SALT LAKE CITY, Aug. 05, 2025 (GLOBE NEWSWIRE) -- Recursion (Nasdaq: RXRX) a leading clinical stage TechBio company decoding biology to radically improve lives, today reported business updates and financial results for its second quarter ended June 30, 2025.

Recursion will host a (L)earnings Call on August 5, 2025 at 8:00 am ET / 6:00 am MT / 1:00 pm BST from Recursion's X (formerly Twitter), LinkedIn, and YouTube accounts giving analysts, investors, and the public the opportunity to ask questions of the company by submitting questions here: https://forms.gle/tZx2fkcmm7BDk9cJ8.

"The power of our platform not only allows us to discover and develop potential new medicines, but also gives us insights on patient populations to target that would be challenging using traditional methods," said Chris Gibson, Co-Founder and CEO of Recursion. "In discovery, we're deploying advanced models like Boltz-2 to rapidly design ligands for high-value targets. State of the art platform capabilities helped us drive our fourth partnered discovery milestone with Sanofi this quarter, reflecting tangible momentum across our joint pipeline. We are leveraging these and other improvements to the Recursion OS to not only accelerate and improve our funnel of new programs, but also execution of later stage programs in our pipeline like RBM39 and CDK7."

Summary of Business Highlights

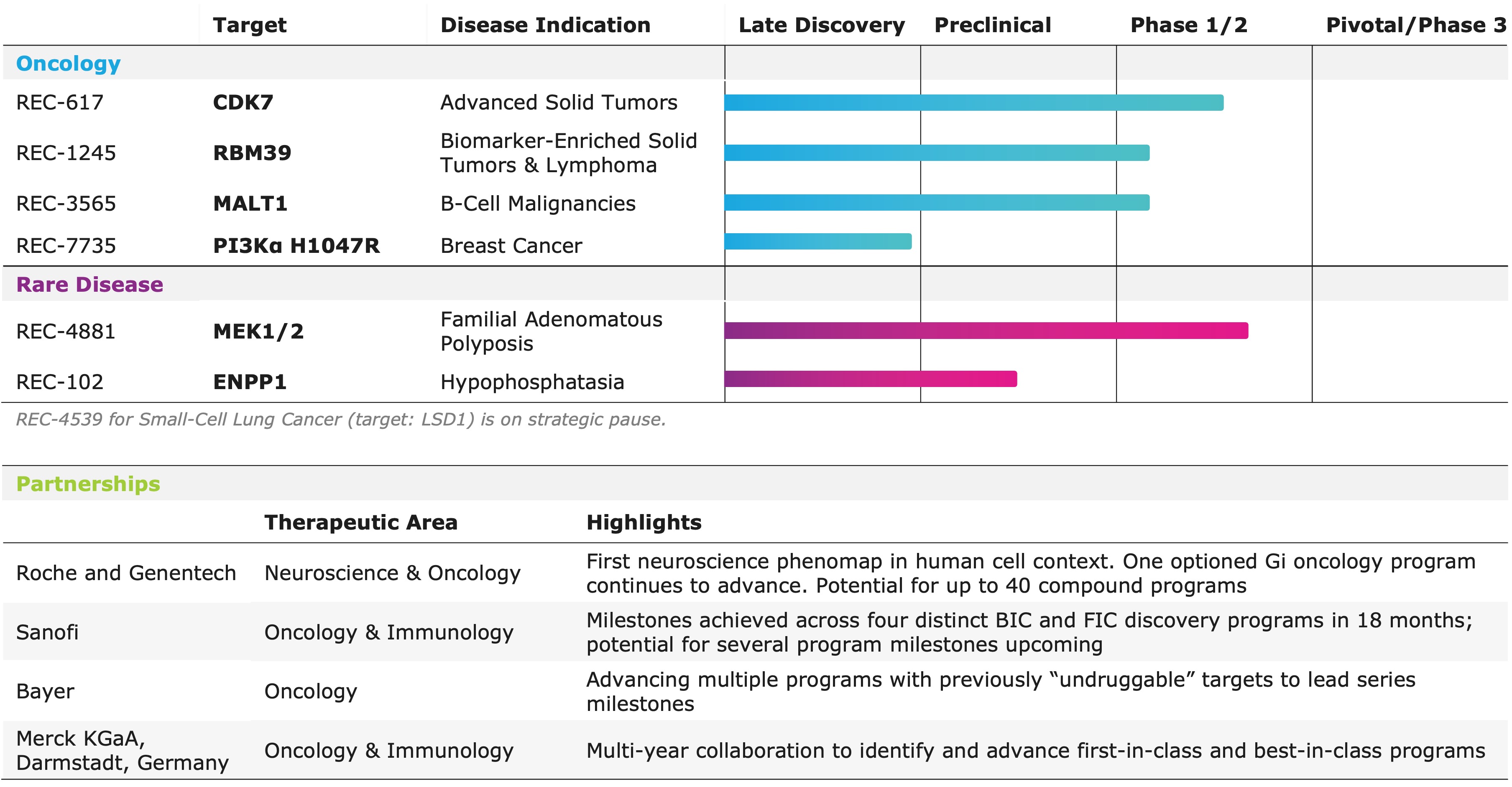

Portfolio - Internal and Partnered Programs

"REC-1245, our potential first-in-class RBM39 degrader, was identified using phenomap-derived insight, and mimics CDK12 loss to induce replication stress and suppress DDR pathways without CDK12 related toxicities. Early data show strong activity in tumors characterized by replication stress and DNA repair vulnerabilities. Our DAHLIA trial is now enrolling select tumor types to identify responsive populations. For REC-617, our CDK7 inhibitor, we leveraged multi-omic and real world patient data and causal AI modeling to select platinum-resistant ovarian cancer as the first combination cohort," said Najat Khan, PhD, Chief R&D Officer and Chief Commercial Officer of Recursion.

Internal Pipeline Updates:

- REC-1245 (RBM39): Recursion provided updates on the biomarker strategy and patient population currently enrolling in the ongoing Phase 1/2 DAHLIA study.

- About REC-1245

