THIS PRESS RELEASE MAY NOT BE MADE PUBLIC, PUBLISHED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEELAND, SINGAPORE, SOUTH AFRICA, SOUTH KOREA, SWITZERLAND, RUSSIA, BELARUS, OR ANY OTHER JURISDICTION IN WHICH SUCH ACTIONS, WHOLLY OR IN PART, WOULD BE UNLAWFUL OR DEMAND ADDITIONAL REGISTRATION OR OTHER MEASURES. PLEASE REFER TO "IMPORTANT INFORMATION" IN THE END OF THIS PRESS RELEASE.

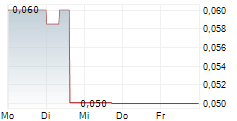

GOTHENBURG, Sweden, Sept. 16, 2025 /PRNewswire/ -- The Board of Directors of Minesto AB (publ) ("Minesto" or the "Company") has today, conditional on the approval of an extraordinary general meeting, resolved on a rights issue of shares of approximately SEK 152.4 million (the "Rights Issue"). The subscription price has been determined to SEK 1.85 per share. Those who on the record date 8 October 2025 are registered as shareholders in Minesto will receive two (2) subscription rights for each share held. Five (5) subscription rights will entitle to subscription for one (1) new share in the Company. Minesto has received guarantee commitments subject to customary conditions which, in aggregate, amount to SEK 99.0 million, corresponding to approximately 65.0 percent of the Rights Issue. The Company has also received subscription intentions from all shareholding members of the Board of Directors and senior management, including the Company's CEO Martin Edlund, consisting of a verbally expressed, non-binding, intention to subscribe for their respective pro rata share of the Rights Issue, in total amounting to approximately SEK 0.2 million, corresponding to approximately 0.1 percent of the Rights Issue.

Notice to the extraordinary general meeting for resolution on approval of the Rights Issue, which will be held on 3 October 2025, will be announced through a separate press release.

Summary

- The Board of Directors of Minesto has today resolved on the Rights Issue, conditional on the subsequent approval of the extraordinary general meeting.

- The extraordinary general meeting will be held on 3 October 2025 and the notice will be published through a separate press release.

- The net proceeds from the Rights Issue are intended to be used for the following purposes, listed in order of priority; (i) repayment of the loan financing raised in June 2025, (ii) upgrading and adapting the Dragon Class system to the Hestfjord configuration and Microgrid product range, (iii) implementation of permit processes, detailed design and preparations for the establishment of the facility at Hestfjord, (iv) strategic investments to enable entry and expansion into relevant markets, and (v) initiation of the development of additional projects in priority markets.

- If the Rights Issue is fully subscribed, the Company will receive approximately SEK 152.4 million before deduction of transaction costs.

- The subscription price is SEK 1.85 per share.

- Those who on the record date 8 October 2025 are registered as shareholders in Minesto will receive two (2) subscription rights for each share held.

- Five (5) subscription rights will entitle to subscription for one (1) new share in the Company.

- The subscription period in the Rights Issue runs from and including 10 October 2025, up to and including 24 October 2025.

- Shareholders who choose not to participate in the Rights Issue will have their ownership diluted by up to approximately 28.6 percent but will have the opportunity to compensate themselves financially for the dilution effect by selling their subscription rights.

- Minesto has received guarantee commitments amounting to approximately SEK 99.0 million, which corresponds to 65.0 percent of the Rights Issue. In addition, the Company has received subscription intentions from all shareholding members of the Board of Directors and senior management, including the Company's CEO Martin Edlund, consisting of a verbally expressed, non-binding, intention to subscribe for their respective pro rata share of the Rights Issue, in total amounting to approximately SEK 0.2 million, corresponding to approximately 0.1 percent of the Rights Issue.

- The full terms and conditions of the Rights Issue will be available in the prospectus which is expected to be published around 6 October 2025.

Background and reasons

Minesto is a development company in renewable ocean energy with a technology for commercial production of electricity from a previously untapped global natural resource: tidal and ocean currents. Minesto owns and develops a patented technology to convert the kinetic energy in slow ocean currents into electricity. The technology has been verified in a grid-connected production facility in the sea of the Faroe Islands since 2020. In February 2024, the facility was upgraded to full scale 1.2 MW in the form of the Dragon 12 power plant. The Company's patented technology platform, Dragon Class, has achieved significant technical and commercial milestones over the past year. Among other things, the Dragon 12 system, installed in Vestmannasund in the Faroe Islands, has demonstrated an increase in power performance of approximately 25 percent as a result of technical improvements. A key step in the Company's commercialization phase is the planned large-scale expansion in the Faroe Islands totalling 200 MW, which will be implemented in stages and completed by 2030. The first phase consists of the Hestfjord project, where Minesto, in collaboration with local actors, plans to establish a tidal park with an initial capacity of 10 MW (Phase 1). Phase 1 includes the installation of several Dragon 12 systems and marks the start of the long-term expansion. The project is strategically important as it not only demonstrates the scalability of the technology but also enables the integration of renewable marine energy into a real energy system.

