HIGHLIGHTS

ATHA closes previously announced CAD $11.5 Million Over-Subscribed Bought Deal (See detail below, "Underwritten Private Placement");

First two drill holes completed at the RIB West Discovery successfully intersected uranium mineralization, including high-grade, over a strike length of ~340 m (Figure 2);

Results represent the third new discovery of uranium mineralization - beyond the Lac 50 Deposit Trend - during the 2025 Angilak Exploration Program, within the Angikuni Basin along the 31 km RIB-Nine Iron Trend (Figure 1);

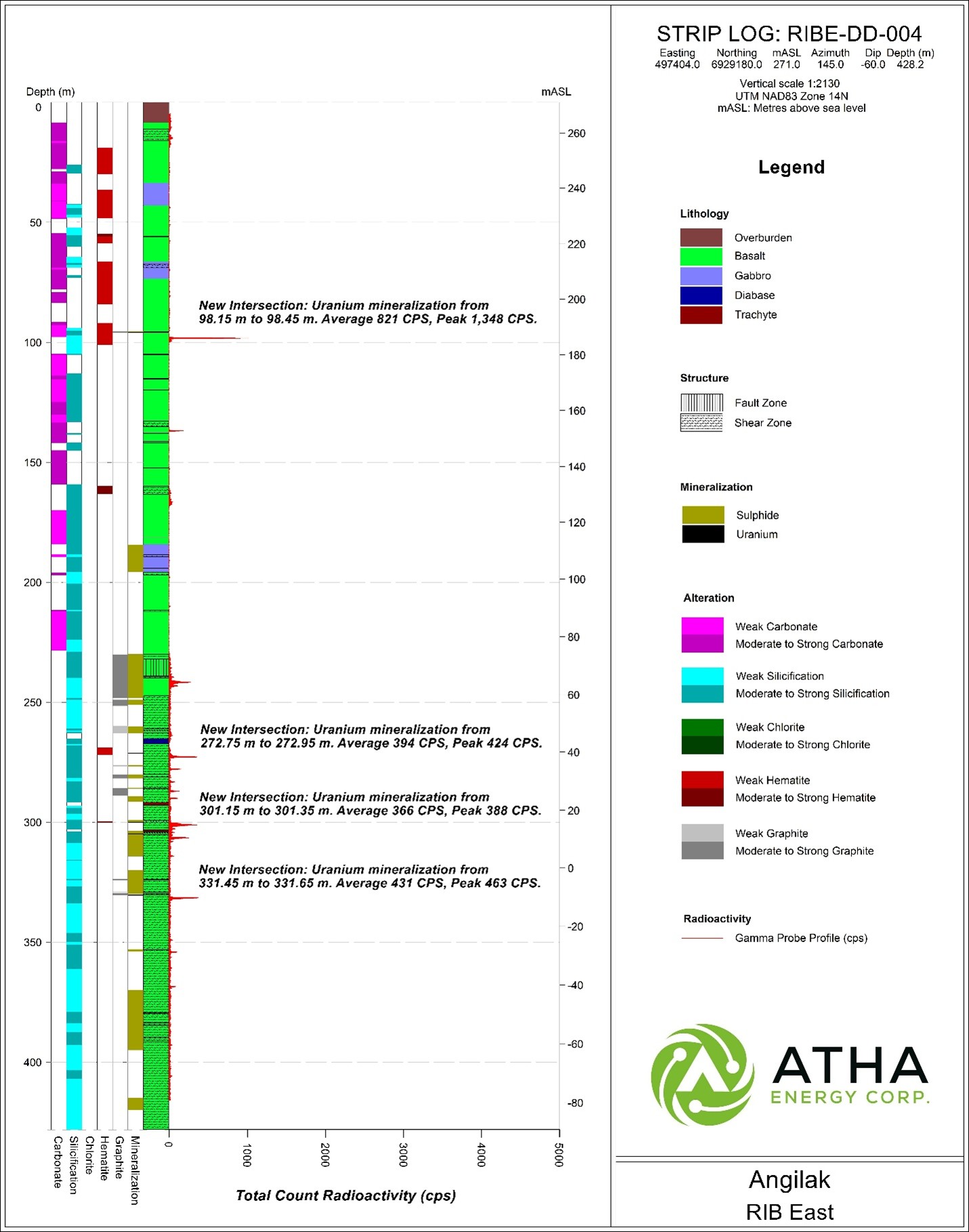

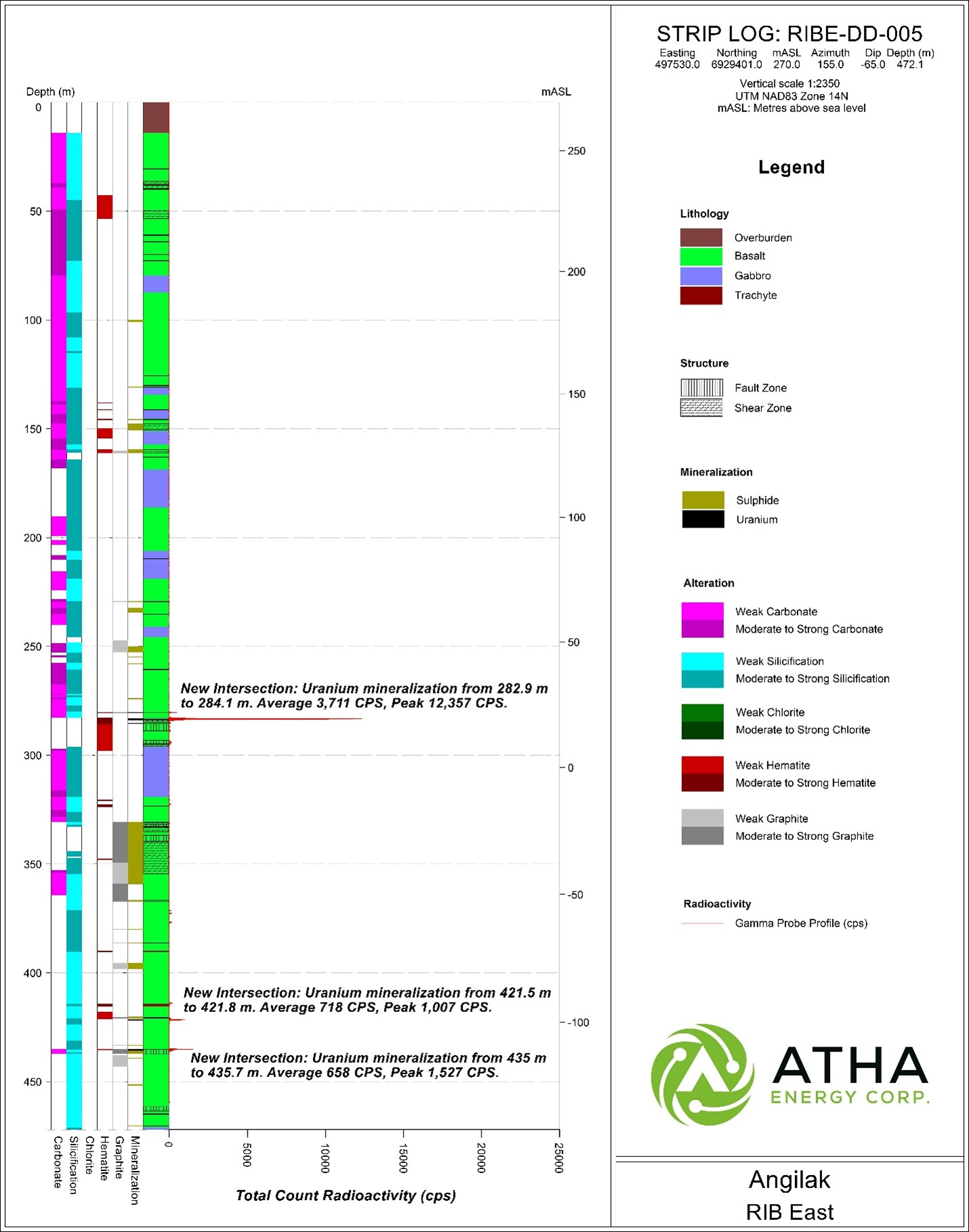

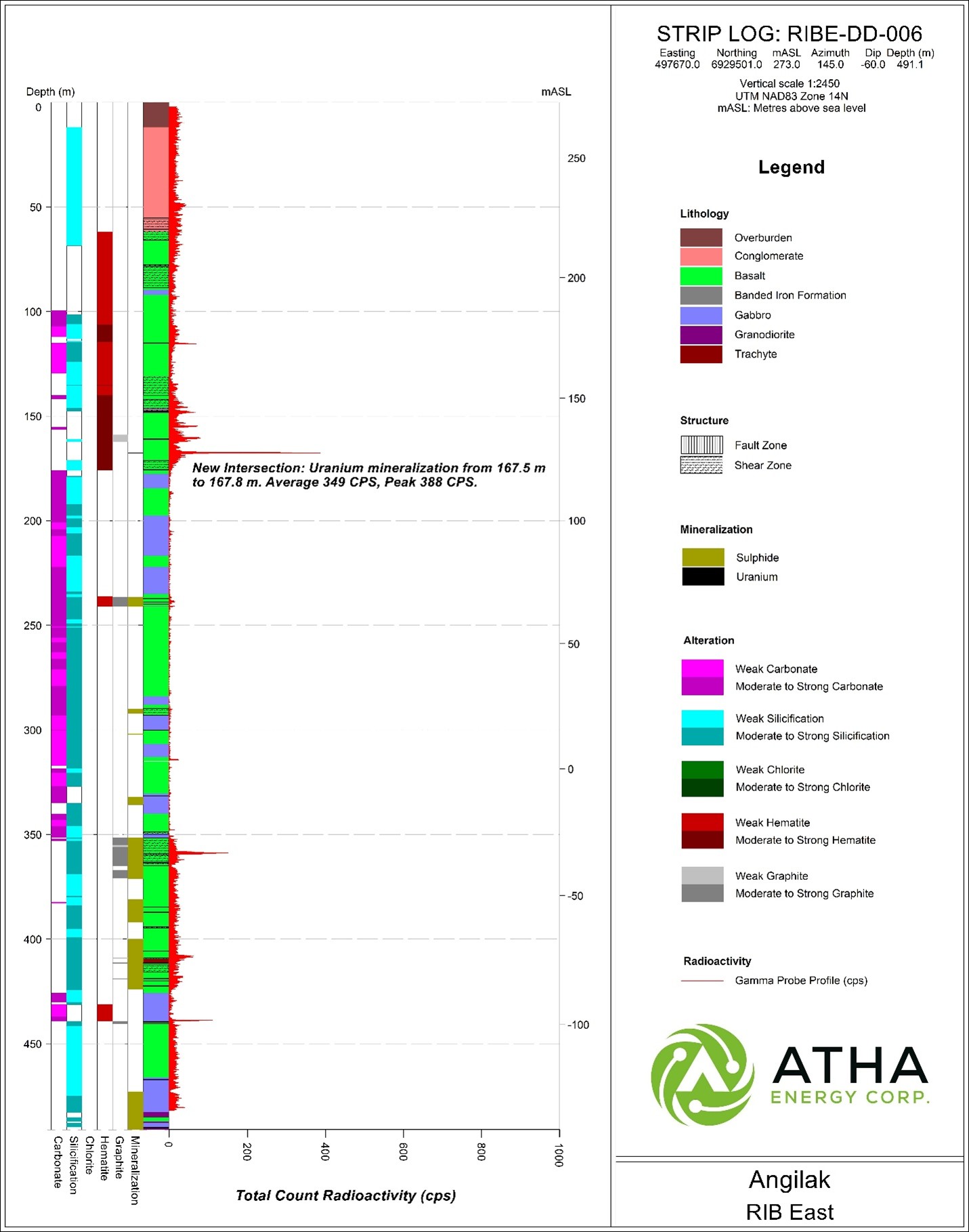

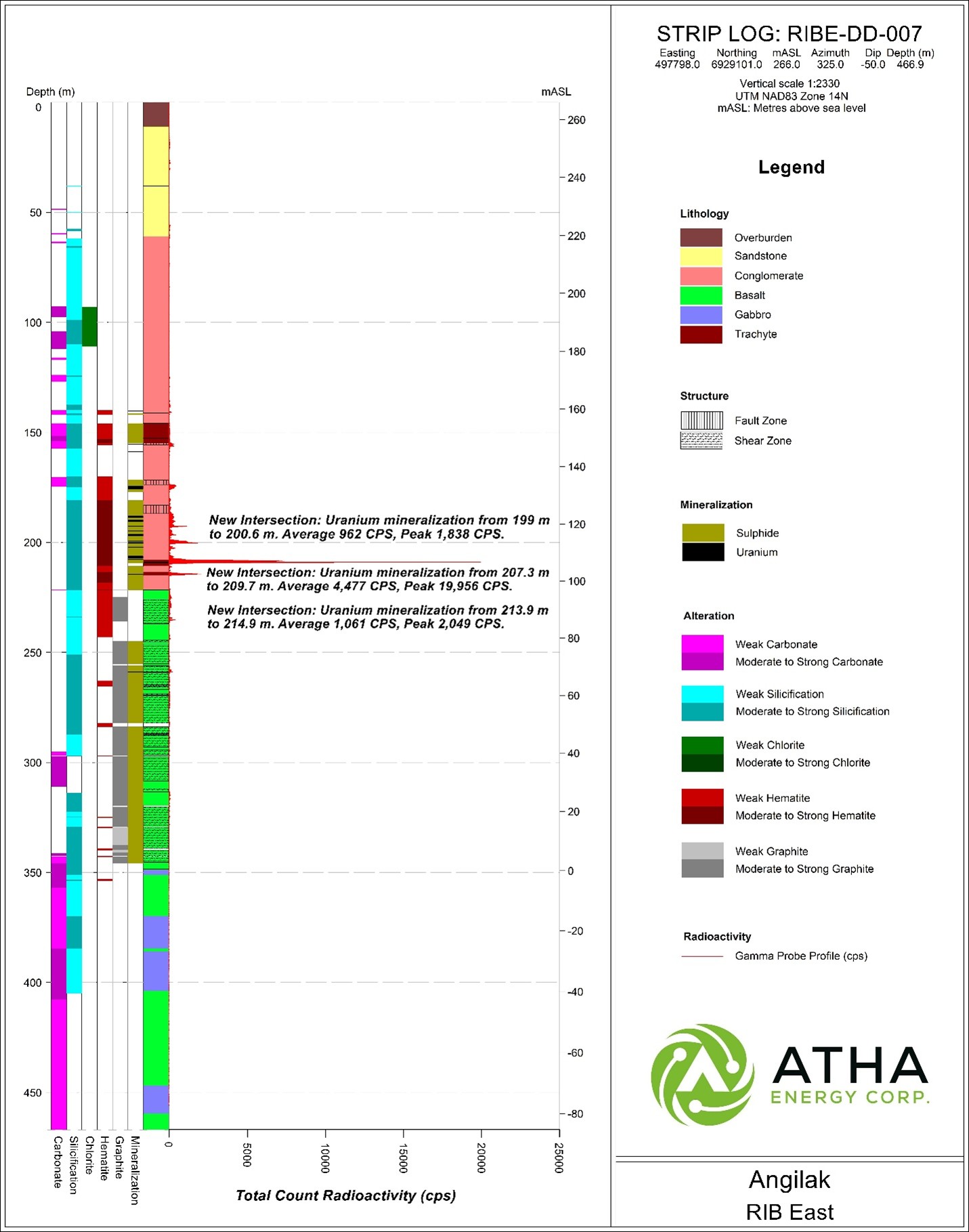

RIB East Discovery is currently defined by eight mineralized drill holes, intersecting shallow uranium mineralization (<275 m depth), the five latest holes extend mineralization from 400 m to a strike length of ~750 m (Figure 2). Based on EM Inversion modelling (see below), RIB East now has prospective strike length of more than 5 km, which remains largely untested by drilling;

