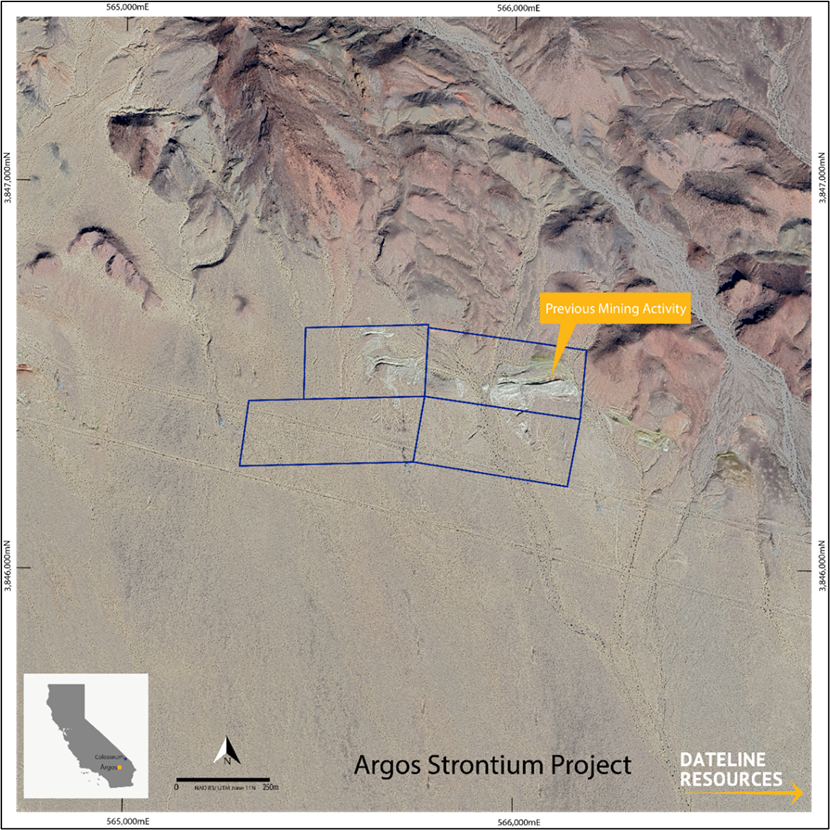

SAN BERNARDINO COUNTY, CA / ACCESS Newswire / September 15, 2025 / Dateline Resources Limited (ASX:DTR)(OTCQB:DTREF)(FSE:YE1) is pleased to announce that it has completed the acquisition of a 100% interest in the Argos Strontium Project, securing 100% ownership of the largest known strontium deposit in the United States at a time when the nation relies entirely on imports for its strontium supply. This strategic acquisition strengthens Dateline's critical minerals portfolio, aligning with U.S. priorities to secure domestic production of minerals vital to national security. The Argos project, located ~100 km from Dateline's flagship Colosseum Gold and Rare Earth Elements (REE) mine, will now be fully controlled by Dateline and advanced alongside its core gold-REE operations.

Highlights

Acquisition Completed: Dateline Resources has completed the acquisition of an 100% interest in the Argos Strontium Project in California, marking the official closure of the deal and securing a major U.S. strontium asset for its critical minerals portfolio.

Largest U.S. Strontium Deposit: The Argos deposit is the largest known strontium deposit in the United States and essentially the only domestic strontium deposit of scale, with no other U.S. strontium mines or production facilities currently in operation.

Strategic Supply Alignment: The Argos Project enhances U.S. supply-chain security for strontium, aligning with the the U.S. Administration's strategic minerals agenda to secure domestic sources of essential materials and reduce reliance on foreign supply.

DoD-Backed Importance: The U.S. Department of War has committed $192.5 million under the Defense Production Act to establish domestic manufacturing of defense-critical chemicals, including strontium compounds, underscoring strontium's strategic importance to national security and industrial supply chains.

Portfolio and Policy Fit: Adding Argos bolsters Dateline's growing strategic minerals portfolio, complementing its existing Colosseum rare earth project and broadening the company's exposure to critical elements needed for high-tech and defense industries.

Stephen Baghdadi, Managing Director of Dateline Resources, commented:

"Consolidating 100% ownership of the Argos strontium project is a significant milestone for Dateline. It gives us full control over a uniquely strategic asset at a time when the U.S. is urgently seeking domestic sources of minerals. Argos is a natural fit within our portfolio, it's near our Colosseum project and complements our focus on minerals needed for advanced technologies. We intend to progress Argos in a disciplined manner that adds value without detracting from Colosseum's development. With strontium's importance in electric vehicles, defense ordnance, and even space systems growing, having the only American strontium deposit of note puts Dateline in an enviable position. We look forward to advancing Argos alongside our flagship gold-REE project and delivering on our strategy to supply materials crucial to the nation's industrial and security needs."

