Acuity RM Group Plc - Issue of Equity

PR Newswire

LONDON, United Kingdom, September 22

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT, IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.PLEASE SEE THE IMPORTANT NOTICE IN THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU) 596 / 2014 WHICH FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

22 September 2025

Acuity RM Group plc

("Acuity", or the "Company")

Proposed Placing and Subscription to raise approximately £0.35 million

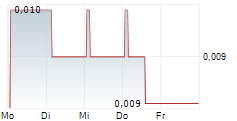

Acuity (AIM: ACRM), the software group focused on cybersecurity, announces a fundraising, to raise approximately £0.35 million (before expenses) through the issue of new ordinary shares of 0.1p each in the capital of the Company (the "Ordinary Shares") at 1 penny per Ordinary Share (the "Issue Price") (the "Fundraising"). The net proceeds of the Fundraising will be used to provide general working capital. The Fundraising will comprise a placing of 29,000,000 new Ordinary Shares ("Placing Shares") ("Placing"), and a direct subscription of 6,000,000 new Ordinary Shares ("Subscription Shares") ("Subscription").

The Issue Price represents a discount of approximately 16.67 per cent. to the closing mid-market price on AIM of 1.2 pence per Ordinary Share on 19 September 2025, being the latest practicable business day prior to the publication of this Announcement.

The Company also proposes to issue warrants to Placees and Subscribers in the Fundraising on the basis of one Warrant for every one new Ordinary Share subscribed under the Fundraising (the "Warrants"). Each Warrant grants the holder the right to subscribe for one additional new Ordinary Share at 1.5 pence and is exercisable for a period of up to 12 months from the date of admission of the Placing Shares and Subscription Shares to trading on AIM ("Admission"). Further details regarding the Warrants are set out below.

Transaction Highlights

- The Company intends to raise approximately £0.35 million, in aggregate, pursuant to the Fundraising (further details outlined below).

- The Fundraising will be conducted by way of a non pre-emptive share issue.

- The Fundraising includes a Placing and Subscription with new and existing investors

- The net proceeds of the Fundraising will be used for general working capital purposes.

Zeus Capital Limited ("Zeus") and Peterhouse Capital Limited ("Peterhouse") are acting as joint brokers (the "Joint Bookrunners") in connection with the Placing.

Current trading and prospects

There has been no material change in the Company's trading and prospects since the announcement of the Company's interim results for the six months ended 30 June 2025 on 2 September 2025.

The Placing

The Placing is being conducted by the Joint Bookrunners. A placing agreement has been entered into between the Company, Zeus and Peterhouse in connection with the Placing (the "Placing Agreement").

The Placing will utilise the Company's existing shareholder authorities to issue the Placing Shares on a non-pre-emptive basis for cash.

The Placing is not being underwritten.

The allotment and issue of the Placing Shares is conditional, inter alia, upon:

- Admission becoming effective by no later than 8.00 a.m. on 26 September 2025 (or such other time and/or date, being no later than 8.00 a.m. on 3 October 2025, as the Joint Bookrunners and the Company may agree);

- the conditions in the Placing Agreement in respect of the Placing Shares being satisfied or (if applicable) waived; and

- the Placing Agreement not having been terminated in accordance with its terms prior to Admission.

Accordingly, if any of such conditions are not satisfied or, if applicable, waived, the Placing will not proceed.

The Placing Shares will be credited as fully paid and will rank pari passu in all respects with the existing Ordinary Shares then in issue, including the right to receive all future distributions, declared, paid or made in respect of the Ordinary Shares from the date of Admission. the Placing Shares and Subscription Shares will represent approximately 14.6 per cent. of the Company's enlarged share capital.

Subject to satisfaction of the relevant conditions, it is expected that Admission will become effective, and dealing in the Placing Shares will commence, at 8.00 a.m. (London time) on or around 26 September 2025.

The Joint Bookrunners have the right to terminate the Placing Agreement in certain circumstances prior to Admission, including (but not limited to): in the event that any of the warranties set out in the Placing Agreement become untrue, inaccurate or misleading in any material respect or the Company materially fails to comply with any of its obligations prior to Admission. The Joint Bookrunners may also terminate the Placing Agreement if there has been (i) a material adverse change affecting the business or prospects of the Company or its group or (ii) any change in national or international financial, economic, political, industrial or market conditions or currency exchange rates or exchange controls, or any incident of terrorism or outbreak or escalation of hostilities or any declaration by the UK or the US of a national emergency or war or any other calamity or crisis which, in the reasonable opinion of the Joint Bookrunners, is likely to have an adverse effect on business or prospects of the Company or its group and makes it impractical or inadvisable to proceed with the Placing. If this termination right is exercised, or if the conditionality in the Placing Agreement is not satisfied, the Placing will not proceed.

The Subscription

Certain investors have indicated their intention to subscribe for new Ordinary Shares at the Issue Price pursuant to the terms and conditions of subscription letters to be entered into between the relevant parties and the Company on or about the date hereof.

