NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

CALGARY, Alberta, Aug. 06, 2025 (GLOBE NEWSWIRE) -- Traction Uranium Corp. (CSE: TRAC) (FRA: Z1K) (the "Company" or "Traction") announces that it has entered into debt settlement agreements (the "Agreements") with a director, an officer, and a consultant of the Company, respectively.

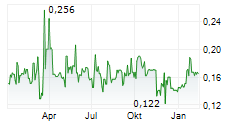

Pursuant to the Agreements, the Company has agreed to settle debts in the aggregate amount of $283,400 through the issuance of 1,288,181 units (each, a "Unit") at a deemed price of $0.22 per Unit, with each Unit being comprised of one (1) common share in the capital of the Company (each a "Share") and one (1) Share purchase warrant (a "Warrant"). Each Warrant will be convertible into one Share (a "Warrant Share") at a price of $0.285 for a period of two (2) years.

Two of these three Agreements constitute "related party transactions" as defined in Multilateral Instrument 61-101 - Protection of Minority Securityholders in Special Transactions ("MI 61-101"), as a director and a company owned and controlled by an officer of the Company are parties to the Agreements. The Company is relying on exemptions from the valuation and minority shareholder approval requirements of MI 61-101, as the Fair Market Value of the transactions contemplated by these Agreements will not exceed 25% of the Company's Market Capitalization, as such term is defined in MI 61-101. The Company did not file a material change report in respect of the related party transactions at least 21 days before the closing of the Agreements, which the Company deems reasonable in the circumstances.

The Agreements and the issuance of the securities thereunder are subject to the approval of the CSE. The securities will be subject to a hold period of four months and one day pursuant to applicable securities laws.

ABOUT TRACTION URANIUM CORP.

Traction Uranium Corp. (CSE: TRAC) (FRA: Z1K) is in the business of mineral exploration and the development of discovery prospects in Canada, including its uranium project in the world-renowned Athabasca Region.

We invite you to find out more about our exploration-stage activities across Canada's Western region at https://tractionuranium.com/.

On Behalf of The Board of Directors

Paul Gorman

Chief Executive Officer

(604) 425-2271

info@tractionuranium.com

Forward Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. All statements, other than statements of historical fact, included herein, without limitation, statements relating to the debt settlement transactions and the receipt of all necessary regulatory and other approvals, are forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain the necessary approvals in connection with the Agreements and the transactions contemplated thereby and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. The Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

The Canadian Securities Exchange has not reviewed, approved or disapproved the contents of this press release, and does not accept responsibility for the adequacy or accuracy of this release.