The energy commodities trader and convenience store network Virši (AS VIRŠI-A and its associated group companies) achieved turnover of EUR 188.6 million in the first six months of 2025 and closed the period with 83 service stations, EBITDA of EUR 6.3 million, as well as a net profit of EUR 1.5 million. Despite high geopolitical and global trade policy uncertainty, as well as particularly fierce competition among market participants, the Company has managed to continue rapidly growing its market share in key business segments.

One of the Company's long-term strategic and sustainability goals is the trade of alternative fuels, i.e. the decarbonisation of the transport sector. In line with this goal, the construction of a biomethane plant in Naukšeni was launched during the reporting period and is expected to be completed in the first half of 2026.

"In conditions of high geopolitical and global trade policy uncertainty, Latvia's economic growth in 2025 is forecast at only around 1%. In such a slow-growth environment, particularly fierce competition is observed among market participants for the retention of market share. Nevertheless, even in such conditions, we are able to continue rapidly growing our market share in key business segments. We view the second half of the year with cautious optimism, as a large number of the service stations opened over the past year are expected to reach full operating capacity and thereby contribute positively to the Company's financial results in the future," emphasises Janis Viba, Chairman of the Management Board of Virši.

Continuing the development of the network and new business segments, investments reached EUR 7.4 million during the reporting period. A service station was opened in Salacgriva, a strategically important location on the A1 motorway between Adaži and the Estonian border, where Virši had not been previously represented. Continuing the expansion of the network, the Company announces that another location is planned to open in Kuldiga in the second half of the year.

Development of key business segments

In the first half of the year, convenience stores contributed 50.7% of gross profit, or EUR 10.5 million, which is EUR 1.3 million and 13.8% more than in the corresponding period of 2024. Challenges in this segment are linked to a slowdown in the macroeconomic environment and high food inflation. Growth continued to be driven by a diverse assortment and high service standards.

Retail fuel volumes in Latvia increased by 1.1% in the first five months, while Virši volumes grew by 11.5%. Gross profit from fuel products in 2025 reached EUR 9.8 million, which is EUR 0.5 million or 4.8% more than the previous year. The Company continues to strengthen its market share by expanding the service station network, promoting brand awareness and enhancing customer loyalty.

Since 2022, the energy segment has experienced significant price fluctuations, regulatory changes and geopolitical uncertainty. In the first half of 2025, with the synchronisation of the Baltic energy system with Central Europe, the sector's operating environment has significantly changed. To increase the segment's profitability, the Company reviewed its customer and supplier portfolio during the reporting period and continued to invest in the development of IT solutions. Due to increased electricity balancing costs, the segment ended the half-year with a negative gross profit of EUR 51 thousand (in 2024: EUR 256 thousand gross profit).

The full unaudited consolidated financial report of the AS VIRŠI-A group for the first half of 2025 is attached and available at www.virsi.lv. More information about the results for the first half of 2025 and other Company updates will be shared during the "Virši" webinar on 15 August this year at 11:30 a.m. in English (10:00 a.m. in Latvian). Registration is required to attend the conference.

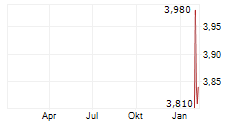

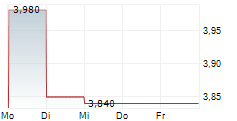

The shares of AS VIRŠI-A are admitted to trading on Nasdaq Baltic First North Market.

The certified adviser for AS VIRŠI-A is the Law Office Eversheds Sutherland Bitans.

Virši is a rapidly growing local energy commodities trader and convenience store network with 30 years of experience. Currently, Virši operates 83 service stations and has more than 900 employees throughout Latvia. Since 11 November 2021, the shares of AS VIRŠI-A have been listed on the Nasdaq Riga First North Alternative Market.

Contact information:

AS VIRŠI-A

Undine Priekule

E-mail: undine.priekule@virsi.lv

Telephone: +371 26141219

Certified adviser:

ZAB Eversheds Sutherland Bitans SIA

Karlis Jekabs Ivans

E-pasts: k-j.ivans@eversheds-sutherland.lv

Talrunis: +371 20 380 986