VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / August 11, 2025 / CoTec Holdings Corp. (TSXV:CTH)(OTCQB:CTHCF) ("CoTec" or the "Corporation") is pleased to announce the repayment of its existing convertible loan (the "Prior Convertible Loan") with Kings Chapel International Limited ("Kings Chapel") pursuant to the convertible loan agreement dated November 19, 2024, as amended (the "Prior Convertible Loan Agreement"). The Corporation has also entered into new convertible loan agreements (the "New Convertible Loan Agreements") with Kings Chapel and certain funds managed by Epic Capital Management Inc. ("Epic Capital"). Pursuant to the New Convertible Loan Agreements, Kings Chapel and Epic Capital have agreed to make available loans to the Corporation in the aggregate principal amounts of up to $5,000,000 and up to $1,600,000, respectively (the "New Convertible Loans").

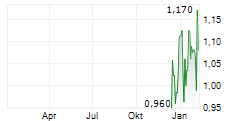

Pursuant to the Prior Convertible Loan Agreement, the entire outstanding principal amount of the Prior Convertible Loan, being $4,851,387, was automatically repaid by the Corporation by the delivery to Kings Chapel as a result of the volume weighted average trading price of the Common Shares on the TSX Venture Exchange (the "TSXV") over the immediately preceding 15 trading days being greater than $1.00. The Corporation satisfied its obligation to repay the outstanding principal amount by delivering to Kings Chapel 6,468,515 of common shares in the capital of the Corporation ("Common Shares") at a price of $0.75 per Common Share.

Pursuant to the New Convertible Loan Agreements, the outstanding principal amount of each of the New Convertible Loans bears interest at an annual rate of 10% and is repayable, together with accrued and outstanding interest, on December 31, 2028. The undrawn principal amounts under the New Convertible Loans also bear a stand-by fee of 2.5% per annum, which shall be calculated and accrue daily and compounded annually. The Corporation's obligations under the New Conterible Loan Agreements are unsecured. No amounts have been drawn under the New Convertible Loan Agreements as of the date hereof.

The outstanding principal amount under each of the New Convertible Loan Agreements will be converted into Common Shares at a price of $1.15 per Common Share (i) at any time after November 15, 2025 at Kings Chapel's or Epic Capital's election, and (ii) automatically at any time after December 31, 2025, on the first day on which the volume weighted average trading price of the Common Shares on the principal stock exchange on which the Common Shares are then traded over the immediately preceding 15 trading days is equal to or greater than $1.35. No conversion of the outstanding principal amount under the New Convertible Loan Agreements will occur to the extent that, after giving effect to the conversion, the applicable lender, its affiliates and any person with whom such lender or its affiliates act jointly or in concert would own more than 49% of the outstanding Common Shares.

Kings Chapel is an existing insider and Control Person (as defined by the TSXV Rules) of the Corporation. Julian Treger, a director of the Corporation and its Chief Executive Officer, is a beneficiary of a family trust associated with Kings Chapel. As a result, the execution of the New Convertible Loan Agreement with Kings Chapel is a related party transaction subject to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The execution of the New Convertible Loan Agreement with Kings Chapel is exempt from the formal valuation requirements of MI 61-101 pursuant to subsection 5.5(b) of MI 61-101 because the Common Shares are listed only on the TSXV and OTCQB and is exempt from the minority shareholder approval requirements of MI 61-101 pursuant to subsection 5.7(1)(a) of MI 61-101 because neither the fair market value of the New Convertible Loan Agreement with Kings Chapel (and the Common shares issuable pursuant to the conversion of the outstanding principal amount of the New Convertible Loan Agreement with Kings Chapel) exceeds 25% of the Corporation's market capitalization as determined in accordance with MI 61-101.

The issuance of Common Shares upon any conversion of the outstanding principal amount under the New Convertible Loan Agreements is subject to the Corporation obtaining all necessary TSXV approvals. All securities listed in connection with the New Convertible Loan Agreements will be subject to a statutory hold period of four months plus a day from the date of the New Convertible Loan Agreements in accordance with applicable securities legislation in Canada.

Early Warning Disclosure

This press release is also being disseminated as required by National Instrument 62-103 - The Early Warning System and Related Take Over Bids and Insider Reporting Issues in connection with the filing of an early warning report by Kings Chapel in respect of its ownership position in the Corporation.

Prior to the conversion of the amounts outstanding under the Prior Convertible Loan Agreement, (i) Kings Chapel owned or controlled 35,786,306 Common Shares representing approximately 39.07% of the 91,604,695 issued and outstanding Common Shares as well as 833,332 warrants to purchase Common Shares, and (ii) Mr. Treger owned or controlled 2,939,269 Common Shares representing approximately 3.21% of the issued and outstanding Common Shares as well as 3,727,935 options to purchase Common Shares and 230,769 warrants to purchase Common Shares.