Strategic Importance to U.S. Supply Security

The Argos Strontium Project directly supports U.S. national security and supply chain resiliency goals. Notably, the United States has no active strontium mines or production facilities and has not mined strontium domestically since 1959. As a result, 100% of U.S. strontium demand is met by imports, leaving critical industries vulnerable to supply disruptions. The awareness of the strategic value of strontium is rising, especially as allies like the EU have declared strontium a critical material.

U.S. government initiatives underscore the importance of establishing domestic sources. The Department of War recently announced $192.5 million in funding to boost domestic production of critical chemicals for defense systems, including specialized strontium compounds used in munitions. For example, rocket propellant manufacturer Estes Energetics was awarded $13.0 million to domestically produce strontium-based oxidizers (strontium nitrate, strontium oxalate, strontium peroxide) for military applications.

Unique World-Class Strontium Deposit at Argos

The Argos deposit is known for its exceptional purity and geology. It is a celestite-hosted strontium deposit (celestite being strontium sulfate), with high inherent ore grades and very low barium content. Historical analyses of Argos material showed up to 95% strontium sulfate (SrSO4) indicating a very high-purity celestite resource. Crucially, the deposit's geochemistry means there is minimal barite (barium sulfate) impurity, which is significant because many strontium occurrences worldwide are rendered uneconomic by high barium or calcium content. Argos' clean metallurgy should allow strontium concentrate to be produced with minimal processing avoiding the costly beneficiation steps required for lower-grade deposits.

The deposit consists of stratiform celestite beds near surface, making it amenable to open-pit mining. Strontium mineralization at Argos is exposed along a 4,000-foot stretch of the Cady Mountains foothills. These shallow, flat-lying ore horizons were historically mined by trenching and shallow underground workings, demonstrating the ease of access. The DuPont company operated the Argos mine in the mid-20th century, producing high-grade strontium concentrates until 1959. The presence of an existing trench and the absence of significant overburden highlight the deposit's potential for low strip-ratio, open-pit development.

Dateline assayed a series of rock chip samples in 2023 and reported results up to 49.8% SrO (equivalent to 88% SrSO4), consistent with historic reports of high-grade celestite from the district. A small gravity survey was completed, with the Company planning to have a 3D inversion model completed.

Comparisons to Global Strontium Deposits

With 100% ownership of Argos, Dateline controls a deposit comparable in scale and quality to the world's top strontium sources. Globally, strontium production today is dominated by a few key regions: China, Iran, Mexico, and Spain account for nearly all production. These operations succeed because they exploit large, high-grade deposits, a model Argos fits squarely into. For example, Mexico (the largest exporter to the U.S.) and Turkey mine material that often exceeds 90% SrSO4 content, requiring only crushing and hand-sorting to reach market specifications In Spain's Montevive-Escúzar deposit, by contrast, run of mine grades are ~60% SrSO4, necessitating a beneficiation plant to upgrade concentrate to 90% purity. Many lower-grade or impurity-laden deposits around the world remain undeveloped because the cost of removing barite or other contaminants is prohibitive.

Argos distinguishes itself by combining world-class grade, thickness, and accessibility. Like the top Mexican deposits, Argos' celestite is high-purity and near-surface, suggesting it can achieve favorable production economics on par with established producers. Notably, most strontium mines globally are able to operate profitably only if feedstock is at least 80% strontium sulfate, a benchmark that Argos comfortably meets. This gives Dateline confidence that Argos can be developed as a cost-competitive domestic source, especially given its proximity to infrastructure (road and rail are adjacent to the claims) and the growing U.S. demand for strontium in advanced manufacturing.

Growing Demand in Defense

Strontium's market dynamics are increasingly attractive due to emerging applications. In the defense arena, strontium compounds have long been used in signal flares, fireworks, and propellants, imparting the bright red hues in pyrotechnics and tracer rounds. The U.S. military's push to onshore production of these energetic materials, exemplified by the Estes Energetics project, is directly tied to strontium supply.

