LONDON (dpa-AFX) - Spirax Group PLC (SPXSF), a British provider of steam management systems, peristaltic pumps, and associated technologies, on Tuesday reported a decline in revenue for the first half.

For the six-month period to June 30, the company recorded a pre-tax income of GBP 87.9 million, less than the GBP 124.8 million reported for the same period last year. Excluding items, pre-tax earnings improved to GBP 139.9 million from GBP 137.9 million in the previous year.

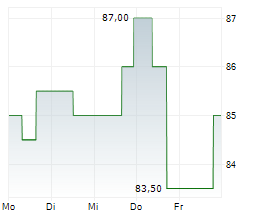

Net income stood at GBP 62.7 million as against the prior year's GBP 91.2 million. Net earnings per share were 84.8 pence, compared with the previous year's 123.6 pence per share.

Excluding items, income was GBP 101.5 million, higher than GBP 101.1 million last year. Adjusted income per share also moved up to 137.3 pence from 136.9 pence per share in the previous year.

Operating profit was GBP 106.8 million, down from GBP 147.2 million a year ago. Revenue was GBP 822.2 million, less than GBP 827 million in 2024.

The Board will pay an interim dividend of 48.9 pence per share on November 14, to shareholders on the register as of October 17.

Looking ahead, the Group expects its second-half organic sales growth to accelerate. Second half growth is projected to be supported by shipments from the strong order books in STS and WMFTS and continued sales momentum in ETS despite a materially stronger comparator for the second half. This is expected to result in a sales profile aligned with the company's typical weighting towards the second half.

Spirax still expects around GBP 35 million of cash costs and GBP 5 million of non-cash costs to deliver its restructuring program, most of which will be taken as a restructuring charge in 2025, with the cash impact expected in 2025 and 2026.

The Group, said: 'Our Group guidance for the full year remains unchanged. We continue to anticipate organic growth in Group revenues consistent with that achieved in 2024 and well ahead of IP. Group adjusted operating profit margin is expected to be ahead of the currency-adjusted 19.4% in 2024, driving mid-single-digit organic growth in adjusted operating profit.'

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News