NEW YORK, Aug. 4, 2025 /PRNewswire/ -- High-Trend International Group (the "Registrant" or the "Company") (NASDAQ: HTCO), a global ocean technology company is reporting that its board of directors (the "Board") has approved a reverse stock split (the "Reverse Stock Split") of the Company's Class A ordinary shares, a par value of US$0.0001 each (the "Ordinary Shares"), at a ratio of 1-for-25 (the "Reverse Split Ratio"), with a post-Reverse Stock Split par value of US$0.0025.

The Company is undertaking the Reverse Stock Split with the objective of meeting the minimum $1.00 per Ordinary Share bid requirement for maintaining the listing of the Ordinary Shares on The Nasdaq Capital Market.

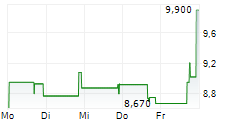

The Reverse Stock Split will be effective at 04:01 p.m. (ET) on Thursday August 7, 2025 (the "Record Date") and the Ordinary Shares will begin trading on a split-adjusted basis when the Nasdaq Stock Market LLC opens for trading on Friday, August 8, 2025. The Ordinary Shares will continue to trade on The Nasdaq Capital Market under the trading symbol "HTCO" but will trade under the following new CUSIP number: G1901X 116.

As a result of the Reverse Stock Split, every 25 Ordinary Shares held as of the Record Date will be automatically combined into one Ordinary Share. The number of outstanding Ordinary Shares will be reduced from approximately 140,000,000 Ordinary Shares to approximately 5,600,000 Ordinary Shares. No fractional shares will be created or issued in connection with the reverse stock split.

The Reverse Stock Split will affect all holders of Ordinary Shares uniformly and will not affect any shareholder's percentage ownership interest in the Company.

Shareholders with Ordinary Shares held in book-entry form or through a bank, broker, or other nominee are not required to take any action and will see the impact of the Reverse Stock Split reflected in their accounts on or after August 8, 2025. Such beneficial holders may contact their bank, broker, or nominee for more information.

Forward-Looking Statements

This current report on Form 6-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The forward-looking statements can be also identified by terminology such as "may," "might," "could," "will," "aims," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements.

These forward-looking statements are based on our current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to a number of risks. The reader should not place undue reliance on these forward-looking statements, as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur. A detailed discussion of factors that could cause or contribute to such differences and other risks that affect our business is included in filings we make with the Commission from time to time, including our most recent report on Form 20-F, particularly under the heading "Risk Factors".

SOURCE High-Trend International Group