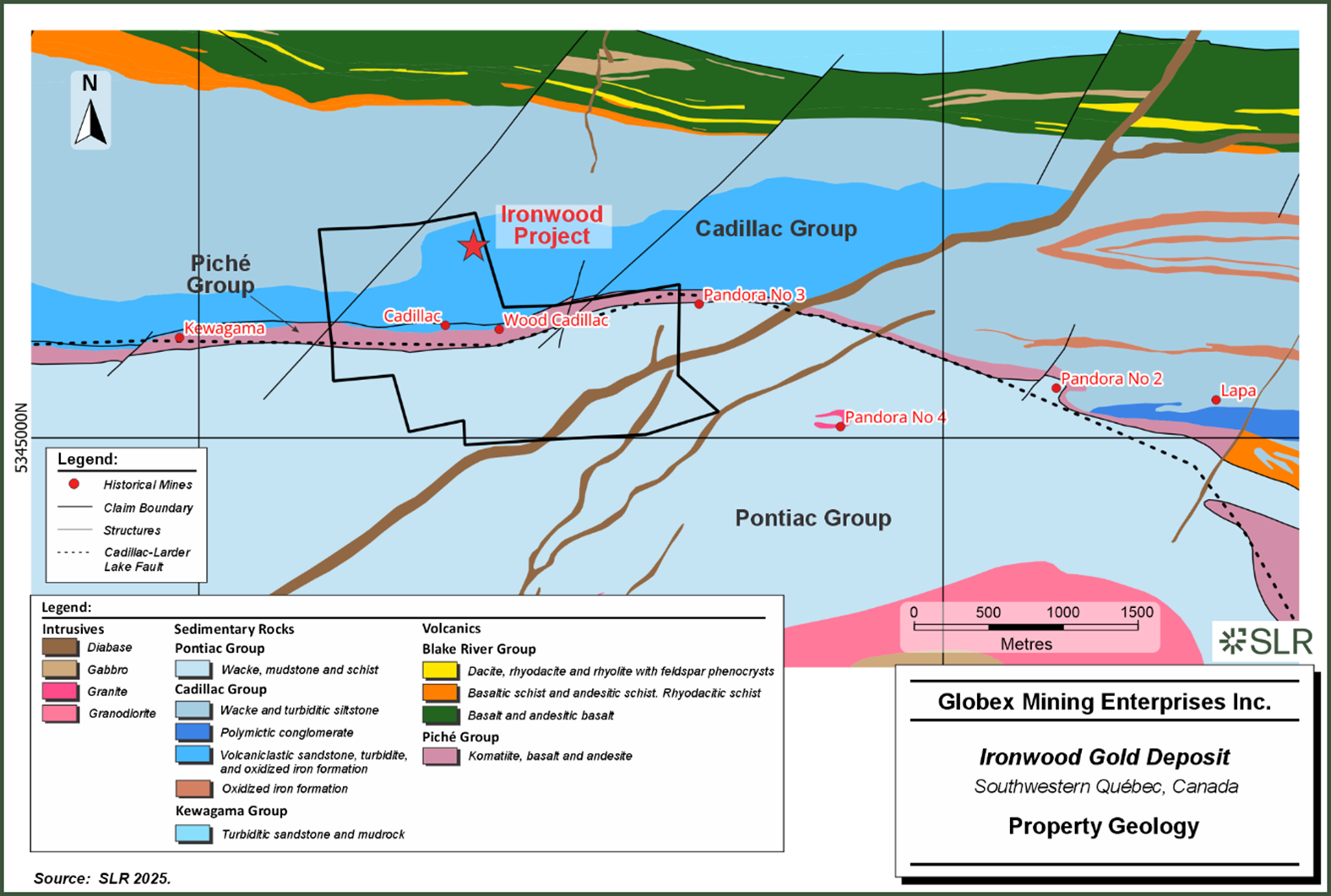

ROUYN-NORANDA, Quebec, Sept. 09, 2025 (GLOBE NEWSWIRE) -- GLOBEX MINING ENTERPRISES INC. (GMX - Toronto Stock Exchange, G1MN - Frankfurt, Stuttgart, Berlin, Munich, Tradegate, Lang & Schwarz, LS Exchange, TTMzero, Düsseldorf and Quotrix Düsseldorf Stock Exchanges and GLBXF - OTCQX International in the US) is pleased to provide an additional update as regards drilling by Radisson Mining Resources Inc. (RDS-TSXV, RMRDF-OTCQB) on Globex's Kewagama Gold Mine Royalty claims. Globex holds a two percent (2%) Net Smelter Royalty (NSR) on the eastern portion of what Radisson calls East O'Brien, including all the Kewagama Gold Mine royalty claims eastward to the adjoining 100% Globex owned Central Cadillac/Wood Gold Mines property including the Ironwood gold deposit.

