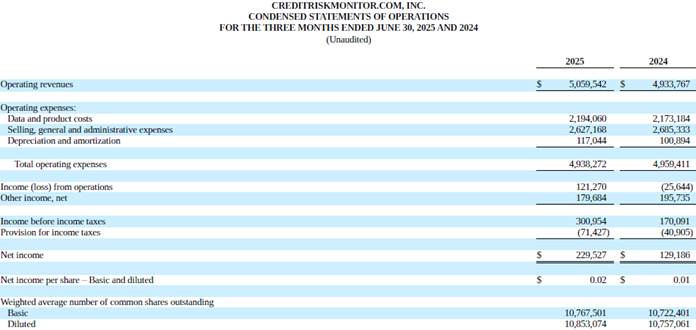

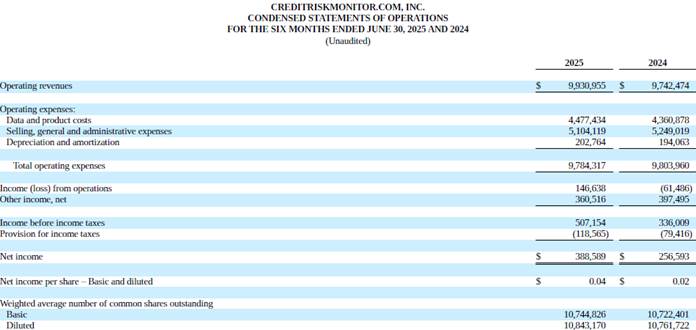

TARRYTOWN, NY / ACCESS Newswire / August 6, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported operating revenues of $5.1 million, an increase of approximately $126 thousand or 3%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024. The Company reported pre-tax income of approximately $301 thousand, an increase of approximately $131 thousand or 77%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024. The increase in pre-tax profitability was primarily driven by a decrease in expenses related to employee salaries, employee benefits, and commissions. The Company reported net income of approximately $230 thousand, an increase of approximately $100 thousand or 78%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024.

Mike Flum, CEO, said, "The second quarter was dynamic for us as we geared up to launch our revamped Client Services model and new Customer Relationship Management ("CRM") platform for Q3. Subscribers now have a support team that includes client success and sales representatives, following more systematic processes with enhanced tracking focused on driving value creation for clients. Customer service is paramount to our success and is consistently mentioned as one of our distinctions when compared to our competition. These changes should improve customer satisfaction while also promoting increases in gross and net revenue retention. The new CRM also unites our marketing and revenue teams on a single platform that should improve transparency and accountability at all levels of the Go-To-Market effort. While these modifications pose some risk to our short-term performance while the teams assimilate to the new systems, they will support far greater efficiency and performance in the long term.

We're also very excited about some upcoming feature releases later this year, including our new Financial Analyst Strength Test or FAST Rating, an update to the FRISK® Score, enhanced industry norms benchmarking, and more. The Company is also working on some interesting conversational AI use cases, which may start rolling out into beta testing as well.

On the macroeconomic front, we continue to see increasing bankruptcy rates across all market size segments, with some notable recent bankruptcies in the over $1 billion liability filers, including Wolfspeed Inc., Del Monte Foods Inc., At Home Group Inc., and Everstream Solutions LLC, to name a few. Recent economic reporting for the U.S. market also points toward increasing recession risks, with nonresidential business investment contributing only 0.27% to Q2 U.S. GDP and the July jobs data calling the labor market's resiliency in the face of tariffs into question. All of these conditions increase demand for our services and we started to see some of our pending deals close in Q2 as businesses moved out of the 'wait & see' strategy that dominated the prior 2 quarters."

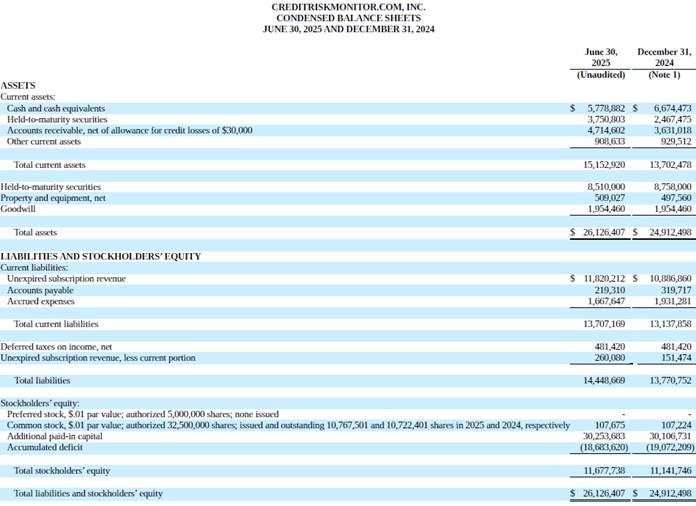

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. Our primary SaaS subscription products for analyzing commercial financial risk are CreditRiskMonitor® and SupplyChainMonitor. These products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively. Our subscribers include nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide.

To help subscribers prioritize and monitor counterparty financial risk, our SaaS platforms offer the proprietary FRISK® and PAYCE® scores, the well-known Altman Z"-score, agency ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), curated news, and detailed financial spreads & ratios. Our FRISK® and PAYCE® scores are financial distress classification models that measure a business's probability of bankruptcy within a year. The FRISK® score also includes a risk signal based on the aggregate research behaviors of our subscribers, who control counterparty access to trade credit at some of the most sophisticated companies in the world. The inclusion of this risk signal boosts the overall accuracy of this bankruptcy analytic by lowering the false positive rate for the riskiest corporations.

Through its Trade Contributor Program, the Company receives monthly confidential accounts receivables data from hundreds of subscribers and non-subscribers, which it parses, processes, aggregates, and reports to summarize the invoice payment behavior of B2B counterparties without disclosing the specific contributors of this information. The size of the Trade Contributor Program's current annualized trade credit transaction data is approximately $3 trillion.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, Chief Executive Officer

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/computers-technology-and-internet/creditriskmonitor-announces-second-quarter-results-1057487