In August 2025, Expert Geophysics Ltd. utilized the MMT survey data acquired in 2024 to complete Advanced Electromagnetic Inversion modelling ("EM Inversion") across 12 km of the 31 km long RIB-Nine Iron Trend, focused on the RIB East and West Discovery areas. The EM Inversion has proved successful in mapping out multiple stacked conductors, including numerous interpreted north-south and east-west trending cross cutting structures. Drilling at both RIB East and West has demonstrated the EM Inversion is accurately mapping graphitic structural corridors which are associated with uranium mineralization (Figure 2);

To date the Company has only explored a small proportion of the 12 km long prospective EM Inversion model at RIB East and West. The Company will be completing additional EM inversion modelling over the remaining 62% of the RIB-Nine Iron Trend where MMT data was acquired in 2024;

Through the end of the 2025 Angilak Exploration Program, the Company will be focused on targeting newly derived EM Inversion anomalies, including the newly identified north-south and east-west cross cutting trends;

The 2025 Angilak Exploration Program is on-going, to date, only ~55% of expected diamond drillhole results have been announced.

RIB West Discovery:

RIB West Discovery is located approximately 1.5 km to the west of the RIB East Discovery and is currently defined by two drill holes, both intersecting uranium mineralization, over a strike length of approximately ~340 m (Figure 2). The mineralization is hosted within graphitic structures accurately mapped by the advanced EM Inversion. Based on the EM Inversion model, the RIB West Discovery has a prospective strike length over 3 km, with an associated EM conductor;

RIB_W-DD-001, intersected high-grade uranium mineralization with total composite mineralization of 2.1 m, hosted within a broad graphitic structure. Mineralization was found between 396.25 m and 398.35 m, including 0.5 m of high-grade mineralization with a maximum down-hole-triple gamma probe value of 18,485 counts per second (CPS 1 ) over 0.1 m (Figure 2 & 3) ;

RIB_W-DD-002, drilled ~340 m along strike to the northeast of RIB_W-DD-001, intersected six zones of uranium mineralization within a broad graphitic structure. The hole intersected total composite mineralization of 8.5 m between 204.8 m and 269.5 m, including 2.0 m with an average of 1,586 CPS 1 and a max peak of 5,193 CPS 1 (Figure 2 & 4).

RIB East Discovery:

ATHA has completed eight drill holes at the RIB East Discovery during the 2025 Angilak Exploration Program (See July 21 st , 2025, News Release, for results from the first three drill holes). To date, all holes have successfully intersected uranium mineralization;

Today's release comprises five additional drill holes that have extended the strike length of mineralization at the RIB East Discovery from 400 m to ~750 m.

Drilling is highlighted by:

RIBE-DD-005, tested 100 m down-dip and 100 m along strike to the north of mineralization intersected in RIBE-DD-003. The hole intersected three zones of mineralization totaling 2.2 m of composite mineralization, including a shallow interval (between 282.9 m and 284.4 m) of high-grade uranium mineralization that had an average down-hole probe value of 3,711 CPS 1 and a peak of 12,357 CPS 1 over 0.10 m (Figure 2 & 6) ;

RIBE-DD-007, was drilled in a scissor orientation ~400 m to the southeast of RIBE-DD-003. The hole intersected four zones of mineralization (between 192.5 m and 214.9 m) with a total composite mineralization of 6.0 m, including a high-grade intersection from 207.3 m to 209.7 m, with an average down hole probe value of 4,477 CPS 1 and a peak of 19,956 CPS 1 , over 0.10 m (Figure 2 & 8).

