DJ Petrofac Limited: Restructuring and business update

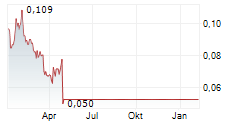

Petrofac Limited ( PFC)

Petrofac Limited: Restructuring and business update

01-Aug-2025 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

PETROFAC LIMITED

Restructuring and business update

Petrofac today issues an update on its Restructuring Plan and the progress of the business in the six months ending 30

June 2025.

Restructuring update

-- The Group announces the extension of the original Lock-Up Agreement. The Group's bondholders, investors and those

creditors party to the Lock-Up Agreement have reinforced their support for the Group by committing to an extension

until 30 November 2025.

-- The Board has identified and is actively progressing a number of routes to deliver the Restructuring, including

through a Plan that addresses the narrow grounds on which the Court of Appeal issued its judgment on 1 July 2025.

The Board welcomes the extension of the Lock-Up Agreement and the ongoing support of key clients which provide the

Group with a stable platform to continue to pursue the Restructuring.

-- Additionally, the Group will today apply to the Supreme Court for leave to appeal the judgment handed down by the

Court of Appeal on 1 July.

First Half Business highlights

-- All business units continued to execute contracts despite the Group's financial constraints:

- Progress was maintained on the current ADNOC and TenneT contracts;

- Legacy contracts continued to be closed out and now represent a small proportion of E&C's contract backlog.

-- First Half Business Performance Revenue and EBIT are expected to be significantly ahead of the prior year despite

financial constraints impacting project costs and schedules.

-- E&C secured two major new contracts with ADNOC:

- USUSD330 million EPC contract for new gas compressor plant at the Habshan complex;

- EPC Management Services contract for a USUSD1.2 billion project to expand gas production facilities on Das

Island.

-- Asset Solutions secured around USUSD500 million new orders.

-- Group backlog(1)(3) was USUSD6.7 billion at 30 June, broadly in line with the 2024 year-end.

-- The Group has been able to maintain liquidity to support its operations, reflecting,

- suspension of debt service payments;

- commercial settlements and associated collections secured as part of the close out of legacy contracts;

- supportive supply chain and customer relationships, and careful cash flow management.

-- USUSD40 million of net liquidity(2)(3) was generated in the First Half, increasing Group's net liquidity to USUSD192

million at 30 June 2025 (31 December 2024: USUSD152 million).

-- Group's pipeline remains strong, largely focused on the MENA region and ETP opportunities.

Tareq Kawash, Petrofac's Group Chief Executive, commented:

"The agreement of stakeholders to extend the Lock-Up demonstrates their support for the work underway to address the

narrow grounds on which the Court of Appeal upheld the challenge to our Restructuring Plan. While the need for the

balance sheet restructuring remains clear, the commitments formalised today give me confidence that we can deliver a

successful outcome.

"Petrofac's operational capability remains intact, and the business continues to deliver for its clients. We have

secured new contract awards and have a strong pipeline of future opportunities. This is in no small part thanks to the

dedication of our people, and the continued support of our clients and suppliers. Following a prolonged period of

challenge for the Group, I am more focused than ever on delivering the best possible outcome for all stakeholders."

ENDS

1. Backlog consists of the estimated revenue attributable to the uncompleted portion of E&C projects; and for the

Asset Solutions division, the revenue attributable to the lesser of the remaining contract term and five years.

2. Net liquidity consisted of gross cash, less cash held in countries whose exchange controls restrict or delay

remittance of these amounts to foreign countries, less cash held in jointly controlled consortium bank accounts,

and less cash held in joint operation bank accounts which are generally available to meet the working capital

requirements of these joint ventures but can only be made available to the Group for general corporate use with the

agreement of the joint-venture partners.

3. Full-Year 2024 balances unaudited.

Disclaimer:

This announcement contains forward-looking statements relating to the business, financial performance and results of

Petrofac and the industry in which Petrofac operates. These statements may be identified by words such as "expect",

"believe", "estimate", "plan", "target", or "forecast" and similar expressions, or by their context. These statements

are made on the basis of current knowledge and assumptions and involve risks and uncertainties. Various factors could

cause actual future results, performance or events to differ materially from those expressed in these statements and

neither Petrofac nor any other person accepts any responsibility for the accuracy of the opinions expressed in this

presentation or the underlying assumptions. No obligation is assumed to update any forward-looking statements.

For further information contact:

Petrofac Limited

+44 (0) 207 811 4900

David Boyd, Investor Relations

David.boyd@petrofac.com

Sophie Reid, Group Director of Communications

Sophie.reid@petrofac.com

Teneo (for Petrofac)

+44 (0) 207 353 4200

petrofac@teneo.com

NOTES TO EDITORS

Petrofac

Petrofac is a leading international service provider to the energy industry, with a diverse client portfolio including

many of the world's leading energy companies.

Petrofac designs, builds, manages and maintains oil, gas, refining, petrochemicals and renewable energy infrastructure.

Our purpose is to enable our clients to meet the world's evolving energy needs. Our four values - driven, agile,

respectful and open - are at the heart of everything we do.

Petrofac's core markets are in the Middle East and North Africa (MENA) region and the UK North Sea, where we have built

a long and successful track record of safe, reliable and innovative execution, underpinned by a cost effective and

local delivery model with a strong focus on in-country value. We operate in several other significant markets,

including India, South East Asia and the United States. We have 7,300 employees based across 31 offices globally.

Petrofac is listed on the London Stock Exchange (symbol: PFC) trading in Petrofac shares is currently suspended pending

publication of the Groups Full Year 2024 Audited Accounts.

For additional information, please refer to the Petrofac website at www.petrofac.com

=----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B0H2K534

Category Code: MSCH

TIDM: PFC

LEI Code: 2138004624W8CKCSJ177

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 397631

EQS News ID: 2178042

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2178042&application_name=news&site_id=dow_jones%7e%7e%7ebed8b539-0373-42bd-8d0e-f3efeec9bbed

(END) Dow Jones Newswires

August 01, 2025 02:00 ET (06:00 GMT)

© 2025 Dow Jones News