Complementary to Dateline's Colosseum Project

Dateline reiterates that developing Argos will complement, not distract from, its flagship Colosseum Gold and Rare Earths project. The Colosseum mine, a past-producing gold operation with recently identified REE potential, remains the company's primary focus for near-term development. Bringing Argos into full ownership simply adds a valuable strategic asset alongside Colosseum. The two projects are geographically close (both in San Bernardino County, CA) and share operational synergies. The company's U.S. team can leverage its existing regional expertise and stakeholder relationships to advance Argos efficiently in parallel with Colosseum.

Transaction Details and Path Forward

Under the finalized acquisition agreement, Dateline has acquired a 100% interest Western Strontium, the owner of the four patented claims. Consideration for the purchase of the 100% interest has been agreed at eight million fully-paid ordinary Dateline shares, representing approximately A$2 million in value. The vendor will also retain a 1.25% Net Smelter Royalty (NSR) on the Argos project; To align the vendor with Dateline's long-term success, the issued shares will be subject to escrow lock-up and released in staged intervals (1 million shares per month for 8 months).

This structure ensures an orderly addition of equity and demonstrates the vendor's confidence in Argos' future. Notably, the share-based consideration conserves Dateline's cash while granting the vendor upside exposure as Dateline adds value to Argos.

Next Steps at Argos

Dateline's technical team is now integrating historical data and planning the next phase of exploration at Argos, which is expected to include modelling of gravity data, confirmatory drilling to define a JORC-compliant mineral resource and metallurgical testwork on representative material.

This press release has been authorized for release by the Board of Dateline Resources Limited.

For more information, please contact:

Stephen Baghdadi

Managing Director

+61 2 9375 2353

Andrew Rowell

Corporate & Investor Relations Manager

+61 400 466 226

a.rowell@dtraux.com

www.datelineresources.com.au

Follow Dateline on socials:

X - @Dateline_DTR

Truth Social - @dateline_resources

LinkedIn - dateline-resources

About Dateline Resources Limited

Dateline Resources Limited (ASX: DTR, OTCQB: DTREF, FSE: YE1) is an Australian company focused on mining and exploration in North America. The Company owns 100% of the Colosseum Gold-REE Project in California.

The Colosseum Gold Mine is located in the Walker Lane Trend in East San Bernardino County, California. On 6 June 2024, the Company announced to the ASX that the Colosseum Gold mine has a JORC-2012 compliant Mineral Resource estimate of 27.1Mt @ 1.26g/t Au for 1.1Moz. Of the total Mineral Resource, 455koz @ 1.47/t Au (41%) are classified as Measured, 281koz @1.21g/t Au (26%) as Indicated and 364koz @ 1.10g/t Au (33%) as Inferred.

On 23 May 2025, Dateline announced that updated economics for the Colosseum Gold Project generated an NPV6.5 of US$550 million and an IRR of 61% using a gold price of US$2,900/oz.

The Colosseum is located less than 10km north of the Mountain Pass Rare Earth mine. Planning has commenced on drill testing the REE potential at Colosseum.

Dateline has also acquired the high-grade Argos Strontium Project, also located in San Bernadino County, California. Argos is reportedly the largest strontium deposit in the U.S. with previous celestite production grading 95%+ SrSO4.

Forward-Looking Statements

This announcement may contain "forward-looking statements" concerning Dateline Resources that are subject to risks and uncertainties. Generally, the words "will", "may", "should", "continue", "believes", "expects", "intends", "anticipates" or similar expressions identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond Dateline Resources' ability to control or estimate precisely, such as future market conditions, changes in regulatory environment and the behavior of other market participants. Dateline Resources cannot give any assurance that such forward-looking statements will prove to have been correct. The reader is cautioned not to place undue reliance on these forward-looking statements. Dateline Resources assumes no obligation and does not undertake any obligation to update or revise publicly any of the forward-looking statements set out herein, whether as a result of new information, future events or otherwise, except to the extent legally required.

Competent Person Statement

Sample preparation and any exploration information in this announcement is based upon work reviewed by Mr Greg Hall who is a Chartered Professional of the Australasian Institute of Mining and Metallurgy (CP-IMM). Mr Hall has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves" (JORC Code). Mr Hall is a Non-Executive Director of Dateline Resources Limited and consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Company Confirmations

The Company confirms it is not aware of any new information or data that materially affects the information included in the announcements dated 23 October 2024 with regard to the Colosseum MRE and 23 May 2025 with regard to Colosseum Project Economics. Similarly, the Company confirms that all material assumptions and technical parameters underpinning the estimates and the forecast financial information referred to in those previous announcements continue to apply and have not materially changed.

SOURCE: Dateline Resources Limited

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/dateline-resources-acquires-100-of-argos-americas-largest-known-strontium-mine-su-1073072