Troy Boisjoli, CEO commented: " The newest discovery along the 31 km long RIB-Nine Iron Trend - at RIB West - is the Company's third discovery of the 2025 Angilak Exploration Program. This is an unprecedented feat from a greenfield exploration program targeting uranium discovery and speaks to the metal endowment at the Angilak Project area, beyond the Lac 50 Deposit area and ATHA's top tier technical teams' ability to plan and execute on its thesis. We continue to see the hallmarks of a generational bull market for uranium and based on ATHA's continued exploration success over the last two years, the Company is well positioned to accelerate uranium discovery and build value for this cycle ."

Cliff Revering, VP Exploration added: " We are very excited about the results emerging from the RIB regional target area, including another discovery along the RIB West trend and the continued expansion of the mineralized strike length along the RIB East trend. To date, we have drill-tested only a relatively small proportion of the prospective trends within the RIB area, with all completed holes intersecting uranium mineralization associated with graphitic structural corridors. All prospective trends remain open along strike and at depth. We are also very encouraged by the accuracy of the EM inversion model provided by Expert Geophysics in locating graphitic structural corridors associated with uranium mineralization. This model has been highly valuable in guiding our targeting strategy in the RIB area, and in highlighting numerous additional prospective trends that have yet to be drill-tested. "

VANCOUVER, BC / ACCESS Newswire / September 17, 2025 / ATHA Energy Corp. ( TSX.V:SASK )( FRA:X5U )( OTCQB:SASKF ) (" ATHA " or the " Company "), is pleased to announce that the Company has closed its previously announced underwritten private placement of special warrants (the " Offering ") for aggregate gross proceeds of $11,499,928.30, which included the full exercise of the Underwriters' option. The Offering was led by Stifel Canada, as lead underwriter and sole bookrunner, on behalf of a syndicate which included Red Cloud Securities Inc. and Paradigm Capital Inc. (collectively, the " Underwriters "). Further details of the Offering are described below. Additionally, the Company is pleased to announce further drilling and geophysics results from the 2025 Angilak Exploration Program at its 100%-owned Angilak Uranium Project in Nunavut, Canada.

The Company has completed two maiden drill holes at the RIB West Discovery resulting in the third new discovery of its 2025 drill program. RIB_W-DD-001 targeted a gravity and EM anomaly located ~1.5 km to the west of the RIB East Discovery. The hole intersected 2.1 m of composite mineralization, including 0.5 m of high-grade uranium mineralization with a peak response of 18,485 CPS 1 . The second hole at RIB West, RIB_W-DD-002, drilled approximately 340 m along strike to the north-east of RIB_W-DD-001, successfully intersected 8.5 m of composite mineralization over a broad interval, between 204.8 m and 269.5 m, hosted with a broad graphitic structure. Drilling at RIB West has demonstrated uranium mineralization potential continuity over a 340 m strike length; the majority of the prospective RIB West trend remains untested by drilling.

At the RIB East Discovery, the Company has completed an additional five drill holes. All eight drill holes at the RIB East Discovery have successfully intersected uranium mineralization. With today's release, the potential strike length of mineralization has been extended from ~400 m to ~750 m. The RIB East Discovery remains open along strike and at depth, with the majority of prospective conductive trend remaining untested.

In mid-August, the Company received results of Advanced Electromagnetic Inversion (" EM Inversion ") modelling work across 12 km of the 31 km long RIB-Nine Iron Trend, focused on the RIB East and West Discovery areas, from Expert Geophysics Ltd. The EM Inversion model utilized MMT survey data that was completed in September of 2024. The EM Inversion has proved successful in mapping out multiple stacked conductors, including numerous north-south and east-west cross cutting trends. Drilling at both RIB East and West has demonstrated the EM Inversion is accurately mapping graphitic structural corridors which are associated with uranium mineralization (Figure 2).

Figure 1: Angilak Project Area - 2025 Exploration Target Area (Black Rectangles) & Mapped Historic

Figure 2: 2025 RIB (East & West) Regional Target Area - EM Inversion Model & Drill Collar Locations at RIB East & West Discoveries

Table 1: 2025 Angilak Exploration Program Drill Collar Information

Hole ID | Trend | Zone | Azimuth (°) | Dip (°) | Easting (mE) | Northing (mN) | Elevation (m) | Final Depth (m) |

*RIBE-DD-001 | RIB-Nine Iron | RIB East | 145 | -55 | 497928 | 6929449 | 270 | 443 |

*RIBE-DD-002 | RIB-Nine Iron | RIB East | 145 | -55 | 497766 | 6929322 | 271 | 345 |

*RIBE-DD-003 | RIB-Nine Iron | RIB East | 145 | -63 | 497524 | 6929337 | 271 | 398 |