The Subscription is not part of the Placing and any Subscription Shares would be subscribed pursuant to the terms of subscription agreements between the Company and the relevant subscribers.

Subject to satisfaction of the relevant conditions, it is expected that Admission will become effective, and dealing in the Subscription Shares will commence, at 8.00 a.m. (London time) on or around 26 September 2025.

The Warrants

The Company also proposes to issue Warrants to Placees and subscribers in the Fundraising on the basis of one Warrant for every one New Ordinary Share subscribed under the Fundraising. Each Warrant grants the holder the right to subscribe for one additional new Ordinary Share at a price of 1.5 pence per new Ordinary Share. The Warrants will not be traded on an exchange.

The Warrants have an accelerator clause. If the closing mid-market price of the Company's shares is sustained at greater than £0.02 for five consecutive trading days, the Company may choose to force execution of the Warrant. The Company is obliged to write to each Warrant holder providing seven calendar days' notice to exercise the warrants (the "Notice"), after which each Warrant holder will have up to 21 days to pay for the exercise of their Warrants, subject to the terms of the Warrant Deed. Warrants for which notice of execution is not given within seven days from the date of Notice will be forfeited.

If the accelerator clause is not triggered, the Warrants have a life of 12 months from the date of Admission.

Admisison and Total Voting Rights

Application has been made to the London Stock Exchange for Admission and it is expected that such Admission will occur at 8.00 a.m. on 26 September 2025. The Placing Shares and Subscription Shares will be issued credited as fully paid and will rank in full for all dividends and other distributions declared, made or paid after the admission of the Subscription Shares, respectively and will otherwise be identical to and rank on Admission pari passu in all respects with the existing Ordinary shares.

Following Admission of the Placing Shares and Subscription Shares, the Company will have 239,618,249 Ordinary Shares in issue, of which none are held in treasury. Accordingly, the total number of voting rights in the Company will be 239,618,249 and shareholders may use this figure as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company under the FCA's Disclosure Guidance and Transparency Rules.

For further information please contact: |

|

Acuity RM Group plc | https://www.acuityrmgroup.com |

Angus Forrest | +44 (0) 20 3582 0566 |

Zeus (NOMAD & Broker) | https://www.zeuscapital.co.uk |

Mike Coe / James Bavister | +44 (0) 20 3829 5000 |

Peterhouse Capital (Joint broker) |

|

Lucy Williams / Duncan Vasey | +44 (0) 20 7469 0936 |

|

|

|

|

|

|

Note to Editors

Acuity RM Group plc

Acuity RM Group plc (AIM: ACRM), is an established provider of risk management services. Its award-winning STREAM® software platform which collects and analyses data to improve business decisions and management used by clients operating in markets including government, defence, broadcasting, utilities, manufacturing and healthcare.

The Company is focused on delivering long term, sustainable growth in shareholder value from organic growth and complementary acquisitions.

IMPORTANT NOTICES

Zeus Capital Limited ("Zeus"), which is authorised and regulated in the United Kingdom by the FCA, is acting as nominated adviser and broker exclusively for the Company and no one else in connection with the contents of this Announcement and will not regard any other person (whether or not a recipient of this Announcement) as its client in relation to the contents of this Announcement nor will it be responsible to anyone other than the Company for providing the protections afforded to its clients or for providing advice in relation to the contents of this Announcement. Apart from the responsibilities and liabilities, if any, which may be imposed on Zeus by the Financial Services and Markets Act 2000, as amended ("FSMA") or the regulatory regime established thereunder, Zeus accepts no responsibility whatsoever, and makes no representation or warranty, express or implied, as to the contents of this Announcement including its accuracy, completeness or verification or for any other statement made or purported to be made by it, or on behalf of it, the Company or any other person, in connection with the Company and the contents of this Announcement, whether as to the past or the future. Accordingly, Zeus disclaims all and any liability whatsoever, whether arising in tort, contract or otherwise (save as referred to above), which it might otherwise have in respect of the contents of this Announcement or any such statement. The responsibilities of Zeus as the Company's Nominated Adviser under the AIM Rules for Companies and the AIM Rules for Nominated Advisers are owed solely to the London Stock Exchange and are not owed to the Company or to any director or shareholder of the Company or any other person, in respect of its decision to acquire shares in the capital of the Company in reliance on any part of this Announcement, or otherwise.

Peterhouse Capital Limited ("Peterhouse"), which is authorised and regulated in the United Kingdom by the FCA, is acting as joint broker exclusively for the Company and no one else in connection with the contents of this Announcement and will not regard any other person (whether or not a recipient of this Announcement) as its client in relation to the contents of this Announcement nor will it be responsible to anyone other than the Company for providing the protections afforded to its clients or for providing advice in relation to the contents of this Announcement. Apart from the responsibilities and liabilities, if any, which may be imposed on Peterhouse by the FSMA or the regulatory regime established thereunder, Peterhouse accepts no responsibility whatsoever, and makes no representation or warranty, express or implied, as to the contents of this Announcement including its accuracy, completeness or verification or for any other statement made or purported to be made by it, or on behalf of it, the Company or any other person, in connection with the Company and the contents of this Announcement, whether as to the past or the future. Accordingly, Peterhouse disclaims all and any liability whatsoever, whether arising in tort, contract or otherwise (save as referred to above), which it might otherwise have in respect of the contents of this Announcement or any such statement.