- Potential first-in-class oral RBM39 degrader that selectively impairs alternative splicing to silence multiple DDR pathways, leading to high replication stress.

- Characterized to selectively mimic the phenotype associated with CDK12 loss of function using Recursion's AI-powered maps of human biology.

- Update on target patient population

- Early preclinical data shows REC-1245 reduces viability in tumors characterized by replication stress and DNA repair vulnerabilities (DDR defects) across multiple solid tumor types, including MSI-H/dMMR, HRR altered cancers, and other tumors.

- Multi-omic profiling underway to refine the molecular signature of sensitivity.

- Additional DAHLIA trial details

- Monotherapy dose-escalation of Phase 1/2 DAHLIA trial in patients with advanced solid tumors ongoing.

- Early safety and PK data from the Phase 1 dose-escalation portion on track for 1H26.

- About REC-1245

- REC-617 (CDK7): Recursion initiated a combination dose escalation portion of the ELUCIDATE Phase 1/2 trial in 1H25.

- About REC-617

- Orally bioavailable, highly potent, and selective CDK7 inhibitor with best-in-class potential.

- Precision-designed using Recursion's generative AI and active learning platform to optimize for non-covalent binding and ADME/PK, potentially delivering a broader therapeutic window, reduced off-target effects, and enhanced absorption.

- Early Phase 1/2 results demonstrated promising safety and efficacy signals, including a durable partial response in a late-stage metastatic ovarian cancer patient and stable disease across four other patients with solid tumors (e.g. CRC, NSCLC).

- Update on target patient population

- Based on early clinical, preclinical, and causal AI modeling data, Recursion selected ovarian cancer as the initial combination dose expansion cohort.

- Additional ELUCIDATE combination trial details

- REC-617 in combination with standards of care in 2L+ platinum-resistant ovarian cancer population. Enrollment activities have been initiated.

- Additional tumor types and therapies for single-arm expansion cohorts under evaluation.

- Additional data from monotherapy dose-escalation on-track for 2H25.

- About REC-617

- REC-102 (ENPP1): Acquired full rights to REC-102, Recursion's ENPP1 inhibitor for the treatment of hypophosphatasia (HPP), from its joint venture with Rallybio.