In light of the increased demand for sustainable energy solutions and the Company's ambition to accelerate the commercialization of its technology, the Board of Directors has resolved to carry out the Rights Issue.

Use of issue proceeds

If the Rights Issue is fully subscribed, the Company will receive a maximum of approximately SEK 152.4 million before deduction of transaction costs. Given the Company's current business plan and against the above background, the Company intends to distribute the expected net proceeds in accordance with the below, listed in order of priority:

- Repayment of the loan financing raised in June 2025 - approximately 15 percent.

- Upgrading and adapting the Dragon Class system to the Hestfjord configuration and Microgrid product range - approximately 55 percent.

- Implementation of permit processes, detailed design and preparations for the establishment of the facility at Hestfjord - approximately 10 percent.

- Strategic investments to enable entry and expansion into relevant markets - approximately 10 percent.

- Initiation of the development of additional projects in priority markets - approximately 10 percent.

Extraordinary general meeting

Through a separate press release, the Company will convene an extraordinary general meeting to be held on 3 October 2025 to approve the Rights Issue.

The Rights Issue

Shareholders who are registered in the share register in Minesto on the record date on 8 October 2025 will receive two (2) subscription rights for each share held in the Company. Five (5) subscription rights entitle the holder to subscribe for one (1) new share in the Company. The subscription price is SEK 1.85 per share, which means that Minesto will receive gross proceeds of approximately SEK 152.4 million before deduction of transaction costs, provided that the Rights Issue is fully subscribed. In addition, investors are offered the opportunity to sign up for subscription of shares without the support of subscription rights.

Provided that the Rights Issue is fully subscribed, and provided that the extraordinary general meeting resolves to approve the Rights Issue, the number of shares in Minesto will increase by 82,364,595, from 205,911,488 to 288,276,083, and the share capital will increase by a maximum of SEK 4,118,229.75, from SEK 10,295,574.40 to SEK 14,413,804.15.

Shareholders who choose not to participate in the Rights Issue will, through the Rights Issue, have their ownership diluted by up to approximately 28.6 percent (calculated on the total number of outstanding shares in the Company after completion of the Rights Issue). These shareholders have the opportunity to compensate themselves financially for this dilution effect by selling their received subscription rights.

The last day of trading in Minesto's shares including the right to receive subscription rights in the Rights Issue is 6 October 2025. The shares are traded excluding the right to receive subscription rights in the Rights Issue as of 7 October 2025. The subscription period, with or without the support of subscription rights, runs from and including 10 October 2025 up to and including 24 October 2025. Trading in subscription rights will take place on Nasdaq First North Growth Market during the period from 10 October 2025 up to and including 21 October 2025 and trading in BTAs (paid subscribed share) will take place on Nasdaq First North Growth Market during the period from and including 10 October 2025 up to and including 12 November 2025 or until the registration of the Rights Issue with the Swedish Companies Registration Office.

The complete terms and conditions of the Rights Issue and information about the Company will be presented in a prospectus that is expected to be published on the Company's website around 6 October 2025.

Guarantee commitments and subscription intentions

Minesto has entered into guarantee commitments on customary terms. The guarantee commitments amount to a total of SEK 99.0 million, corresponding to approximately 65.0 percent of the Rights Issue. In addition, the Company has received subscription intentions from all shareholding members of the Board of Directors and management, including the Company's CEO Martin Edlund, consisting of a verbally expressed, non-binding, intention to subscribe for their respective pro rata share of the Rights Issue, in total amounting to approximately SEK 0.2 million, corresponding to approximately 0.1 percent of the Rights Issue. Neither the guarantee commitments nor the subscription intentions are secured by bank guarantees, escrow funds, pledges or similar arrangements.

The guarantee commitments are subject to an underwriting commission, adapted to the prevailing market condition, of ten (10) percent of the guaranteed amount if the underwriters choose to receive cash compensation or twelve (12) percent of the guaranteed amount if the underwriters choose to receive compensation through set-off against shares in the Company. In the event the underwriters choose to receive compensation through set-off against shares, the Board of Directors intends to resolve, by virtue of the authorization from the annual general meeting on 22 May 2025, on a directed issue of shares to the underwriters with payment through set-off. The subscription price in such a directed issue will correspond to the subscription price in the Rights Issue. No commission is paid for the subscription intentions.

The full terms and conditions of the Rights Issue and further information about the parties that have entered into guarantee commitments will be presented in the prospectus that is expected to be published around 6 October 2025.

Lock-up undertakings

Prior to the execution of the Rights Issue, shareholding members of the Board of Directors and senior management of the Company have entered into lock-up undertakings, which, among other things mean that they, with customary exceptions, have undertaken not to sell shares in the Company. The lock-up undertakings expire on the day that falls 180 days after the announcement date of the Rights Issue. Further information about the parties that have entered into lock-up undertakings will be presented in the prospectus that is expected to be published around 6 October 2025.

Indicative time plan

The following time plan for the Rights Issue is preliminary and subject to change.