Immediately following conversion of the amounts outstanding under the Prior Convertible Loan Agreement, (i) Kings Chapel owned or controlled 42,254,821 Common Shares representing approximately 43.08% of the 98,073,210 issued and outstanding Common Shares as well as 833,332 warrants to purchase Common Shares, and (ii) Mr. Treger owned or controlled 2,939,269 Common Shares representing approximately 3.00% of the issued and outstanding Common Shares as well as 3,727,935 options to purchase Common Shares and 230,769 warrants to purchase Common Shares.

Kings Chapel and Mr. Treger hold Common Shares for investment purposes. Each of them has a long-term view of the investment and may acquire additional securities including on the open market or through private acquisitions or sell the securities including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors. Depending on market conditions, general economic, and industry conditions, the Company's business and financial condition, and/or other relevant factors, each such shareholder may develop such plans or intentions in the future.

A copy of the Early Warning Report to be filed by Kings Chapel in connection with the transactions described above will be available on the Corporation's SEDAR+ profile at www.sedarplus.ca.

The head office of the Corporation is located at Suite 428, 755 Burrard Street, Vancouver, BC V6Z 1X6. Kings Chapel's address is No. 2 The Forum, Grenville Street, St. Helier, Jersey JE1 4HH.

About CoTec

CoTec is a publicly traded investment issuer listed on the TSXV and the OTCQB and trades under the symbol CTH and CTHCF respectively. CoTec is a forward-thinking resource extraction company committed to revolutionizing the global metals and minerals industry through innovative, environmentally sustainable technologies and strategic asset acquisitions. With a mission to drive the sector toward a low-carbon future, CoTec employes a dual approach: investing in disruptive mineral extraction technologies that enhance efficiency and sustainability while applying these technologies to undervalued mining assets to unlock their full potential. By focusing on recycling, waste mining, and scalable solutions, the Company accelerates the production of critical minerals, shortens development timelines, and reduces environmental impact. CoTec's strategic model delivers low capital requirements, rapid revenue generation, and high barriers to entry, positioning it as a leading mid-tier disruptor in the commodities sector.

For more information, please visit www.cotec.ca.

Forward-Looking Information Cautionary Statement

Statements in this press release regarding the Company, its investments and the Offerings which are not historical facts are "forward-looking statements" that involve risks and uncertainties, including statements relating to management's expectations with respect to its current and potential future investments and the benefits to the Company which may be implied from such statements. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties.

Actual results in each case could differ materially from those currently anticipated in such statements, due to known an unknown risks and uncertainties affecting the Company, including by not limited to: general economic, political and market factors in North America and internationally, interest and foreign exchange rates, changes in costs of goods and services, global equity and capital markets, business competition, technological change, changes in government relations, industry conditions, unexpected judicial or regulatory proceedings and catastrophic events. The Company's investments are being made in mineral extraction related assets and technologies which are subject to their own inherent risks and the success of such Investments may be adversely impacted by, among other things: environmental risks and costs; labor costs and shortages; uncertain supply and price fluctuations in materials; increases in energy costs; labor disputes and work stoppages; leasing costs and the availability of equipment; heavy equipment demand and availability; contractor and subcontractor performance issues; worksite safety issues; project delays and cost overruns; extreme weather conditions; and social disruptions. As the investments are being made in mineral extraction technology, such investments will also be subject to risks of successful application, scaling and deployment of technology, acceptability of technology within the industry, availability of assets where technology could be applied, protection of intellectual property in relation to such technology, successful promotion of technology and success of competitor technology. Any material adverse change in the Company's financial position or a failure by the Company to successfully make investments in the manner currently contemplated, could have a corresponding material adverse change on the investments and, by extension, the Company.

For further details regarding risks and uncertainties facing the Company, please refer to "Risk Factors" in the Company's filing statement dated April 6, 2022 and its other continuous disclosure documents, copies of which may be found under the Company's SEDAR+ profile at www.sedarplus.com. The Company assumes no responsibility to update forward-looking statements in this press release except as required by law. Readers should not place undue reliance on the forward-looking statements and information contained in this press release and are encouraged to read the Company's continuous disclosure documents, which are available on SEDAR+ at www.sedarplus.ca.

For further information, please contact:

Braam Jonker - (604) 992-5600

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

NOT FOR DISTRIBUTION TO THE U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

SOURCE: CoTec Holdings Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/cotec-holdings-corp.-announces-automatic-conversion-of-kings-chapel-converitble-l-1059412