RIBE-DD-004 | RIB-Nine Iron | RIB East | 145 | -60 | 497404 | 6920180 | 271 | 428 |

RIBE-DD-005 | RIB-Nine Iron | RIB East | 155 | -65 | 497530 | 6929401 | 270 | 472 |

RIBE-DD-006 | RIB-Nine Iron | RIB East | 145 | -60 | 497670 | 6929501 | 273 | 491 |

RIBE-DD-007 | RIB-Nine Iron | RIB East | 325 | -50 | 497798 | 6929101 | 274 | 467 |

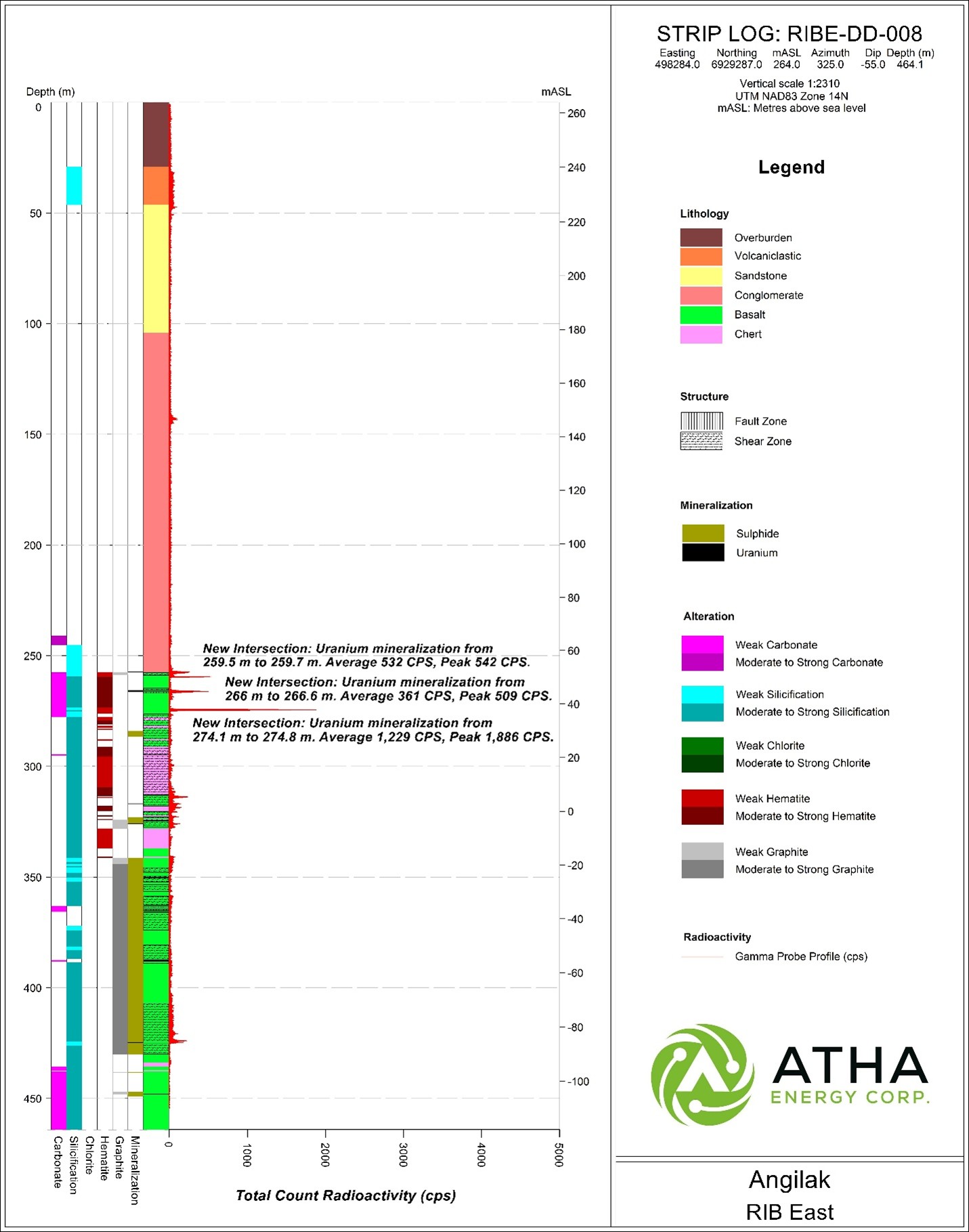

RIBE-DD-008 | RIB-Nine Iron | RIB East | 325 | -55 | 498284 | 6929287 | 264 | 464 |

RIB_W-DD-001 | RIB-Nine Iron | RIB West | 150 | -50 | 495831 | 6929490 | 274 | 503 |

RIB_W-DD-002 | RIB-Nine Iron | RIB West | 145 | -55 | 497766 | 6929322 | 271 | 380 |

* Previously released drill holes from 2025 Angilak Exploration Program

Figure 3: Striplog RIB_W-DD-001 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Figure 4: Striplog RIB_W-DD-002 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Figure 5: Striplog RIBE-DD-004 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Figure 6: Striplog RIBE-DD-005 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Figure 7: Striplog RIBE-DD-006 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Figure 8: Striplog RIBE-DD-007 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Figure 9: Striplog RIBE-DD-008 showing radioactivity based on 40TGU-1000 Triple Gamma Down Hole Probe 1 .