Extraordinary general meeting to resolve on the approval of the Rights Issue | 3 October 2025 |

Planned publishing date of prospectus | 6 October 2025 |

Last day of trading in shares including right to receive subscription rights | 6 October 2025 |

First day of trading in shares excluding right to receive subscription rights | 7 October 2025 |

Record date for the Rights Issue | 8 October 2025 |

Trading in subscription rights | 10 - 21 October 2025 |

Subscription period | 10 - 24 October 2025 |

Trading in paid subscribed share (BTA) | 10 October - 12 November 2025 |

Expected announcement of the preliminary outcome in the Rights Issue | 28 October 2025 |

Advisers

Vator Securities AB is financial advisor and issuing agency, and MAQS Advokatbyrå is legal adviser to the Company in connection with the Rights Issue.

For additional information please contact

Martin Edlund, CEO

ir@minesto.com

Cecilia Sernhage, Chief Communications Officer

+46 735 23 71 58

ir@minesto.com

This information is such insider information that Minesto AB (publ) is obligated to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted, through the agency of the contact person above, for publication on 16 September 2025, 21:20 CEST.

About Minesto

Minesto is a leading marine energy technology company with the mission to minimise the global carbon footprint of the energy industry by enabling plannable commercial power production from the ocean.

Minesto's award winning and patented product is the only verified marine power plant that operates cost efficiently in areas with low-flow tidal streams and ocean currents.

Minesto was founded in 2007 and has operations in Sweden, the Faroe Islands, Wales and Taiwan. The major shareholders in Minesto are BGA Invest and Corespring New Technology. The Minesto share (MINEST) is traded on Nasdaq First North Growth Market. Certified Adviser is G&W Fondkommission.

Read more about Minesto at www.minesto.com

Press images and other media material is available for download via minesto.com/media

Financial information in English, including reports, prospectuses, and company descriptions, is available at www.minesto.com/investors.

Important information

Publication, release, or distribution of this press release may in certain jurisdictions be subject to legal restrictions and persons in the jurisdictions where this press release has been made public or distributed should inform themselves of and follow such legal restrictions. The recipient of this press release is responsible for using this press release and the information herein in accordance with applicable rules in each jurisdiction. This press release does not constitute an offer, or a solicitation of an offer, to acquire or subscribe for any securities in Minesto in any jurisdiction, neither from Minesto nor from anyone else.

This press release is not a prospectus for the purposes of Regulation (EU) 2017/1129 (the "Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. A simplified prospectus for secondary issuances regarding the Rights Issue referred to in this press release will be prepared and published by the Company before the subscription period in the Rights Issue begins. Within the European Economic Area ("EEA), no public offering of shares is made in member states other than Sweden. In any other EEA Member State, this communication is only addressed to and is only directed at "qualified investors" in that Member State within the meaning of the Prospectus Regulation.

This press release does not identify, or purport to identify, risks (direct or indirect) that may be associated with an investment in the Company. The information contained in this announcement is for background purposes for the Rights Issue only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public offering of the securities in the United States. The information in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, within or into the Unites States, Australia, Belarus, Canada, Hong Kong, Japan, New Zeeland, Russia, Singapore, South Africa, South Korea, Switzerland, or in any other jurisdiction where such announcement, publication or distribution of the information would not comply with applicable laws and regulations or where such actions are subject to legal restrictions or would require additional registration or other measures than what is required under Swedish law. Actions taken in violation of this instruction may constitute a crime against applicable securities laws and regulations.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, "qualified investors" who are (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons"). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company's intentions, beliefs, or current expectations about and targets for the Company's future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors and readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements that are expressly or implicitly contained herein speak only as of its date and are subject to change without notice. Neither the Company nor anyone else undertake to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release, unless it is required by law or Nasdaq First North Growth Market rule book for issuers.

Information to distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the "MiFID II Product Governance Requirements"), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any "manufacturer" (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares have been subject to a product approval process, which has determined that such shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the "Target Market Assessment").

Notwithstanding the Target Market Assessment, Distributors should note that: the price of the shares in the Company may decline and investors could lose all or part of their investment; the shares in the Company offer no guaranteed income and no capital protection; and an investment in the shares in the Company is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Rights Issue.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares in the Company.

Each distributor is responsible for undertaking its own Target Market Assessment in respect of the shares in the Company and determining appropriate distribution channels.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/minesto-ab/r/the-board-of-directors-of-minesto-has-resolved-on-a-rights-issue-of-shares-of-approximately-sek-152-,c4235663

The following files are available for download:

https://mb.cision.com/Main/14621/4235663/3672660.pdf | Press Release |

![]() View original content:https://www.prnewswire.co.uk/news-releases/the-board-of-directors-of-minesto-has-resolved-on-a-rights-issue-of-shares-of-approximately-sek-152-4-million-conditional-on-the-approval-of-the-extraordinary-general-meeting-302558317.html

View original content:https://www.prnewswire.co.uk/news-releases/the-board-of-directors-of-minesto-has-resolved-on-a-rights-issue-of-shares-of-approximately-sek-152-4-million-conditional-on-the-approval-of-the-extraordinary-general-meeting-302558317.html