Toronto, Ontario--(Newsfile Corp. - September 19, 2025) - Green Rise Foods Inc. (TSXV: GRF) ("Green Rise" or the "Corporation") today announced that the Board of Directors has approved the amendment to certain stock options granted to Mr. George Hatzoglou, the Chief Financial Officer of the Corporation, on July 3, 2024 (the "July 3, 2024 Options" or the "Options").

The Options were evidenced by a stock option agreement signed between the parties dated as of July 3,2024 (the "2024 Original Option Agreement"), pursuant to which Mr. Hatzoglou (the "Optionee") was issued 900,000 Options exercisable at an option price of $0.60 per Share, which Options were expressed to vest on July 3, 2027 and expire and terminate in certain circumstances including on October 1, 2027, being the day which is ninety (90) days following July 3, 2027.

The purpose of the original Option grant in 2024 was to incentivize the Chief Financial Officer to efficiently and prudently assist in the long-term growth and profitability of the business of the Corporation and to permit him to share in the equity growth of the Corporation at the then-current market price.

After further consideration of the 2024 Original Option Agreement, the Corporation believes that the vesting provision and the requirement for the Optionee to exercise the Options within ninety (90) days following October 1, 2027 are burdensome to the Optionee for financial and other reasons. Also, the benefits to the Corporation and the purpose of granting the Options to the Optionee were to incentivize him to stay and work with the Corporation on a longer term basis to grow its profitability and value, and these benefits and this purpose would be significantly weakened to the extent that the vesting date and exercise window for the Options are, respectively, too proximate and too short, and the immediate financial consequences to the Optionee of exercising them would be more financially burdensome under a shorter vesting and exercise period compared to a more evenly spread out period over a longer term.

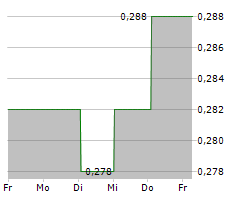

Also, the restricted ninety (90) day window for exercise of the Options is not in accord with every other option granted under the Stock Option Plan as those options all have five (5) year terms and the exercise price for the Options is currently $0.60 per Share which is well below recent closing prices for the Corporation's Shares trading on the TSX-V. The Optionee has agreed to have the exercise price for the Options (as amended) maintained at, and there will be no reduction in, the exercise price of $0.60 per Share, notwithstanding this fact.

The Board of Directors ( the "Board") has determined that the 2024 Original Option Agreement be amended and restated: to provide that the Options: i) shall have a five (5) year term expiring on July 3, 2029; ii) shall vest as to 300,000 Options on each of July 3, 2027, January 1, 2028 and January 1 2029 and shall be exercisable thereafter until their date of expiration or termination, whereupon they would expire or terminate if not exercised on or before such date, and iii) and shall otherwise have the terms and conditions of this restated and amended agreement (the "Agreement", the "Amendment" or the "2024 Amended and Restated Stock Option Agreement") which reflects the provisions of the 2024 Original Option Agreement amended as contemplated herein and updated in accordance with the standard form option agreement currently being used by the Corporation.

The independent directors of the Corporation were unanimous in their in agreement with the Amendment and, as a result, the Board authorized and approved today the 2024 Amended and Restated Stock Option Agreement, subject to the approval of the TSX V and the satisfaction of its customary conditions, and the approval of "disinterested shareholders" within the meaning of TSX-V Policy 4.4 such that the votes attached to Common Shares beneficially owned or controlled by Mr. Hatzoglou or his Affiliates or Associates will be excluded from any vote on a resolution to approve the Amendment at the next Annual General and Special Meeting of Shareholders to be held on November 4, 2025.

The Amendment constitutes a "related party transaction" under applicable Canadian securities laws, including under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions, because the Chief Financial Officer is an "insider". However, such insider participation is exempt from the formal valuation and minority shareholder approval requirements under applicable Canadian securities laws because the Common Shares are listed on the TSX-V (and not the TSX) and given the relatively small size of the transaction and the fact that all independent directors have unanimously approved the Amendment.

A copy of the redacted Amended and Restated Stock Option Agreement will be included in the information circular, which will be mailed to shareholders in advance of the Annual General and Special Meeting of Shareholders to be held on November 4, 2025. The information circular will also be available under the Corporation's profile on SEDAR+ at www.sedarplus.ca.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Vincent Narang

Chief Executive Officer

Phone: 1-416-551-5015

E-mail: info@greenrisefoods.ca

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267266

SOURCE: Green Rise Foods Inc.