- REC-102 is the first potential oral disease-modifying treatment for HPP, a rare and debilitating genetic disorder with limited treatment options.

- Additional preclinical data from the REC-102 program will be presented at the 2025 American Society for Bone and Mineral Research (ASMBR), being held in Seattle, WA.

- A poster titled Amelioration of osteomalacia in late-onset HPP mice via pharmacological inhibition of ENPP1 is scheduled for presentation on September 6, 2025 between 2:00 PM - 3:30 PM PT, during the Basic and Translational session.

- Phase 1 initiation remains on-track for 2H26.

Upcoming milestones:

- REC-4881 (MEK1/2): Additional data in FAP from TUPELO expected in 2H25.

- REC-617 (CDK7): Additional monotherapy data expected in 2H25.

- REC-7735 (PI3Ka H1047R): Preclinical studies ongoing with development candidate expected in 2H25.

- REC-1245 (RBM39): Early Phase 1 safety and PK monotherapy data expected in 1H26.

- REC-3565 (MALT1): Early Phase 1 safety and PK monotherapy data expected in 2H26.

- REC-102 (ENPP1): Phase 1 initiation expected in 2H26.

- Potential for over $100 million in partnership milestones by the end of 2026.

- Several programs are advancing towards potential development candidate designation over the next 12-15 months.

- Multiple neuroscience target validation programs advancing by leveraging the Recursion OS.

Partnered Discovery Updates:

- Sanofi: Recursion and Sanofi continue to advance multi-target collaboration for up to 15 best-in-class or first-in-class programs across oncology and immunology, with $130 million in upfront and milestone payments achieved to date. Each program has the potential for over $300 million in milestone payments.

- In 2Q, achieved a $7 million milestone payment for an immunology program. Under the collaboration, this is the fourth partnered program reaching a significant discovery milestone in 18 months.

- Sanofi is now leveraging combined Recursion OS 2.0, including phenomics, to identify new program opportunities.

- Several programs are advancing towards potential development candidate designation over the next 12-15 months.

- Roche and Genentech: Recursion continues to make meaningful progress on both building additional neuromaps and driving target validation and small molecule programs in a single GI oncology indication.

- Neuro: To date, the collaboration has built a whole-genome knockout phenomap derived from over one trillion iPSC-derived neural cells, alongside around 5,000 transcriptomes representing approximately 171 TB of data.

- Potential neuroscience targets have been identified for validation from the map, and today multiple novel target validation programs are advancing leveraging the Recursion OS and Genentech's biological expertise.

- Building additional neuromaps, including multi-modal maps, combining Roche and Genentech's expertise in single cell screens with Recursion's and Genentech's multi-omic machine learning capabilities.

- GI-Oncology: To date, Recursion has generated all whole genome scale and small molecule GI-oncology specific phenomaps contemplated in the partnership, from which both novel target and small molecule programs can be surfaced.

- One optioned program continues to advance toward lead series.

- Focused on advancing multiple novel target and/or compound programs.

- Neuro: To date, the collaboration has built a whole-genome knockout phenomap derived from over one trillion iPSC-derived neural cells, alongside around 5,000 transcriptomes representing approximately 171 TB of data.

- Bayer: Recursion and Bayer have nominated multiple early discovery precision oncology programs against previously "undruggable" targets. Work is underway to advance multiple programs to lead series milestone decisions.

- Merck KgAa, Darmstadt, Germany: Collaboration ongoing to identify first-in-class and best-in-class targets.