The Placing Shares have not been and will not be registered under the Securities Act or with any securities regulatory authority of any state or other jurisdiction of the United States and may not be offered, sold, pledged, taken up, exercised, resold, renounced, transferred or delivered, directly or indirectly, in or into the United States absent registration under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. The Placing Shares have not been approved, disapproved or recommended by the U.S. Securities and Exchange Commission, any state securities commission in the United States or any other U.S. regulatory authority, nor have any of the foregoing authorities passed upon or endorsed the merits of the offering of the Placing Shares. Subject to certain exceptions, the securities referred to herein may not be offered or sold in the United States, Australia, Canada, Japan, New Zealand, the Republic of South Africa or to, or for the account or benefit of, any national, resident or citizen of the United States, Australia, Canada, Japan, New Zealand or the Republic of South Africa.

No public offering of securities is being made in the United States.

The relevant clearances have not been, nor will they be, obtained from the securities commission of any province or territory of Canada; no prospectus has been lodged with, or registered by, the Australian Securities and Investments Commission, the Financial Markets Authority of New Zealand or the Japanese Ministry of Finance; the relevant clearances have not been, and will not be, obtained from the South Africa Reserve Bank or any other applicable body in the Republic of South Africa in relation to the Placing Shares; and the Placing Shares have not been, and nor will they be, registered under or offered in compliance with the securities laws of any state, province or territory of Canada, Australia, Japan, New Zealand or the Republic of South Africa. Accordingly, the Placing Shares may not (unless an exemption under the relevant securities laws is applicable) be offered, sold, resold or delivered, directly or indirectly, in or into Canada, Australia, Japan, New Zealand or the Republic of South Africa or any other jurisdiction outside the United Kingdom or to, or for the account or benefit of any national, resident or citizen of Australia, Japan, New Zealand or the Republic of South Africa or to any investor located or resident in Canada.

No public offering of the Placing Shares is being made in the United States, the United Kingdom or elsewhere. All offers of the Placing Shares will be made pursuant to an exemption under the EU Prospectus Regulation, or the UK Prospectus Regulation, (as the case may be) from the requirement to produce a prospectus. This Announcement is being distributed to persons in the United Kingdom only in circumstances in which section 21(1) of FSMA does not apply.

The information in this Announcement, which includes certain information drawn from public sources, does not purport to be comprehensive and has not been independently verified. This Announcement contains statements that are, or may be deemed forward-looking statements, which relate, inter alia, to the Company's proposed strategy, plans and objectives. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the control of the Company (including but not limited to future market conditions, legislative and regulatory changes, the actions of governmental regulators and changes in the political, social or economic framework in which the Company operates) that could cause the actual performance or achievements on the Company to be materially different from such forward-looking statements.

The content of this Announcement has not been approved by an authorised person within the meaning of the FSMA. Reliance on this Announcement for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested. The price of securities and any income expected from them may go down as well as up and investors may not get back the full amount invested upon disposal of the securities. Past performance is no guide to future performance, and persons needing advice should consult an appropriate independent financial adviser.

No prospectus will be made available in connection with the matters contained in this Announcement and no such prospectus is required (in accordance with the EU Prospectus Regulation or the UK Prospectus Regulation) to be published. This Announcement and the terms and conditions set out herein are for information purposes only and are directed only at persons who are: (a) persons in Member States who are Qualified Investors; and (b) in the United Kingdom, Qualified Investors who are persons who (i) have professional experience in matters relating to investments falling within the definition of "investment professionals" in article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order"); (ii) are persons falling within article 49(2)(a) to (d) ("high net worth companies, unincorporated associations, etc") of the Order; or (iii) are persons to whom it may otherwise be lawfully communicated; (all such persons together being referred to as "relevant persons").

This Announcement and the terms and conditions set out herein must not be acted on or relied on by persons who are not relevant persons. Persons distributing this Announcement must satisfy themselves that it is lawful to do so. Any investment or investment activity to which this Announcement and the terms and conditions set out herein relates is available only to relevant persons and will be engaged in only with relevant persons.

No representation or warranty, express or implied, is or will be made as to, or in relation to, and no responsibility or liability is or will be accepted by Joint Bookrunners or by any of their affiliates or agents as to, or in relation to, the accuracy or completeness of this Announcement or any other written or oral information made available to or publicly available to any interested party or its advisers, and any liability therefore is expressly disclaimed.

No statement in this Announcement is intended to be a profit forecast or estimate, and no statement in this Announcement should be interpreted to mean that earnings per share of the Company for the current or future financial years would necessarily match or exceed the historical published earnings per share of the Company.

Neither the content of the Company's website nor any website accessible by hyperlinks on the Company's website is incorporated in, or forms part of, this Announcement.