TORONTO, Sept. 02, 2025 (GLOBE NEWSWIRE) -- NorthWest Copper ("NorthWest" or the "Company") (TSX-V: NWST) is pleased to announce that drilling is well underway at its 100% owned Kwanika project for the 2025 season. The success of the flow through financing has allowed the Company to mobilize two drill rigs to site to execute on its planned 5,135 metre drill program.

The work includes drilling at the existing Kwanika Central deposit and two exploration targets: the Transfer and Andesite Breccia targets.

Kwanika Central Deposit

NorthWest's 2025 plan at the Kwanika Central Deposit is to complete drill holes to confirm and expand its higher-grade target model announced on April 10, 2025 from surface to a depth of approximately 350 metres. The main objective of the program is to use drill results to inform an updated mineral resource estimate and support a revised mine design based on a surface pit and a more selective underground bulk mining method.

Transfer Target

The Company plans to drill test the Transfer Target located approximately 300 metres south of the Kwanika Central Deposit. This target represents a near surface IP chargeability proximal to favourable alteration and discontinuous anomalous gold values identified in previous drilling. The 2025 drilling is designed to determine the orientation of intense alteration associated with late intermediate dykes and for increases in vein intensity and/or mineralization consistent with that at Kwanika Central. The Transfer target represents an opportunity for new discoveries on the Kwanika property that potentially represent parallel zones to Kwanika Central Deposit's western area.

Andesite Breccia Target

NorthWest will also test the Andesite Breccia Target located 600 metres north of the Kwanika Central Deposit with 350 metres in one hole. The 2025 program is to follow-up a historic drill intercept of 87.0 metres at 0.38% Cu & 0.06 g/t Au from 102.4 metres hosted in an andesite hosted tectonic breccia. The breccia remains open at depth and along strike. This mineralization is different from the Kwanika Central Deposit but warrants drilling to understand its orientation, context and whether it represents the northern extension of the Central Fault that runs through the Kwanika Central Deposit.

The drilling at the Kwanika Central Deposit, the Transfer Target and the Andesite Breccia Target is scheduled to continue through to the end of October.

Geoff Chinn, VP Business Development and Exploration stated, "We are thrilled to launch the next drill program at Kwanika guided by our higher-grade target model informed by all historical drilling. This includes 11,876 metres of drilling in 30 holes conducted in 2022 that was excluded from the results of the 2023 Preliminary Economic Assessment1. The 2022 exploration program also included a SkyTEM airborne magnetics survey that has provided additional context for both the Kwanika Central Deposit and the Transfer Target areas that we are keen to evaluate given the potential. The 2025 program, together with the 2022 drilling will be used to inform an updated mineral resource including enhanced higher-grade estimation domains that will be used to support an updated PEA in the first half of 2026."

