Original-Research: TeamViewer AG - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to TeamViewer AG

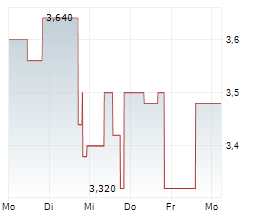

Enterprise business well on track On July 29, 2025, TeamViewer released its Q2 2025 financial results and confirmed its guidance for 2025. Revenue growth was stable and in line with our expectation, supported by double-digit Enterprise growth, strong performance in EMEA and APAC, and retention of key US federal customers. However, revenue was held back by headwinds in the Americas due to political uncertainty and IT budget cuts in the US public sector, as well as weaker SMB demand. Additional growth came from product launches such as DEX Essentials for SMBs and TeamViewer ONE, alongside expanded AI features, though the uptake of new products remains in early stages. The adj. EBITDA margin improved due to lower marketing costs and efficiency gains from the 1E integration, while sales and R&D expenses increased. Guidance for 2025 was reiterated, forecasting revenue growth of 5.1%-7.7% yoy and an adj. EBITDA margin of around 43%. While macro uncertainty, particularly in the US, remains a risk, resilient Enterprise growth, and cross-sell opportunities underpin the investment case. We decrease our target price to EUR 15.50 (previously EUR 17.50) due to more cautious adjustments to our estimates and confirm our Buy recommendation. You can download the research here: TEAMVIEWER_AG_20250826 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2188942 26.08.2025 CET/CEST

© 2025 EQS Group