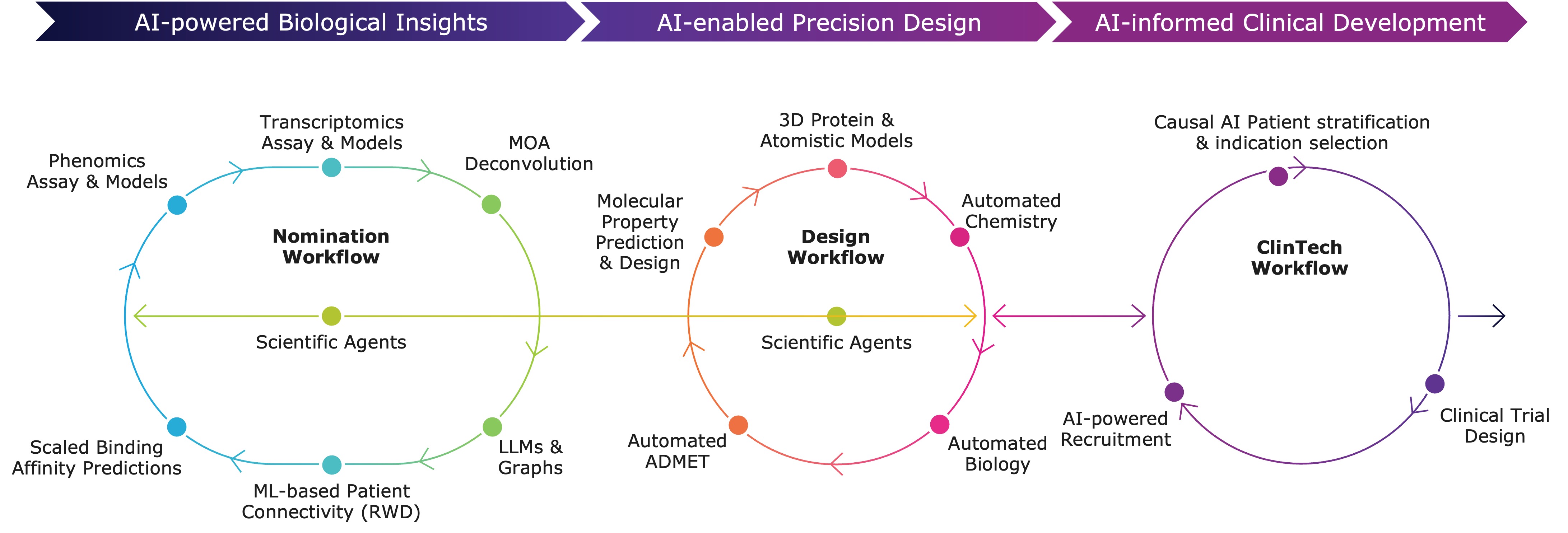

Platform

Recursion OS 2.0: The platform is continuing to drive program development with applications across biology, chemistry and clinical development.

- Actively expanding the Virtual Cell to understand and predict cellular behavior across a wider range of biology.

- Boltz-2 open source model released with MIT and Nvidia to commoditize state of the art performance for binding affinity prediction approaching the accuracy of physics-based free energy perturbation (FEP) calculations while being over 1,000 times faster and less computationally expensive. The open source tool has been downloaded by over 40,000 unique users to date.

- Incorporating diverse cell types beyond HUVEC and disease areas beyond oncology, to discover more novel biology and new medicines.

- Recursion continues to expand its ClinTech platform, integrating high-quality, linked patient datasets like Tempus, HealthVerity, and Helix to strengthen programs, bolster preclinical and early clinical data to select patients (e.g., for REC-617), and optimize recruitment.

Second Quarter 2025 Financial Results

- Cash Position: Cash, cash equivalents and restricted cash were $533.8 million as of June 30, 2025 compared to $603.0 million as of December 31, 2024. Based on current operating plans, the Company believes that its expected cash runway will extend into the fourth quarter of 2027.

- Revenue: Total revenue, consisting primarily of revenue from collaboration agreements, was $19.2 million for the second quarter of 2025, compared to $14.4 million for the second quarter of 2024.

- Research and Development Expenses: Research and development expenses were $128.6 million for the second quarter of 2025, compared to $73.9 million for the second quarter of 2024. The increase was primarily driven by the Company's agreement with Tempus as well as its business combination with Exscientia in November 2024. This includes recognition of $22.7 million in non-cash expenses for use of Tempus' patient-centric multimodal oncology data under the companies' ongoing collaboration.

- General and Administrative Expenses: General and administrative expenses were $46.7 million for the second quarter of 2025 compared to $31.8 million for the second quarter of 2024. The increase compared to the prior period was primarily due to the inclusion of G&A expenses from the business combination with Exscientia.

- Net Loss: Net loss was $171.9 million for the second quarter of 2025, compared to a net loss of $97.5 million for the second quarter of 2024.