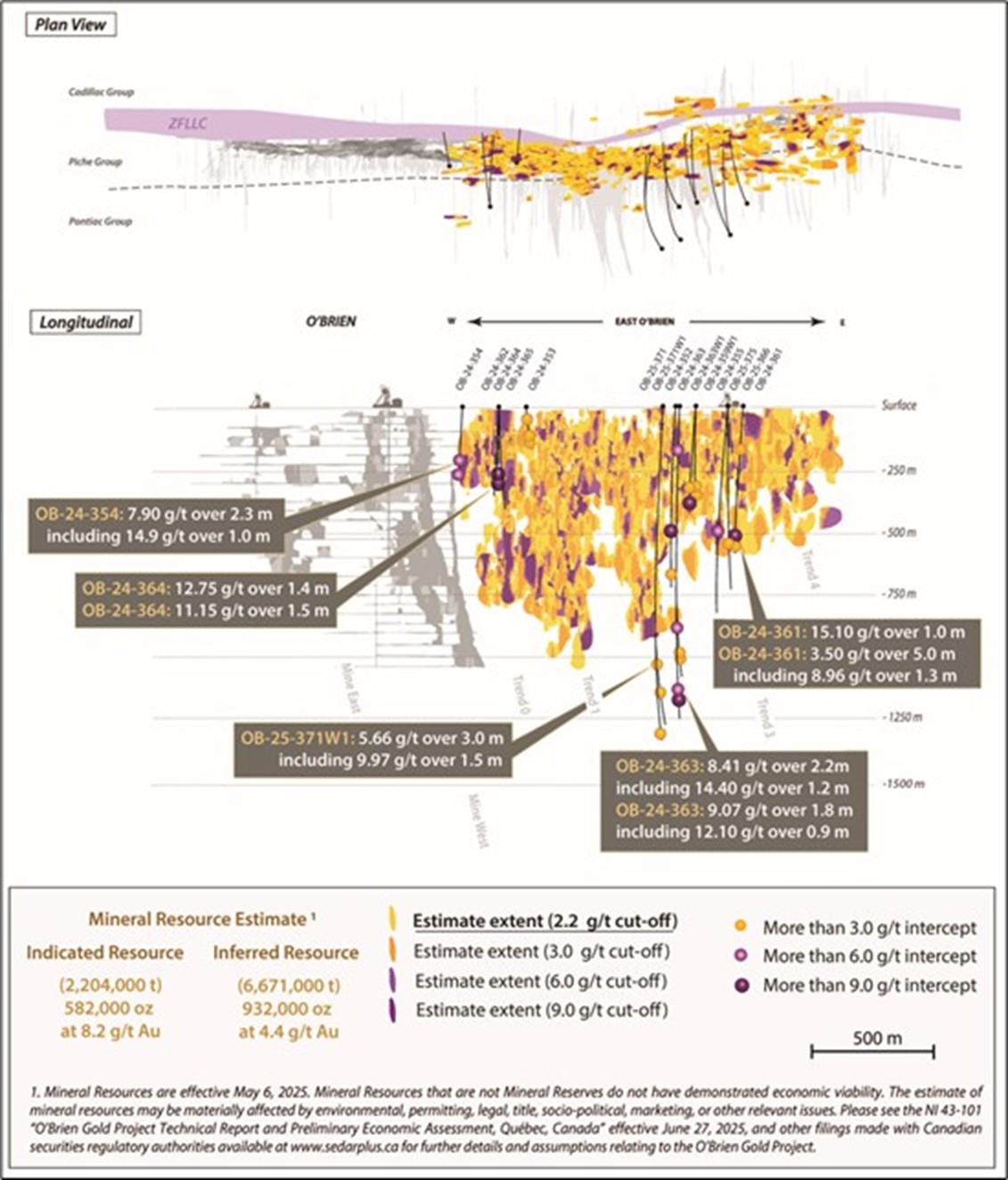

The assay results published by Radisson in yesterday's press release include deep drill intersections at the western edge of the Globex Kewagama royalty claims with new intersections from 850 m to 1,300 m vertical as well as shallower gold intersections in the 200 m to 500 m vertical range between the new deeper intersections and the Kewagama shaft area. The new assays confirm the excellent gold potential on the Globex royalty claims both at shallow depths and significantly deeper. It is worth noting that there has been very little drilling beyond the gold intersections previously reported east of the historic Kewagama Gold Mine to the Globex Central Cadillac/Wood Gold Mines boundary. The Radisson drilling has and continues to intercept gold on the O'Brien and Kewagama claims within the Piche Group of rocks. It is worth noting that there here is very limited drilling in the Piche Group across the 2.0 kms of Piche Group strike length on the Central Cadillac/Wood Gold Mine Property. This lack of drilling on the Central Cadillac/Wood Gold Mine property points to the strong gold prospectivity of the property.