Underwritten Private Placement

The Company is also pleased to announce that further to its news release dated September 4, 2025, it has closed its previously announced underwritten private placement of 17,126,138 special warrants (" Special Warrants ") comprised of: (i) 5,756,820 non-flow through special warrants (the " NFT Special Warrants ") at a price of $0.54 per NFT Special Warrant; (ii) 5,111,888 flow-through special warrants (the " FT Special Warrants ") at a price of $0.65 per FT Special Warrant; and (iii) 6,257,430 charity flow-through special warrants (the " Charity FT Special Warrants " and, collectively with the NFT Special Warrants and FT Special Warrants, the " Special Warrants ") at a price of $0.81 per Charity FT Special Warrant, raising aggregate gross proceeds of $11,499,928.30 (the " Offering ").

Each Special Warrant entitles the holder thereof to receive, subject to adjustment in certain circumstances and the Penalty Provision (for the NFT Special Warrants and FT Special Warrants) (as defined herein), and without payment of additional consideration, one unit of the Company (a " Unit "). Each Unit consists of one common share of the Company (a " Unit Share ") and one common share purchase warrant (a " Warrant "). Each Warrant entitles the holder thereof to purchase one common share of the Company (a " Warrant Share ") at a price of $0.65 per Warrant Share until September 18, 2028.

The Special Warrants are duly and validly created and issued pursuant to the terms and conditions of special warrant indentures dated September 18, 2025, between the Company and Odyssey Trust Company (" Odyssey "). The Warrants are duly and validly created and issued pursuant to the terms and conditions of a warrant indenture dated September 18, 2025, between the Company and Odyssey.

The Special Warrants are exercisable by the holders thereof at any time after the closing date for no additional consideration. All unexercised Special Warrants shall be deemed exercised on behalf of, and without any required action on the part of, the holders (including the payment of additional consideration) on the earlier of:

the second business day following the date on which a final receipt is obtained from the British Columbia Securities Commission, as principal regulator on behalf of the securities regulatory authorities in each of the provinces and territories of Canada other than Québec, for a (final) short form prospectus filed pursuant to National Instrument 44-101 - Short Form Prospectus Distributions qualifying the distribution of the Unit Shares and Warrants to be issued upon exercise of the Special Warrants (the " Qualification Date ");

4:59 p.m. (Toronto time) on January 19, 2026.

In the event the Qualification Date has not occurred on or before November 2, 2025, each NFT Special Warrant and FT Special Warrant shall thereafter entitle the holder to receive, upon the exercise or deemed exercise of each NFT Special Warrant and FT Special Warrant, for no additional consideration, 1.1 Units (the " Penalty Provision ").

The gross proceeds of the sale of FT Special Warrants and Charity FT Special Warrants will be used for exploration expenditures that qualify as Qualifying Expenditures at the Company's Angilak project and other exploration stage projects. The net proceeds of the sale of NFT Special Warrants will be used for exploration expenditures on the Angilak project and for general corporate purposes.

In consideration for their services, the Underwriters received an aggregate $646,414.15 in cash and an aggregate 957,805 compensation warrants (the " Broker Warrants "). Each Broker Warrant shall be exercisable to acquire one common share of the Company (each, a " Compensation Share ") at a price of $0.65 per common share, until September 18, 2028.

All securities issued in connection with the Offering - the Special Warrants, the Units, the Unit Shares, the Warrants, the Broker Warrants and the Compensation Shares - are subject to a statutory hold period expiring four months and one day following the date of issuance, in accordance with applicable Canadian securities legislation. The Offering remains subject to the final approval of the TSX Venture Exchange.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States (as defined in Regulation S under the 1933 Act) or to, or for the account or benefit or "U.S. persons" (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state of the United States in which such offer, solicitation or sale would be unlawful.

Down Hole Gamma Probe

1 A Mount Sopris 40TGU-1000 Triple Gamma Geiger down hole probe was utilized for radiometric surveying. The total gamma results provided were selected using an average cutoff of 500 CPS over intervals of 0.1 metre width. All drill intercepts are core width and true thickness is yet to be determined.

Core samples are submitted to the Saskatchewan Research Council (SRC) Geoanalytical Laboratories in Saskatoon. The SRC facility is ISO/IEC 17025:2005 accredited by the Standards Council of Canada (scope of accreditation #537). The samples are analyzed for a multi-element suite using partial and total digestion inductively coupled plasma methods, for boron by Na2O2 fusion, and for uranium by fluorimetry.

