WASHINGTON (dpa-AFX) - Eastman Kodak, the 133-year-old photography pioneer, has issued a stark warning about its future, cautioning investors that it may not be able to continue operating.

In an SEC filing late Monday, the company said there is 'substantial doubt' about its ability to remain a going concern due to mounting losses, shrinking liquidity, and looming debt obligations.

Once a household name in film and cameras, Kodak swung from a $25 million profit a year ago to a $26 million loss in its latest quarter. The company also burned through $46 million in cash, leaving just $155 million on hand, and faces about $500 million in debt coming due within 12 months without committed financing to cover it.

In a cost-cutting move, Kodak terminated its pension plan to redirect funds toward debt repayment, with clarity on obligations to plan participants expected by August 15.

Despite these challenges, CEO Jim Continenza maintained that Kodak is making 'progress against our long-term plan' and expressed confidence in paying off a significant portion of its term loan early while seeking to amend, extend, or refinance remaining debts and preferred stock obligations.

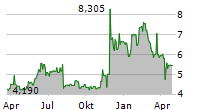

The market, however, reacted sharply Kodak shares plunged 26% to $5.04 on Tuesday. This crisis marks another chapter in Kodak's turbulent modern history, from its dominance in the 20th century to its failure to capitalize on digital technology, leading to bankruptcy in 2012.

While the company has since diversified into pharmaceuticals, films, and specialty chemicals, its survival now hinges on urgent financial restructuring.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News