The transaction adds larsucosterol, an FDA Breakthrough Therapy for alcohol-associated hepatitis with a registrational Phase 3 clinical trial in development, to Bausch Health's hepatology pipeline

LAVAL, QC, AND CUPERTINO, CA / ACCESS Newswire / September 11, 2025 / Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC) ("Bausch Health"), a global, diversified pharmaceutical company, today announced the successful completion of its previously announced tender offer to acquire DURECT Corporation ("DURECT"). Under the terms of the agreement, Bausch Health acquired all outstanding shares of DURECT for $1.75 per share in cash, representing a total upfront cash payment of approximately $63 million at closing. The transaction also includes the potential for two additional net sales milestone payments of up to $350 million in the aggregate (subject to certain adjustments in respect of a retention plan) if the milestones are achieved before the earlier of the 10-year anniversary of the first commercial sale in the United States and December 31, 2045.

The acquisition adds DURECT's lead asset, larsucosterol, a novel epigenetic modulator with FDA Breakthrough Therapy Designation for treatment of alcohol-associated hepatitis ("AH"), to Bausch Health's hepatology pipeline. Currently, there are no approved therapies indicated to treat AH, and patients must rely on supportive care such as corticosteroids, which are often inadequate for long-term treatment and result in about 30% mortality within 90 days of hospitalization. A registrational Phase 3 program is currently being planned to evaluate the safety and efficacy of larsucosterol for the treatment of patients with severe AH.

"We are pleased to complete the acquisition of DURECT, which brings larsucosterol into our hepatology pipeline as a promising advanced-stage therapy," said Thomas J. Appio, Chief Executive Officer, Bausch Health. "There is an urgent need for treatments for alcohol-associated hepatitis, a disease that leads to a significant number of hospitalizations each year. This addition supports our ongoing efforts to develop innovative therapies for liver diseases with limited or no current treatment options. The acquisition aligns with our strategic focus on purposeful R&D and advancing solutions in areas of unmet medical need."

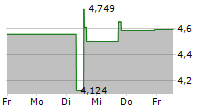

The tender offer for all outstanding shares of DURECT expired at 5:00 p.m., New York City time, on September 10, 2025. Equiniti Trust Company, LLC, the depositary for the tender offer, has advised Bausch Health that approximately 19,984,767 shares of DURECT common stock were validly tendered and not properly withdrawn in the tender offer, representing approximately 62% of the then-outstanding shares of DURECT's common stock. All of the conditions to the tender offer have been satisfied, and on September 11, 2025, a wholly owned subsidiary of Bausch Health ("Merger Sub") accepted for payment and will as promptly as practicable pay for all shares validly tendered and not properly withdrawn in the tender offer. Following the consummation of the tender offer, Merger Sub merged with and into DURECT in accordance with Section 251(h) of the Delaware General Corporation Law without a vote of DURECT stockholders (the "Merger"), with DURECT continuing as the surviving corporation in the Merger under the name DURECT Corporation. In the Merger, shares of DURECT that were not tendered in the tender offer were converted into the right to receive $1.75 per share in cash plus one CVR.

Following the closing of the tender offer and Merger, DURECT Corporation became a wholly owned subsidiary of Bausch Health. Prior to the opening of trading on The Nasdaq Stock Market LLC ("Nasdaq") on September 11, 2025, all shares of DURECT common stock will cease trading on Nasdaq, and DURECT intends to promptly cause such shares to be delisted from Nasdaq and deregistered under the Securities Exchange Act of 1934, as amended.

Advisors

Centerview Partners LLC acted as exclusive financial advisor and Sullivan & Cromwell LLP acted as legal advisor to Bausch Health. Locust Walk acted as exclusive financial advisor and Orrick, Herrington & Sutcliffe LLP acted as legal advisor to DURECT.

About Bausch Health

Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC), is a global, diversified pharmaceutical company enriching lives through our relentless drive to deliver better health care outcomes. We develop, manufacture and market a range of products primarily in gastroenterology, hepatology, neurology, dermatology, dentistry, aesthetics, international pharmaceuticals and eye health, through our controlling interest in Bausch + Lomb Corporation. Our ambition is to be a globally integrated healthcare company, trusted and valued by patients, HCPs, employees and investors. Our gastroenterology business, Salix Pharmaceuticals, is one of the largest specialty pharmaceutical businesses in the world and has licensed, developed and marketed innovative products for the treatment of gastrointestinal diseases for more than 30 years. For more information about Salix, visit www.Salix.com and connect with us on Twitter and LinkedIn. For more information about Bausch Health, visit www.bauschhealth.com and connect with us on LinkedIn.

About DURECT Corporation

DURECT Corporation is a late-stage biopharmaceutical company pioneering the development of epigenetic therapies that target dysregulated DNA methylation to transform the treatment of serious and life-threatening conditions, including acute organ injury. Larsucosterol, DURECT's lead drug candidate, binds to and inhibits the activity of DNA methyltransferases, epigenetic enzymes that are elevated and associated with hypermethylation found in AH patients. Larsucosterol is in clinical development for the potential treatment of AH, for which the FDA has granted a Fast Track and a Breakthrough Therapy designation; MASH has also been explored. For more information about DURECT, please visit www.durect.com and follow DURECT on X (formerly Twitter) at https://x.com/DURECTCorp.

Forward Looking Statements

This news release may contain forward-looking statements about the proposed transaction with DURECT and the future performance of Bausch Health (Bausch Health and DURECT, collectively, "the Parties"), which may generally be identified by the use of the words "anticipates," "hopes," "expects," "intends," "plans," "should," "could," "would," "may," "believes," "subject to" and variations or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Actual results are subject to other risks and uncertainties that relate more broadly to the Parties' overall businesses, including those more fully described in the Parties' most recent annual reports on Form 10-K and quarterly reports on Form 10-Q and detailed from time to time in the Parties' other filings with the U.S. Securities and Exchange Commission and, in the case of Bausch Health, the Canadian Securities Administrators, which factors are incorporated herein by reference. In addition, such risks and uncertainties include, but are not limited to, the following: uncertainties relating to the success of larsucosterol and its path to regulatory approval; achievement of the net sales milestone payments; reliance on third parties, which increases the risk that submissions for regulatory approval of larsucosterol may be delayed or that we will not have sufficient quantities of larsucosterol available at an acceptable cost, which could delay, prevent or impair our development and commercialization efforts of larsucosterol; future clinical trials for larsucosterol may be delayed and may not demonstrate efficacy or safety; and open-label trials of larsucosterol in AH have inherent limitations. Additional information regarding certain of these material factors and assumptions may be found in the Parties' filings described above. These forward-looking statements speak only as of the date hereof. The Parties undertake no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this news release or to reflect actual outcomes, unless required by law.

Investor Contact: |

| Media Contact: |

SOURCE: Bausch Health Companies Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/bausch-health-completes-acquisition-of-durect-corporation-expanding-l-1071552