Vancouver, British Columbia--(Newsfile Corp. - September 9, 2025) - Military Metals Corp. (CSE: MILI) (OTCQB: MILIF) (FSE: QN90) (the "Company" or "MILI"), is pleased to announce the successful completion of a field program at its wholly-owned Last Chance antimony-gold property, located 18 kilometers west of Kinross Gold's Round Mountain gold mine in south-central Nevada. The purpose of the field program was to map geological structures targeting both known mineralized structures as well as potential additional ones that could be accurately delineated, forty-nine outcrops across the property were used in the analysis. Last Chance is a historical producer, however modern exploration methods have never been applied.

Highlights:

- Historical producer: four hundred tons of material averaging 20% antimony were reportedly shipped during World War I, and 29 tons averaging 45 percent antimony were shipped in 1939;1

- During 1941-42, over 200 tons of mined antimony were shipped. The last reported production was in 1958 comprising 44 tons at shipped grades of between 10-15% antimony;1

- Structural measurements at 49 outcrops using the ESRI Field Maps app GPS control were obtained;

- Generated projections of structures in 3D in Datamine Studio RM for drill target generation;

- Previous samples taken by the Company include 6.66% and 11.61% Stibnite, ranging from 0.005% to 11.61% stibnite, are found in quartz-carbonate veins and quartz-carbonate flooded metasedimentary host rocks in at least three locations over a distance of 1 kilometer (see also MILI News Release dated June 19, 2025;

- Additional stibnite-rich quartz vein samples were recently identified (image 3 below).

Scott Eldridge, CEO and Director, stated, "We are excited to report on the independent findings of a professional Structural Geologist, which has helped us to identify high-priority drill targets. Last Chance is a historical producer in a top mining jurisdiction, where modern exploration methods were never implemented. We look forward to further honing in on the identified drill targets with the aim of making a new discovery. The U.S. government has significantly ramped up funding for critical minerals projects-including antimony as part of a broader push to secure domestic supply chains and reduce reliance on foreign sources like China. The U.S. urgently needs domestic antimony production for several strategic, economic, and security reasons. Antimony is the linchpin in defense, energy, and tech."

Historical infrastructure including a shaft, three adits, dumps and the ruins of a mill remain on site. Aside from limited gold-focused exploration during the 1980s, the property has not seen any exploration activity until the Company acquired it. Originally discovered in the late 1800s, the Last Chance property was initially developed to exploit antimony followed by repeated intervals of small-scale production until the 1950s, with exploration efforts in the 1980s focused on gold. According to a Nevada Bureau of Mines report, four hundred tons of material averaging 20% antimony were reportedly shipped during World War I, and 29 tons averaging 45 percent antimony were shipped in 1939. During 1941-42, over 200 tons of mined antimony were shipped. The last reported production was in 1958 comprising 44 tons at shipped grades of between 10-15% antimony. The mine was developed by a 180-foot shaft with a total of 300 feet of drifting on the 60-, 80-, 96-, 126-, and 175-foot levels. An adit connected with the 126-foot level. Other workings elsewhere on the property included a 180-foot long adit, several open pits, and short adits.

(1)(source: Lawrence, E.F., 1963: ANTIMONY DEPOSITS OF NEVADA, Nevada Bureau of Mines, Bulletin 61, p. 152).

