Vancouver, British Columbia--(Newsfile Corp. - September 23, 2025) - Equity Metals Corporation (TSXV: EQTY) ("Equity") reports new precious and base metal assays from the Summer '25 drill program on its 100% owned Silver Queen Au-Ag project, British Columbia, which continue to extend the lateral projection of the No. 3 North vein beyond the Company's 2022 Resource Estimate.

Assay highlights from the latest drilling include:

A 2.5 metre (Est. TT) interval averaging 1.2g/t Au, 79g/t Ag, 0.3% Cu, 0.3% Pb and 2.0% Zn (536g/t AgEq or 7.4g/t AuEq) including a 0.3 metre (est. TT) interval grading 0.8g/t Au, 295g/t Ag, 0.7% Cu, 10.7% Pb and 24.2% Zn (1,448g/t AgEq or 20.0g/t AuEq) from SQ25-157; and

A 1.3 metre (Est. TT) interval averaging 1.3g/t Au, 229g/t Ag, 1.6% Cu, 1.0% Pb and 8.9% Zn (800g/t AgEq or 11.0g/t AuEq) including 0.3 metre (est. TT) interval grading 1.9g/t Au, 413g/t Ag, 3.1% Cu, 0.4% Pb and 15.1% Zn (1,374g/t AgEq or 19.0g/t AuEq) from SQ25-159.

These holes intersected shallow extensions of the No. 3 vein northwest of historic underground workings.

An additional highlight is:

- A 0.8 metre (Est. TT) interval grading 641g/t Ag, 0.1% Pb and 0.3% Zn (659g/t AgEq or 9.1g/t AuEq) in SQ25-153 from a footwall vein that may correlate to the No. 1 Vein, which was previously identified in historical drilling but not specifically targeted during this round of drilling.

Historically, three separate veins have been identified in this target area through drilling and exploration at surface and underground. Multiple veins have been intersected in most holes during the current program, continuing to provide definition to each of these three vein sets. Of note, mineralization related to the No. 3 Vein is adjacent to historical mine workings, providing potential access advantages in any future development scenarios.

The Company also reports that it has now completed the drilling component of the Summer '25 drill program on the Silver Queen project. The program successfully extended the No 3 Vein up to 650 metres laterally to the northwest from the modelled 2022 Mineral Resource, with assays from thirteen holes having now been received. Assays from eight holes are pending, of which six tested the depth projection of the No. 3 Vein to over 450 metres below surface. Assays are anticipated in the coming weeks.

VP Exploration Rob Macdonald commented, "Mineralization identified in the current Summer '25 drill program continues the process of systematic expansion of high-grade gold and silver mineralization along strike and down dip from previously modelled mineral resources on the Silver Queen project. Further assays are pending that will be incorporated into our updated vein modelling and culminating in an updated Mineral Resource Estimate anticipated in late Q4 2025."

2025 Exploration Program Summary

Twenty-one core holes totalling 8,059 metres were drilled on the No. 3 North target. A short surface program consisting of reconnaissance soil and stream sediment sampling is currently underway to investigate several district-scale targets outboard from the No. 3 Vein system. Work in 2025 will continue to incorporate the new drill data into a revised exploration and resource model, in anticipation of a Mineral Resource update to be prepared in late 2025, and to continue exploration on the ever-expanding Silver Queen vein system into 2026.

The No. 3 Vein system contains the single largest resource currently identified on the Silver Queen property, and along with its southern extension, the NG-3 Vein, account for 65% of the currently modelled mineral resource on a AgEq basis. Extensions to the No. 3 Vein should be highly accretive to the current mineral resource. The updated NI43-101 Mineral Resource Estimate with effective date December 1st, 2022 is detailed in a News Release issued on Jan 16, 2023, which can be found by clicking here and the full Technical Report can be found on SEDAR+ and the Company's website.

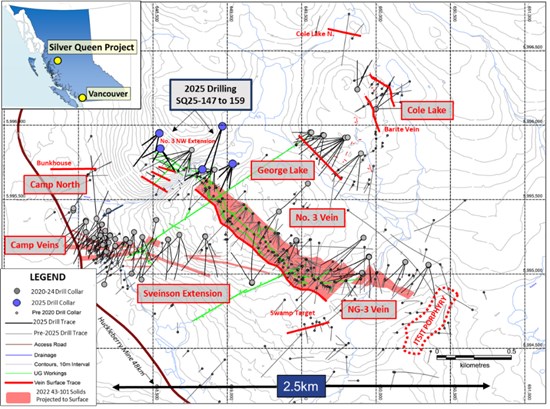

Figure 1: Plan of Silver Queen project area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5566/267500_769540f084feb8e0_002full.jpg

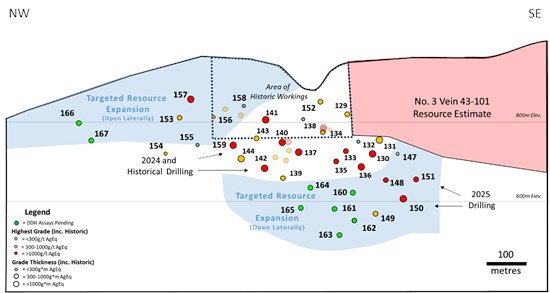

Figure 2: No. 3 North Longitudinal Section showing historical and 2024-25 drill intercepts. Historical Intercepts are semi-transparent. Drill holes with assays pending are shown in green

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5566/267500_769540f084feb8e0_003full.jpg

