INDEXO financial services group plans to make a voluntary share buyback offer to the shareholders of the Latvian fintech company AS DelfinGroup, with the aim of creating one of the strongest local capital financial services groups in Latvia. DelfinGroup views this plan positively. As a profitable and well-known company, DelfinGroup will continue to operate independently within the INDEXO group under its current name. The purpose of this transaction is not to delist DelfinGroup shares from the stock exchange.

Didzis Admidinš, Chairman of the Management Board of DelfinGroup, says: "The planned share transaction, with DelfinGroup becoming part of the INDEXO group, is a good signal for the local capital market, our shareholders, existing and future customers. We have been operating in the market for 16 years, and during this time we have become one of the largest and most successful companies in the non-bank lending sector in Latvia, with our performance indicators continuing to improve every year. I am pleased that our achievements and growth potential have also been recognized by the recently established INDEXO group, which sees new development opportunities in consolidation. This is a story about how 1+1 can be more than 2, and, like DelfinGroup, INDEXO also has a can-do attitude and ambitious goals. This is important on our shared journey."

DelfinGroup provides customized financial services in Latvia and Lithuania through more than 90 branches and online, regularly justifying its shareholders' investments. The company's revenue in 2024 reached EUR 63 million, while in the first half of this year, compared to the same period last year, revenue increased by 27% to EUR 37 million. DelfinGroup net loan portfolio grew to EUR 129 million in the first six months of this year, representing a 14% increase since the beginning of the year.

DelfinGroup market capitalization is over 55 million euros. In synergy with INDEXO, the financial services group could become the largest publicly traded company in Latvia with a broad shareholder base. D. Admidinš emphasizes that the planned share transaction will accelerate DelfinGroup development, providing new growth opportunities.

"I am confident that by establishing a local capital financial services group, DelfinGroup operating results will improve even further. In addition, it should be emphasised that we plan to maintain our dividend payment policy, paying dividends to our shareholders on a quarterly basis. We currently have more than 9,000 shareholders," emphasises D. Admidinš.

As a result of the transaction, no changes are planned in DelfinGroup daily operations or corporate structure, and the company and its brands Banknote and VIZIA will continue to operate as usual.

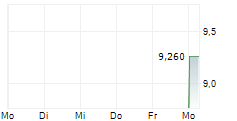

According to information provided by INDEXO, DelfinGroup shareholders will be offered to exchange each DelfinGroup share they own for 0.136986 INDEXO shares. As a second option, DelfinGroup shareholders will be offered to sell their DelfinGroup shares at a price of EUR 1.30 per share. Both the share exchange and share purchase offers value DelfinGroup shares above their current and recent stock market prices. There is also a third option - to keep the existing DelfinGroup shares and continue to participate in the development of DelfinGroup.

About DelfinGroup

AS DelfinGroup is a licenced fintech company established in 2009 and operates under the brand names Banknote and VIZIA. The company has been profitable every year since 2010. DelfinGroup continuously develops and offers consumer and pawn loans, loans developed for senior citizens, Buy now pay later loans (BNPL loans), and the sale of pre-owned goods online and at more than 90 branches across Latvia. Since 2014, DelfinGroup has been known on the Nasdaq Riga Stock Exchange as a bond issuer and, since 2021, as a listed company on the Baltic Main List. The company regularly pays dividends to its shareholders. The sustainability of DelfinGroup is based on focused corporate governance, fintech innovation, responsible lending, financial inclusion, and facilitating the circular economy.