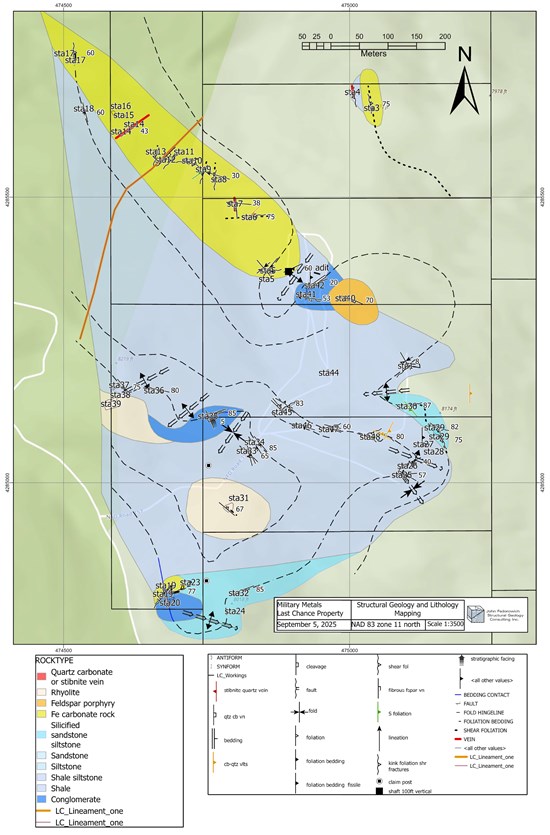

Antimony mineralization at Last chance is controlled both structurally and stratigraphically A field program recently completed by structural geologist John Federowich, PhD, has provided details regarding the property's complex structural setting and its impact upon mineralization both in terms of what was historically exploited and, more importantly, the potential for more. Structural measurements were made at forty-nine outcrops across the property; precise location control was obtained utilizing a differential GPS and ESRI digital mapping app. Based upon these measurements, a form line map of foliation-bedding and faults was produced, along with projections of structures in 3D for drill target generation in a report accompanied by maps, one of which is included below.

IMAGE 1: Structural mapping at the Last Chance property; note the old mill foundations and waste dumps in the background

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10818/265649_4fa24264c4a32822_001full.jpg

IMAGE 2: Lithology Contacts Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10818/265649_4fa24264c4a32822_002full.jpg

IMAGE 3: Sample of mineralized quartz vein, Last Chance property (grade unknown)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10818/265649_4fa24264c4a32822_003full.jpg

Recommendations presented by Dr. Federovich include follow-up detailed structural mapping where intense iron carbonate alteration and quartz-carbonate breccia veining was observed; the margins of the intensely altered zone requires additional attention, as well. Although the surface area of the property has been disturbed by historical mining activity, a recommendation to consider a soil survey was made. The relative advantages of reverse circulation versus diamond drilling in an area where underground workings could complicate the latter, were discussed, as well. The Company is evaluating the recommendations as part of its future program at Last Chance.

Investor Relations Engagement

On September 8, 2025, the Company entered into a media services contract (the "i2i Agreement") with i2i Marketing Group, LLC ("i2i"). Pursuant to the terms of the i2i Agreement, i2i will, among other items, provide the Company with marketing services, which includes social media management, content creation, distribution, digital marketing, digital advertising and any other marketing services as agreed upon by the Company and i2i (the "i2i Services") for distribution by email, and on popular investor platforms. The i2i Agreement has a term of one month and terminates on October 10, 2025. The Company will make two equal payments to i2i for total consideration of US$375,000, for the i2i Services. Joe Grubb and Kailyn White will be providing the i2i Services to the Company on behalf of i2i and may be contacted at (312) 725-3843 or contact@i2illc.com, 1107 Key Plaza, Ste 222, Key West, Florida, 33040. The Company will not issue any securities to i2i as compensation. Both i2i and its principals are arm's length to the Company and do not have any interest, direct or indirect, in the Company or its securities nor do they have any right to acquire such an interest.

The technical contents of this release were reviewed and approved by Avrom E. Howard, MSc, PGeo, VP-Exploration for Military Metals and a qualified person as defined by National Instrument 43-101.

About Military Metals Corp.

The Company is a British Columbia-based mineral exploration company that is primarily engaged in the acquisition, exploration and development of mineral properties with a focus on antimony.

ON BEHALF OF THE BOARD of DIRECTORS

For more information, please contact:

Scott Eldridge

CEO and Director

scott@militarymetalscorp.com or info@militarymetalscorp.com

For enquiries, please call Jeremy Ross, VP Corporate Development 604-537-7556

This news release contains "forward-looking information". Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-Looking information in this news release includes statements related to the Company's exploration plans in relation to the Last Chance gold and antimony project, and future conditions related to global and US critical minerals development. A variety of factors, including known and unknown risks, many of which are beyond our control, could cause actual results to differ materially from the forward-looking information in this news release. Known risks include risks related to future demand for antimony, alterations of supply chains in a manner that deprioritizes domestic exploration, development and production of antimony or critical minerals in the United States and in the world, or risks related operating in the mineral exploration space, including permitting, labour shortages or disruptions, social disruptions, availability of capital, availability of equipment and other resources, or similar risks. Additional risk factors can also be found in the Company's public filings under the Company's SEDAR+ profile at www.sedarplus.ca. Forward-Looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management's estimates, or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

The Canadian Securities Exchange has neither approved nor disapproved the information contained herein and does not accept responsibility for the adequacy or accuracy of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265649

SOURCE: Military Metals Corp.