Per Matt Manson, Radisson President & CEO, "several of the holes represent deep step-outs below our "Trend #2", pushing the scope of known mineralization downwards by up to 300 metres in this important area. Our Exploration Target at O'Brien is between 3 and 4 million ounces of gold in 15 to 20 million tonnes at between 4.5 and 8.0 g/t Au. Four rigs are currently active at the Project and drilling continues."

The reader is cautioned that the potential quantity and grade of an Exploration Target is conceptual in nature, there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Assay Results from Drill Holes OB-24-352 to OB-25-375

| DDH | Zone | From (m) | To (m) | Core Length (m) | Au g/t - Uncut | |

| OB-24-352 | Trend #2 | 521.0 | 522.0 | 1.00 | 13.10 | |

| 703.0 | 704.5 | 1.50 | 3.73 | |||

| OB-24-355 | Trend #3 | 432.4 | 433.7 | 1.30 | 3.91 | |

| 466.8 | 468.9 | 2.10 | 3.49 | |||

| OB-24-359W1 | Trend #3 | 429.3 | 430.8 | 1.50 | 3.88 | |

| 495.0 | 496.0 | 1.00 | 11.20 | |||

| OB-24-361 | Trend #3 | 195.5 | 196.5 | 1.00 | 4.46 | |

| 572.4 | 573.4 | 1.00 | 15.10 | |||

| 633.0 | 638.0 | 5.00 | 3.50 | |||

| Including | 633.0 | 634.3 | 1.28 | 8.96 | ||

| OB-24-363 | Trend #2 | 194.5 | 195.9 | 1.40 | 6.04 | |

| 910.0 | 911.0 | 1.00 | 7.65 | |||

| 1,199.7 | 1,201.9 | 2.20 | 8.41 | |||

| Including | 1,200.7 | 1,201.9 | 1.20 | 14.40 | ||

| 1,231.3 | 1,233.1 | 1.80 | 9.07 | |||

| Including | 1,232.2 | 1,233.1 | 0.90 | 12.10 | ||

| OB-25-363W1 | Trend #2 | 1,037.0 | 1,038.4 | 1.40 | 4.16 | |

| 1,056.5 | 1,058.0 | 1.50 | 4.04 | |||

| OB-25-366 | Trend #2 | 619.0 | 620.0 | 1.00 | 3.71 | |

| OB-25-371 | Trend #2 | 1,402.0 | 1,404.5 | 2.50 | 3.99 | |

| Including | 1,402.0 | 1,403.0 | 1.00 | 5.54 | ||

| OB-25-371W1 | Trend #2 | 1,058.5 | 1,061.5 | 3.00 | 5.66 | |

| Including | 1,058.5 | 1,060.0 | 1.50 | 9.97 | ||

| 1,210.9 | 1,214.0 | 3.10 | 3.21 | |||

| OB-25-375 | Trend #3 | 538.0 | 539.5 | 1.50 | 7.38 |

Intercepts are calculated with a 3.00 g/t Au bottom cut-off. True widths, based on depth of intercept and drill hole inclination, are estimated to be 30% -80% of core length.

Longitudinal Section Published by Radisson on September 8, 2025

Central Cadillac/Wood Mine Property Geology

This press release was written by Jack Stoch, P. Geo., Executive Chairman and CEO of Globex in his capacity as a Qualified Person (Q.P.) under NI 43-101.

| We Seek Safe Harbour. | Foreign Private Issuer 12g3 - 2(b) |

| CUSIP Number 379900 50 9 LEI 529900XYUKGG3LF9PY95 | |

| For further information, contact: | |

| Jack Stoch, P.Geo., Acc.Dir. Executive Chairman & CEO Globex Mining Enterprises Inc. 86, 14th Street Rouyn-Noranda, Quebec Canada J9X 2J1 | Tel.: 819.797.5242 Fax: 819.797.1470 info@globexmining.com www.globexmining.com |

Forward-Looking Statements: Except for historical information, this news release may contain certain "forward-looking statements". These statements may involve a number of known and unknown risks and uncertainties and other factors that may cause the actual results, level of activity and performance to be materially different from the expectations and projections of Globex Mining Enterprises Inc. ("Globex"). No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Globex will derive therefrom. A more detailed discussion of the risks is available in the "Annual Information Form" filed by Globex on SEDARplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0bde022e-ec86-41a1-8c71-3eddcae6e65c

https://www.globenewswire.com/NewsRoom/AttachmentNg/5ef34c09-eb87-42fb-96e4-f59923a0c4a5