- Operational cash flows: Net cash used in operating activities was $208.4 million for the six months ended June 30, 2025, compared to net cash used in operating activities of $184.5 million for the six months ended June 30, 2024. The increase in cash used in operating activities was primarily driven by the inclusion of Exscientia's operations, for which the business combination with Recursion closed in November 2024. This was partially offset by cash inflows from partnerships and operational tax rebates totaling $7.0 million and $28.6 million respectively for the first three and six months of 2025. No cash inflows from partnerships or operational tax rebates were recorded during the six months ended June 30, 2024. In association with the restructuring activities announced in June 2025, the Company expects to incur costs totalling $9.3 million, of which $3.9 million has been paid in the second quarter of 2025. Recursion expects to incur all of these expenses in the year ending December 31, 2025.

About Recursion

Recursion (NASDAQ: RXRX) is a clinical stage TechBio company leading the space by decoding biology to radically improve lives. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously generate one of the world's largest proprietary biological and chemical datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale - up to millions of wet lab experiments weekly - and massive computational scale - owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology and chemistry to advance the future of medicine.

Recursion is headquartered in Salt Lake City, where it is a founding member of BioHive, the Utah life sciences industry collective. Recursion also has offices in Montréal, New York, London, and the Oxford area. Learn more at www.Recursion.com, or connect on X (formerly Twitter) and LinkedIn.

Media Contact

Media@Recursion.com

Investor Contact

Investor@Recursion.com

| Recursion Pharmaceuticals Inc Consolidated Statements of Operations (unaudited) (in thousands, except share and per share amounts) | ||||||||||||||

| Three months ended June 30, | Six months ended June 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Revenue | ||||||||||||||

| Operating revenue | $ | 19,103 | $ | 14,404 | $ | 33,921 | $ | 27,895 | ||||||

| Grant revenue | 120 | 13 | 47 | 316 | ||||||||||

| Total revenue | 19,223 | 14,417 | 33,968 | 28,211 | ||||||||||

| Operating costs and expenses | ||||||||||||||

| Cost of revenue | 20,161 | 9,199 | 41,990 | 20,365 | ||||||||||

| Research and development | 128,636 | 73,928 | 258,269 | 141,488 | ||||||||||

| General and administrative | 46,653 | 31,833 | 101,304 | 63,241 | ||||||||||

| Total operating costs and expenses | 195,450 | 114,960 | 401,563 | 225,094 | ||||||||||

| Loss from operations | (176,227 | ) | (100,543 | ) | (367,595 | ) | (196,883 | ) | ||||||

| Other income (loss), net | 4,330 | 2,480 | (6,947 | ) | 6,668 | |||||||||

| Loss before income tax benefit | (171,897 | ) | (98,063 | ) | (374,542 | ) | (190,215 | ) | ||||||

| Income tax benefit | - | 523 | 158 | 1,302 | ||||||||||

| Net loss | $ | (171,897 | ) | $ | (97,540 | ) | $ | (374,384 | ) | $ | (188,913 | ) | ||

| Per share data | ||||||||||||||

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.41 | ) | $ | (0.40 | ) | $ | (0.91 | ) | $ | (0.79 | ) | ||

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 417,361,147 | 242,196,409 | 410,268,199 | 239,107,879 | ||||||||||

| Recursion Pharmaceuticals Inc Condensed Consolidated Balance Sheets (unaudited) (in thousands) | ||||||

| June 30, | December 31, | |||||

| 2025 | 2024 | |||||

| Assets | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 525,110 | $ | 594,350 | ||

