||||||||

| Research and development | $ | 12,081 | $ | 22,708 | ||||

| General and administrative | 8,949 | 12,547 | ||||||

| Total operating expenses | 21,030 | 35,255 | ||||||

| Loss from operations | (21,030 | ) | (35,255 | ) | ||||

| Other expense | (760 | ) | (1,683 | ) | ||||

| Net loss and comprehensive loss | $ | (21,790 | ) | $ | (36,938 | ) | ||

| Net loss per share attributable to ordinary shareholders, basic and diluted | $ | (4.93 | ) | $ | (14.11 | ) | ||

| Net loss per share attributable to Series A non-voting convertible preferred shareholders, basic and diluted | $ | (4,930.97 | ) | $ | (14,104.9 | ) | ||

| Weighted-average ordinary shares outstanding used in computing net loss per share to ordinary shareholders, basic and diluted | 3,856,925 | 2,331,339 | ||||||

| Weighted-average ordinary shares outstanding used in computing net loss per share to Series A non-voting convertible preferred shareholders, basic and diluted | 565 | 286 | ||||||

| Summary Balance Sheet Data (in thousands) (Unaudited) | |||||||

| June 30, 2025 | December 31, 2024 | ||||||

| Assets | |||||||

| Cash | $ | 152,645 | $ | 34,766 | |||

| Other assets | 4,788 | 851 | |||||

| Total Assets | $ | 157,433 | $ | 35,617 | |||

| Liabilities and Shareholders' Equity (Deficit) | |||||||

| Liabilities | $ | 18,179 | $ | 47,096 | |||

| Shareholders' equity (deficit) and convertible preferred shares | 139,254 | (11,479 | ) | ||||

| Total liabilities and shareholders' equity (deficit) | $ | 157,433 | $ | 35,617 | |||

Reference:

1. Xiong, Anwen et al. Ivonescimab versus pembrolizumab for PD-L1-positive non-small cell lung cancer (HARMONi-2): a randomised, double-blind, phase 3 study in China. The Lancet, 2025; 405(10481): 839-849.

Contact

Amy Reilly

Chief Communications Officer

amy.reilly@crescentbiopharma.com

617-465-0586