TORONTO, Sept. 03, 2025 (GLOBE NEWSWIRE) -- Talisker Resources Ltd. ("Talisker" or the "Company") (TSX: TSK, OTCQX: TSKFF) is pleased to announce preliminary results from the second stage of laser-based ore-sorting of material from the Company's Bralorne Gold Project located in British Columbia ("Bralorne").

The first phase of ore sorting at Bralorne (see press release of February 26, 2025) resulted in an increase of the average feed grade from 14.4 grams per tonne gold to a final sorted product grade of 27.8 grams per tonne gold. The preliminary results also rejected between 35% and 55% of total rock mass as waste and achieved gold recoveries of between 95% and 99% indicating that Bralorne vein material is particularly well suited to laser-based ore-sorting.

The second stage of testing was a run of mine test-work program using full-scale equipment to allow for a direct comparison to full-scale production projections. A total of 371.3 kilograms of material was processed at Tomra's test centre in Wedel, Germany using multi-channel laser sorting technologies, specifically the PRO Secondary LASER Dual Device. Tomra's laser sorting uses a multi-channel laser system to scan the surface of rock particles. The degrees of diffusion (scattering effects) on the surface of the rocks varies with distinct types of minerals, as well as with their crystallinity and colour. The different spot sizes of the diffusion measured are analysed using Tomra's image processing software providing for the detection of small variances in surface patterns, even when those patterns are identical in colour. The different selected colour classes (coloured pixels) are then assessed as a percentage of the single rock area with this percentage used as a parameter to determine and to set the sorting cut-off grade.

Terry Harbort, CEO of Talisker stated, "We are impressed with these results using our run of mine material and full-scale equipment. We can clearly see the ability of the sorter to concentrate mineralized quartz vein material into the high-grade and medium-grade fractions while separating waste material into the pure waste and low-grade fractions (see figures 1 - 3). As we await the corresponding assay results for each fraction, we will be fast-tracking to the design, permitting and construction phases."

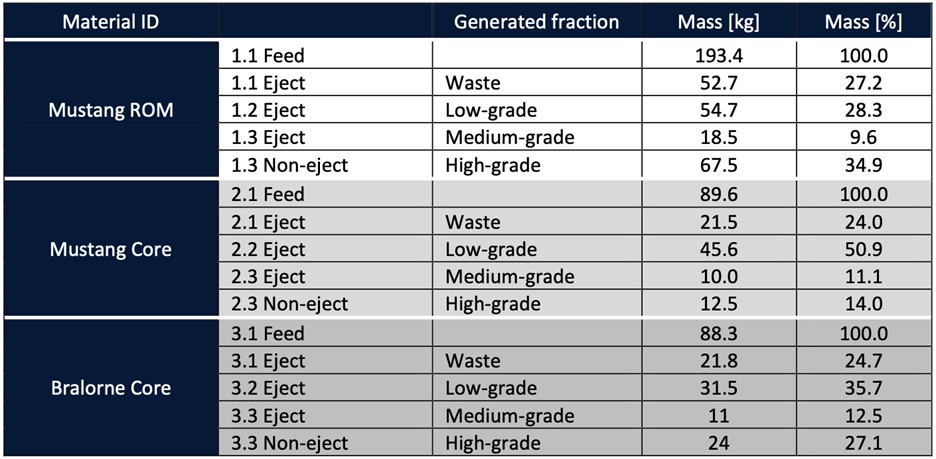

The testing also involved a cascading procedure where gold bearing material was passed multiple times through the sorting device. The cascading procedure involved three sequential sorting steps, each with increasing sensitivity to waste referred to as settings 1 through 3. As the sensitivity increased from setting 1 to setting 3, the mass pull to waste also increased. At setting 1, the sorting produced the highest recovery but with a lower product grade. In contrast, setting 3 yielded the highest product grade, albeit with relatively lower recovery. This approach allows simulation of potential outcomes by applying a specific sensitivity in a single step sorting process.

Table 1 - Results from the second phase of Laser-based ore sorting using PRO Secondary LASER Dual Device with a 3-step cascading procedure.

Upon completion of the ore sorter testing, samples were sent for gold analysis by fire assay and multi-element analysis by four acid digestion followed by inductively coupled plasma mass spectrometry. In addition, material that has been physically concentrated by the ore sorting process will be sent for mineral processing and metallurgical test work.

Figure 1 - Visual results of Run of Mine material from the Mustang Mine showing material sorted into four fractions based on quartz percentage.

Figure 2 - Visual results of drill core material from the Mustang Mine showing material sorted into four fractions based on quartz percentage.

Figure 3 - Visual results of drill core material from the Bralorne West area showing material sorted into four fractions based on quartz percentage.

For further information, please contact:

Lindsay Dunlop

Vice President, Investor Relations

lindsay.dunlop@taliskerresources.com

+1 647 274 8975

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior resource company involved in the exploration and development of gold projects in British Columbia, Canada. Talisker's flagship asset is the high-grade, fully permitted Bralorne Gold Project where the Company is currently transitioning into underground production at the Mustang Mine. Talisker projects also include the Ladner Gold Project, an advanced stage project with significant exploration potential from an historical high-grade producing gold mine and the Spences Bridge Project where the Company has a significant landholding in the emerging Spences Bridge Gold Belt, and several other early-stage Greenfields projects.

About TOMRA

TOMRA Sorting Mining designs and manufactures sensor-based sorting technologies for the global mining industry. The company's systems deliver dry material separation of various ores and minerals, including diamonds and other gemstones, in addition to enabling metal recovery from slag. TOMRA Sorting Mining systems have been installed worldwide, each contributing to extending the lifetime of mining operations and increasing the value derived from deposits. TOMRA Sorting Mining is part of TOMRA Sorting Solutions which also develops sensor-based sorting systems for the recycling and food industries. This powerful combination of technologies makes TOMRA Sorting one of the most advanced providers of sensor-based sorting solutions in the world, with over 12,000 of its systems installed globally. TOMRA Sorting is owned by Norwegian company TOMRA Systems ASA, which is listed on the Oslo Stock Exchange. Founded in 1972, TOMRA Systems ASA has a turnover around €1100m in 2021 and employs over 4,600 people.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Talisker's current belief or assumptions as to the outcome and timing of such future events. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to Talisker. Although such statements are based on reasonable assumptions of Talisker's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions, access and supply risks, reliance on key personnel, operational risks regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks, title and environmental risks and risks relating to the failure to receive all requisite shareholder and regulatory approvals.

The forward-looking information contained in this release is made as of the date hereof, and Talisker is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4f915b26-0527-4ed9-9eb8-f0f0f61ae3e9

https://www.globenewswire.com/NewsRoom/AttachmentNg/519b6098-be9e-434b-9522-2e7e58c5a781

https://www.globenewswire.com/NewsRoom/AttachmentNg/3f697c84-1869-4abb-b4e8-29749a3ebd1b

https://www.globenewswire.com/NewsRoom/AttachmentNg/e3b8e48c-00f9-4431-8b71-f1343d8eafb0