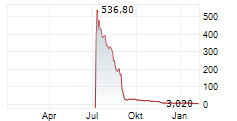

CHEYENNE, Wyoming, Sept. 11, 2025 (GLOBE NEWSWIRE) -- Next Technology Holding Inc. ("NXTT" or the "Company") (NASDAQ: NXTT), a technology firm committed to delivering AI-enabled software development services and strategic Bitcoin acquisition, announced today that it will implement a reverse stock split of its issued and outstanding shares of common stock at a ratio of 200-for-1, effective at 12:01 a.m., Eastern Time on September 16, 2025. The reverse stock split will be effected simultaneously for all outstanding shares of the company's common stock and will affect all of the Company's stockholders uniformly.

The Company's common stock will continue to trade on the Nasdaq Capital Market ("Nasdaq") under the Company's existing trading symbol "NXTT" and will begin trading on a split-adjusted basis at the commencement of trading on September 16, 2025. The new CUSIP number for the common stock following the reverse stock split will be: 961884301.

As a result of the reverse stock split, every two hundred (200) shares of the Company's common stock then issued and outstanding will automatically, and without any action of the Company or any holder thereof, be combined, converted, and changed into one (1) share of common stock. The reverse stock split will reduce the number of shares of the Company's common stock outstanding from approximately 551,578,391 shares to approximately 2,757,892 shares. No fractional shares will be issued as a result of the reverse stock split, and any fractional shares that would otherwise have resulted from the reverse stock split will be rounded up. The reverse stock split will not affect the number of authorized shares of the Company's common stock or the par value of a share of the Company's common stock. Under the Company's 2025 Equity Incentive Plan (the "Plan"), to the extent that the shares of common stock reserved under the Plan remain unissued, such unissued shares will not be subject to adjustment for any decrease in the number shares of common stock resulting from the reverse stock split.

As a result of the reverse stock split, when effected in the market, the Company's stockholders who hold their shares (i) in electronic form at brokerage firms will not need to take any action, as the effect of the reverse stock split will automatically be reflected in their brokerage accounts, (ii) electronically in book-entry form with the transfer agent, Transhare Corporation, will not need to take action to receive shares of post-reverse stock split common stock, and (iii) with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

About Next Technology Holding Inc.

Incorporated in Wyoming on March 28, 2019, the Company is a technology company built on a dual-engine strategy of "AI plus digital assets." The Company delivers AI-enabled SaaS software design, development and implementation to industrial clients across the Asia-Pacific region and beyond. Holdings may also be pledged for financing, partially liquidated for cash, or leveraged to generate additional income streams. The Company believes Bitcoin's finite supply positions it for long-term appreciation as global adoption grows and as a potential hedge against inflation.

For more information, please visit http://www.nxtttech.com/.

Forward-Looking Statements

This press release may include statements that may constitute "forward-looking statements," including statements containing the words "may," "believe," "estimate," "project," "expect," "will," or similar expressions. Forward-looking statements inherently involve risks and uncertainties that could cause actual results of the Company to differ materially from the forward-looking statements. Factors that could contribute to such differences include: fluctuations in the market price of bitcoin and any associated unrealized gains or losses on digital assets that the Company may record in its financial statements as a result of a change in the market price of bitcoin from the value at which the Company's bitcoins are carried on its balance sheet; gains or losses on any sales of bitcoins; changes in the accounting treatment relating to the Company's bitcoin holdings; changes in securities laws or other laws or regulations, or the adoption of new laws or regulations, relating to bitcoin that adversely affect the price of bitcoin or the Company's ability to transact in or own bitcoin; the impact of the availability of spot exchange traded products and other investment vehicles for bitcoin and other digital assets; a decrease in liquidity in the markets in which bitcoin is traded; security breaches, cyberattacks, unauthorized access, loss of private keys, fraud or other circumstances or events that result in the loss of the Company's bitcoins; fluctuations in tax benefits or provisions; competitive factors; general economic conditions, including levels of inflation and interest rates; currency fluctuations; and other risks detailed in the Company's registration statements and periodic and current reports filed with the Securities and Exchange Commission. The Company undertakes no obligation to update these forward-looking statements for revisions or changes after the date of this release.

For investor inquiries, please contact:

ir@nxtttech.com

For general inquiries, please contact:

contact@nxtttech.com