| Restricted cash | 3,106 | 3,045 | ||||

| Other receivables | 21,606 | 49,166 | ||||

| Prepaid data assets | - | 29,601 | ||||

| Other current assets | 37,338 | 38,107 | ||||

| Total current assets | 587,160 | 714,269 | ||||

| Restricted cash, non-current | 5,629 | 5,629 | ||||

| Property and equipment, net | 120,038 | 141,063 | ||||

| Operating lease right-of-use assets | 50,324 | 65,877 | ||||

| Financing lease right-of-use assets | 23,242 | 26,273 | ||||

| Intangible assets, net | 341,319 | 335,855 | ||||

| Goodwill | 164,270 | 148,873 | ||||

| Deferred tax assets | 957 | 1,934 | ||||

| Other assets, non-current | 9,416 | 8,825 | ||||

| Total assets | $ | 1,302,355 | $ | 1,448,598 | ||

| Liabilities and stockholders' equity | ||||||

| Current liabilities | ||||||

| Accounts payable | $ | 19,314 | $ | 21,613 | ||

| Accrued expenses and other liabilities | 64,280 | 81,872 | ||||

| Accrued data liability | 20,258 | - | ||||

| Unearned revenue | 39,690 | 61,767 | ||||

| Operating lease liabilities | 11,732 | 13,795 | ||||

| Notes payable and financing lease liabilities | 8,752 | 8,425 | ||||

| Total current liabilities | 164,026 | 187,472 | ||||

| Unearned revenue, non-current | 126,243 | 118,765 | ||||

| Operating lease liabilities, non-current | 53,395 | 67,250 | ||||

| Notes payable and financing lease liabilities, non-current | 14,196 | 19,022 | ||||

| Deferred tax liabilities | 23,784 | 16,575 | ||||

| Other liabilities, non-current | 1,565 | 4,732 | ||||

| Total liabilities | 383,209 | 413,816 | ||||

| Commitments and contingencies | ||||||

| Stockholders' equity | ||||||

| Common stock (Class A, B and Exchangeable) | 4 | 4 | ||||

| Additional paid-in capital | 2,681,111 | 2,473,698 | ||||

| Accumulated deficit | (1,805,589 | ) | (1,431,283 | ) | ||

| Accumulated other comprehensive loss | 43,620 | (7,637 | ) | |||

| Total stockholders' equity | 919,146 | 1,034,782 | ||||

| Total liabilities and stockholders' equity | $ | 1,302,355 | $ | 1,448,598 | ||

Forward-Looking Statements

This document contains information that includes or is based upon "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995, including, without limitation, those regarding Recursion's ability to discover and develop medicines and the occurrence or realization of near-term milestones; the timing of data readouts and other milestones; the impact of preclinical data on trial outcomes; Recursion's future as a leader in TechBio and ability to deliver better treatments to patients faster; the completion of core integration plans and the results of the business combination with Exscientia; expectations relating to early and late stage discovery, preclinical, and clinical programs, including timelines for commencement of and enrollment in studies, data readouts, and progression toward IND-enabling studies; expectations and developments with respect to licenses and collaborations, including option exercises by partners and the amount and timing of potential milestone payments, and the acceleration of progress across multiple partnered programs; prospective products and their potential future indications and market opportunities; developments with Recursion OS, including the ability to discover and develop new medicines and provide insights into patient populations; financial position and cash runway; and other technologies; business and financial plans and performance; and all other statements that are not historical facts. Forward-looking statements may or may not include identifying words such as "plan," "will," "expect," "anticipate," "intend," "believe," "potential," "continue," and similar terms. These statements are subject to known or unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements, including but not limited to: challenges inherent in pharmaceutical research and development, including the timing and results of preclinical and clinical programs, where the risk of failure is high and failure can occur at any stage prior to or after regulatory approval due to lack of sufficient efficacy, safety considerations, or other factors; our ability to leverage and enhance our drug discovery platform; our ability to obtain financing for development activities and other corporate purposes; the success of our collaboration activities; our ability to obtain regulatory approval of, and ultimately commercialize, drug candidates; our ability to obtain, maintain, and enforce intellectual property protections; cyberattacks or other disruptions to our technology systems; our ability to attract, motivate, and retain key employees and manage our growth; inflation and other macroeconomic issues; and other risks and uncertainties such as those described under the heading "Risk Factors" in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. All forward-looking statements are based on management's current estimates, projections, and assumptions, and Recursion undertakes no obligation to correct or update any such statements, whether as a result of new information, future developments, or otherwise, except to the extent required by applicable law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5f177435-1e39-422b-a35b-582abb38a535

https://www.globenewswire.com/NewsRoom/AttachmentNg/36c0f8b5-9b3c-4d4f-9101-384a9a91fde1