Disclaimer for Historical Drilling and Outcrop Samples

Certain noted technical information provided herein has been derived exclusively and without independent verification from the following reports. Such information is historical in nature and is not considered by the Company to be current. In each case, the reliability of the historical information is considered reasonable by the Company. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results. Readers should read the entirety of such noted reports to fully understand the nature of the information referenced herein. Samples, including, without limitation, outcrop samples, by their nature, are selective in nature and significant variations may be seen from sample to sample. Accordingly, sample information may not be representative of the true underlying mineralization.

References for Historic Diamond Drilling Results and Surficial Sampling

Dufresne, M.B. and Schoeman, P. (2024). Technical report on the Angilak Project, Kivalliq Region, Nunavut. Technical Report prepared on behalf of ATHA Energy Corp. and Labrador Uranium Inc., January 31st, 2024. A copy of such report is available on the SEDAR+ profile of the Company at www.sedarplus.com.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Cliff Revering, P.Eng., Vice President, Exploration of ATHA, who is a "qualified person" as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About ATHA

ATHA is a Canadian mineral company engaged in the acquisition, exploration, and development of uranium assets in the pursuit of a clean energy future. With a strategically balanced portfolio including three 100%-owned post discovery uranium projects (the Angilak Project located in Nunavut, and CMB Discoveries in Labrador, and the newly discovered basement hosted GMZ high-grade uranium discovery located in the Athabasca Basin). In addition, the Company holds the largest cumulative prospective exploration land package (>7 million acres) in two of the world's most prominent basins for uranium discoveries - ATHA is well positioned to drive value. ATHA also holds a 10% carried interest in key Athabasca Basin exploration projects operated by NexGen Energy Ltd. and IsoEnergy Ltd. For more information visit www.athaenergy.com.

On Behalf of the Board of Directors

Troy Boisjoli, CEO, ATHA Energy Corp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

Website: www.athaenergy.com

Phone: 1-(236)-521-0526

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". These forward-looking statements or information may relate to ATHA's proposed exploration program, including statements with respect to the expected benefits of ATHA's proposed exploration program, any results that may be derived from ATHA's proposed exploration program, the timing, scope, nature, breadth and other information related to ATHA's proposed exploration program, any results that may be derived from the diversification of ATHA's portfolio, the prospects of ATHA's projects, including mineral resources estimates and mineralization of each project, the prospects of ATHA's business plans and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA's projects, any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production, the Company's filing and obtaining a receipt for a (final) short form prospectus by the Qualification Date, the use of proceeds of the Offering, the receipt of all necessary regulatory and other approvals, including final approval of the TSX Venture Exchange, and the expected incurrence by the Company of eligible Canadian exploration expenses that will qualify as flow-through critical mineral mining expenditures. Additionally, "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, statements with respect to, the Company filing of a (final) short form prospectus by the Qualification Date; the use of proceeds from the Offering; the receipt of all necessary final regulatory and other approvals, including approval of the TSX Venture Exchange; the expected incurrence by the Company of eligible Canadian exploration expenses that will qualify as flow-through critical mineral mining expenditures; and the renunciation by the Company of the Canadian exploration expenses (on a pro rata basis) to each subscriber of FT Special Warrants and Charity FT Special Warrants by no later than effective December 31, 2025.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the anticipated benefits of ATHA's proposed exploration program will be realized, that no additional permit or licenses will be required in connection with ATHA's exploration programs, the ability of ATHA to complete its exploration activities as currently expected and on the current anticipated timelines, including ATHA's proposed exploration program, that ATHA will be able to execute on its current plans, that ATHA's proposed explorations will yield results as expected, and that general business and economic conditions will not change in a material adverse manner. Although ATHA has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current view of ATHA with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA to realize the benefits anticipated from the exploration and drilling targets described herein or elsewhere; inability of ATHA to complete current exploration plans as presently anticipated or at all; inability for ATHA to economically realize on the benefits, if any, derived from the exploration program; failure to complete business plans as it currently anticipated; overdiversification of ATHA's portfolio; failure to realize on benefits, if any, of a diversified portfolio; unanticipated changes in market price for ATHA shares; changes to ATHA's current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of ATHA; and the ability to advance the Company projects and its proposed exploration program; risks inherent in mineral exploration including risks related worker safety, weather and other natural occurrences, accidents, availability of personnel and equipment, and other factors; aboriginal title; failure to obtain regulatory and permitting approvals; no known mineral resources/reserves; reliance on key management and other personnel; competition; changes in laws and regulations; uninsurable risks; delays in governmental and other approvals, community relations; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where ATHA conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA with the Canadian securities regulators which are available on ATHA's profile on SEDAR+ at www.sedarplus.ca. ATHA does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: ATHA Energy Corp

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/atha-energy-closes-over-subscribed-bought-deal-makes-third-new-discovery-of-2025-1075288