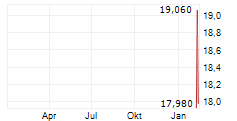

LINKÖPING, Sweden, Sept. 4, 2025 /PRNewswire/ -- International medical imaging IT and cybersecurity company Sectra (STO: SECT B) reports double order bookings, increased sales in all operating areas and a positive earnings trend in the first quarter of 2025/2026. In geographic terms, the US along with the Swedish operations made the largest contribution to the sales growth, despite the fact the outcomes in the US were hampered by exchange-rate effects. The ongoing transition to service sales is progressing well, with growing recurring revenue.

First quarter: May-July 2025

- Contracted order bookings rose 112.9% to SEK 1,309.5 million (615.0), of which SEK 1,192.3 million (543.1) pertained to guaranteed order bookings. Of the guaranteed order bookings, 7% were recognized as revenue during the quarter and a further estimated 13-23% will pertain to revenue within 12 months after the end of the quarter.

- Net sales increased 5.8% to SEK 765.9 million (723.8). Based on unadjusted exchange rates compared with the year-earlier period, the increase was 12.1%. Recurring revenue accounted for SEK 549.2 million (482.3) of net sales, up 13.9%. Based on unadjusted exchange rates, the increase was 20.8%. Cloud recurring revenue (CRR) increased 46.1% to SEK 179.4 million (122.8).

- Operating profit rose 19.0% to SEK 118.8 million (99.8), corresponding to an operating margin of 15.5% (13.8). The outcome includes SEK 36.1 million (12.5) in costs for share-based incentive programs. The increase was partly attributable to the start of a new program after the comparative quarter and partly to the share price trend. Based on unadjusted exchange rates compared with the year-earlier period, operating profit rose 35.9%.

- Profit for the period amounted to SEK 102.8 million (80.4).

- Cash flow from operations amounted to SEK 118.1 million (-56.7). The change was primarily the result of a decrease in capital tied up in current receivables.

Comments from Torbjörn Kronander, President and CEO of Sectra AB

"The fiscal year started with a favorable performance in both medical IT and cybersecurity. Growth in North America was particularly notable. We are also making progress in our change of business model to selling medical diagnostic imaging to healthcare providers. At the same time, we continue to strengthen society's resilience against cyberthreats through our information security solutions.

"The extensive customer contracts we secured in the last fiscal year will soon enter a phase during which customers will start to deploy our solutions, albeit gradually over a number of years. While several large healthcare providers will start producing examinations in 2025/2026, we expect the financial impact from this to remain relatively small during the fiscal year. Once these customers go live, our focus will be on helping them to maximize the benefits of our services and increasing their use-efforts that will ultimately generate stable growth in recurring revenue and further strengthen our customer relationships.

"In Secure Communications, we see continuing favorable demand, not least as a result of security developments. While NATO's decision during the summer to increase member states' defense and security investments has not had an immediate impact on our business, it will create further opportunities in the long term. We are well positioned to contribute solutions for secure communication and information sharing that make societies more resistant to cyberthreats. Our solutions were used, for example, at the NATO summit in the Netherlands during the summer."

Read the attached financial report for further CEO comments and information.

Presentation of the financial report

Torbjörn Kronander, President and CEO of Sectra AB, and Jessica Holmquist, CFO of Sectra AB, will present the financial report and answer questions. The presentation will be held in English.

Time: September 4, 2025 at 10:00 a.m. (CEST)

Follow live or listen to the recording afterward: https://investor.sectra.com/q1report2526

This information constitutes information that Sectra AB (publ) is obligated to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out below, at 08:15 a.m. (CEST) on September 4, 2025.

For further information, please contact:

Dr. Torbjörn Kronander, President and CEO, Sectra AB, +46 (0) 705 23 52 27

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/sectra/r/sectra-s-three-month-interim-report-2025-2026--order-bookings-doubled-following-success-in-the-us-an,c4228858

The following files are available for download:

https://mb.cision.com/Main/1263/4228858/3646726.pdf | Sectra's three-month interim report 2025/2026 |

https://news.cision.com/sectra/i/sectra-one-cloud,c3466359 | Sectra One Cloud |

https://news.cision.com/sectra/i/torbjorn-kronander--president-and-ceo-of-sectra-ab-,c3466357 | Torbjörn Kronander, President and CEO of Sectra AB. |

https://news.cision.com/sectra/i/sectra-tiger-s,c3466358 | Sectra Tiger/S |

![]() View original content:https://www.prnewswire.co.uk/news-releases/sectras-three-month-interim-report-20252026-order-bookings-doubled-following-success-in-the-us-and-canada-302546303.html

View original content:https://www.prnewswire.co.uk/news-releases/sectras-three-month-interim-report-20252026-order-bookings-doubled-following-success-in-the-us-and-canada-302546303.html