BRUSSELS (dpa-AFX) - U.K. stocks are up in positive territory around noon on Tuesday, supported by some encouraging earnings, and easing trade tensions after the U.S. extended its pause on higher tariffs for Chinese goods until November 10.

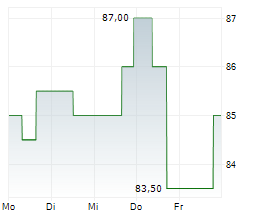

The benchmark FTSE 100, which advanced to 9,165.24 earlier in the session, is up 15.23 points or 0.17% at 9,144.94 a few minutes before noon.

Spirax Group shares are soaring nearly 13%. The British industrial thermal energy and fluid technology company posted first-half 2025 earnings that beat expectations.

Airtel Africa is up 2.2% and BT Group is gaining about 2%. Rio Tinto, Standard Chartered, Pershing Square Holdings, Endeavour Mining and Smith & Nephew are up 1 to 1.6%.

Property investor and developer Derwent London is down more than 4% after announcing the retirement of Executive Director Nigel George.

Ladbrokes owner Entain is down nearly 4% despite reporting strong first-half results and lifting its full-year expectations.

Games Workshop and Croda International are down 2% and 1.9%, respectively. JD Sports Fashion, Scottish Mortgage, RightMve and LSEG are also notably lower.

Recruiter Page Group is down 1.6% on reporting a 99% fall in first-half pre-tax profit against the backdrop of persistent macroeconomic uncertainty and tariff concerns.

Data from the Office for National Statistics showed the UK unemployment rate remained unchanged in three months to June, with the ILO jobless rate holding steady at 4.7%, in line with expectations.

Payroll employees for July decreased 164,000 from the previous year, and by 8,000 from June, to 30.3 million.

Separate set of data revealed that retail sales in the U.K. rose by 2.5% year on year in July.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News