2025 Drill Program Details

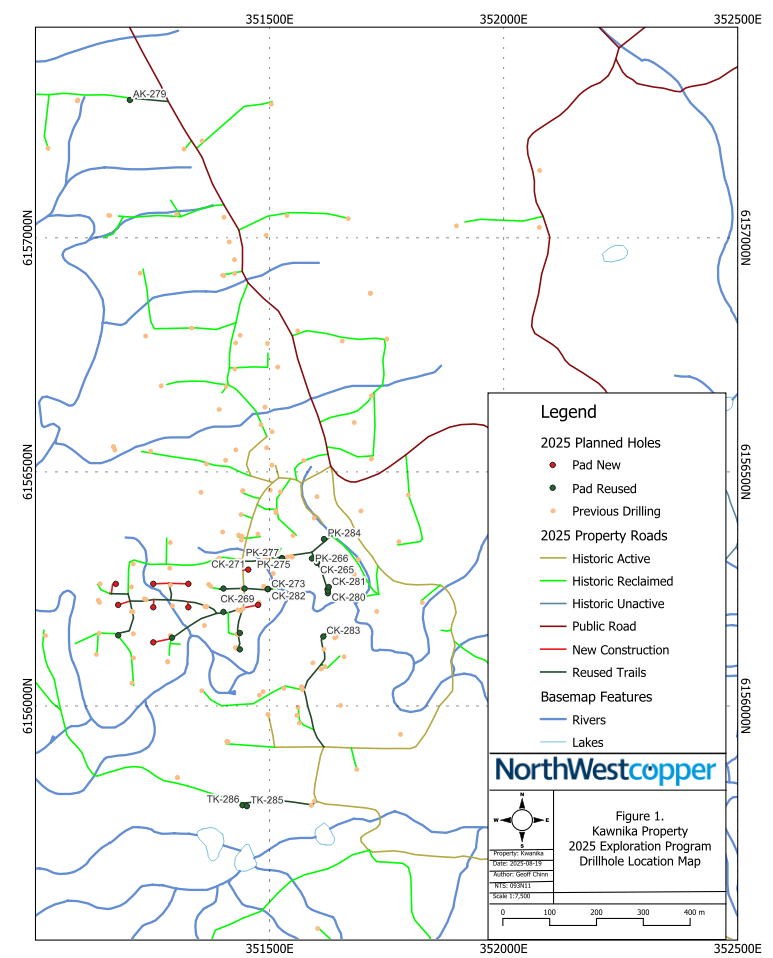

Around Kwanika, the Company plans to complete 5,135 metres of drilling to confirm and expand the higher-grade target model announced April 10th and to drill test the nearby Transfer and Andesite Breccia Targets. Of the total planned drill metres, 4,285 metres is planned at the Kwanika Central Deposit in 14 holes while 850 metres is planned at the Transfer and Andesite Breccia Targets in three holes. A 3D model of the planned holes is available here (2025-2026 3D Drill Program) and a drill hole location map is provided in Figure 1.

The Company will provide additional updates on the drill program as results become available over the coming months.

Technical aspects of this news release have been reviewed, verified, and approved by Geoff Chinn, P.Geo., VP Business Development and Exploration for NorthWest, who is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Minerals Projects.

About NorthWest Copper:

NorthWest Copper is a copper-gold exploration and development company with a pipeline of advanced and early-stage projects in British Columbia, including Kwanika-Stardust, Lorraine-Top Cat and East Niv. With a robust portfolio in a tier one jurisdiction, NorthWest Copper is well positioned to participate fully in a strengthening global copper market. We are committed to responsible mineral exploration which involves working collaboratively with First Nations to ensure future development incorporates stewardship best practices and traditional land use. Additional information can be found on the Company's website at www.northwestcopper.ca.

On Behalf of NorthWest Copper Corp.

"Paul Olmsted"

CEO, NorthWest Copper

For further information, please contact:

604-683-7790

info@northwestcopper.ca

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to statements with respect to; plans and intentions of the Company; proposed exploration and development of NorthWest's exploration property interests; the Company's ability to finance future operations; mine plans; magnitude or quality of mineral deposits; the development, operational and economic results of current and future potential economic studies; adding the Lorraine resource to the Kwanika-Stardust Project; the Company's goals for 2025; geological interpretations; the estimation of Mineral Resources; anticipated advancement of mineral properties or programs; future exploration prospects; the completion and timing of technical reports; future growth potential of NorthWest; and future development plans

All statements, other than statements of historical fact, included herein, constitutes forward-looking information. Although NorthWest believes that the expectations reflected in such forward-looking information and/or information are reasonable, undue reliance should not be placed on forward-looking information since NorthWest can give no assurance that such expectations will prove to be correct. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information, including the risks, uncertainties and other factors identified in NorthWest's periodic filings with Canadian securities regulators. Forward-looking information are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking information. Important factors that could cause actual results to differ materially from NorthWest's expectations include risks associated with the business of NorthWest; risks related to reliance on technical information provided by NorthWest; risks related to exploration and potential development of the Company's mineral properties; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and First Nation groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in NorthWest's filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.com).

Forward-looking information is based on estimates and opinions of management at the date the information is made. NorthWest does not undertake any obligation to update forward-looking information except as required by applicable securities laws. Investors should not place undue reliance on forward-looking information.

_________________________________

1 See NI 43-101 technical report titled "Kwanika-Stardust Project NI 43-101 Technical Report on Preliminary Economic Assessment" dated February 17, 2023, with an effective date of January 4, 2023, filed under the Company's SEDAR+ profile at www.sedarplus.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ba9ca078-4d3d-4b8b-9c78-d24c08763eed