Table 1: Select Composites from 2025 Drilling on the No. 3 North Target

| Hole # | From (m) | To (m) | Interval (m) | ETT (m) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | AgEq (g/t) | AuEq (g/t) | Comments |

| SQ25-152 | 88.0 | 89.2 | 1.2 | 0.9 | 1.7 | 223 | 1.2 | 1.3 | 2.9 | 592 | 8.2 | No. 3 Vein |

| SQ25-153 | 200.8 | 201.8 | 1.0 | 0.8 | 0.4 | 87 | 0.3 | 0.7 | 9.2 | 457 | 6.3 | No. 3 Vein |

| and | 320.0 | 322.0 | 2.0 | 1.6 | 0.3 | 200 | 0.0 | 0.1 | 0.5 | 245 | 3.4 | |

| and | 381.5 | 382.6 | 1.1 | 0.8 | 0.0 | 641 | 0.0 | 0.1 | 0.3 | 659 | 9.1 | Footwall Vein (No. 1?) |

| SQ25-154 | 257.4 | 257.9 | 0.5 | 0.3 | 0.6 | 91 | 0.2 | 5.2 | 14.2 | 733 | 10.1 | No 3 Vein |

| SQ25-155 | 192.2 | -62.5 | 267.0 | NSV | NSV | NSV | NSV | NSV | NSV | NSV | NSV | |

| SQ25-156 | 135.3 | 135.7 | 0.4 | 0.3 | 1.7 | 179 | 1.9 | 2.8 | 2.6 | 638 | 8.8 | No. 3 Vein |

| and | 221.6 | 222.0 | 0.4 | 0.3 | 1.3 | 111 | 0.1 | 8.5 | 18.2 | 993 | 13.7 | No. 2 Vein |

| SQ25-157 | 120.7 | 123.7 | 3.0 | 2.5 | 1.2 | 79 | 0.3 | 2.5 | 7.0 | 478 | 6.6 | No. 3 Vein |

| inc. | 121.1 | 121.5 | 0.4 | 0.3 | 0.8 | 295 | 0.7 | 10.7 | 24.2 | 1448 | 20.0 | |

| and | 180.0 | 181.3 | 1.3 | 1.1 | 0.5 | 49 | 0.0 | 1.5 | 3.9 | 248 | 3.4 | |

| inc. | 180.8 | 181.3 | 0.5 | 0.4 | 0.8 | 88 | 0.1 | 2.8 | 8.3 | 486 | 6.7 | |

| SQ25-158 | 145.3 | 146.3 | 1.0 | 0.8 | VOID | VOID | VOID | VOID | VOID | VOID | VOID | No 3 Vein; Mined Out |

| and | 218.0 | 224.1 | 6.1 | 4.7 | 0.2 | 15 | 0.0 | 0.3 | 2.2 | 111 | 1.5 | 29.5% Dilution |

| inc. | 218.0 | 221.0 | 3.0 | 2.3 | 0.3 | 22 | 0.0 | 0.5 | 3.2 | 162 | 2.2 | |

| SQ25-159 | 197.6 | 199.9 | 2.3 | 1.3 | 1.3 | 229 | 1.6 | 1.0 | 8.9 | 800 | 11.0 | No. 3 Vein |

| inc. | 197.6 | 198.1 | 0.6 | 0.3 | 1.9 | 413 | 3.1 | 0.4 | 15.1 | 1374 | 19.0 |

Notes: drill core samples were analyzed by FA/AAS for gold and 48 element ICP-MS by MS Analytical, Langley, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP-ES analysis, High silver overlimits (>1000g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. Silver >10,000g/t re-assayed by concentrate analysis, where a FA-Grav analysis is performed in triplicate and a weighed average reported. Downhole composites calculated using a 80g/t AgEq (1g/t AuEq) cut-off and <20% internal dilution, except where noted. Accuracy of results is tested through the systematic inclusion of QA/QC standards, blanks and duplicates into the sample stream. AuEq and AgEq were calculated using prices of $2,360/oz Au, $28.50/oz Ag, $4.25/lb Cu, $0.90/lb Pb and $1.20/lb Zn. AuEq and AgEq calculations utilized relative metallurgical recoveries of Au 70%, Ag 80%, Cu 80%, Pb 81% and Zn 90%.

Table 2: Collar Survey data

| Hole # | Survey Data | Collar Data | ||||

| UTM Coordinates_NAD83Z11 | AZ | DIP | Depth | |||

| Easting | Northing | Elev (m) | Deg | Deg | (m) | |

| SQ25-152 | 648833 | 5995703 | 927 | 238 | -45 | 200 |

| SQ25-153 | 648543 | 5995946 | 952 | 218 | -45 | 399 |

| SQ25-154 | 648543 | 5995946 | 952 | 235 | -62 | 300 |

| SQ25-155 | 648543 | 5995946 | 952 | 235 | -62 | 300 |

| SQ25-156 | 648550 | 5995843 | 944 | 210 | -68 | 282 |

| SQ25-157 | 648550 | 5995843 | 944 | 244 | -45 | 192 |

| SQ25-158 | 648550 | 5995843 | 944 | 147 | -45 | 264 |

| SQ25-159 | 648550 | 5995843 | 944 | 140 | -72 | 213 |

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein and the George Lake Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 46 mineral claims, 17 crown grants, and two surface crown grants totalling 18,871ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under-explored.

About Equity Metals Corporation

Equity Metals Corporation is a member of the Malaspina-Manex Group. The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest (57.49%) in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. As well, the Company has an option to acquire a 100% interest in the Arlington Property, located within the Boundary District of south-central British Columbia where 2025 exploration work consisted of geophysics and diamond drilling designed to identify and delineate an apparent gold system. The Company is fully funded to undertake proposed 2025 exploration and development at Silver Queen and Arlington.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure. He has reviewed and approved this news release.

On behalf of the Board of Directors,

"Joseph Anthony Kizis, Jr."

Joseph Anthony Kizis, Jr., P.Geo

President, Director, Equity Metals Corporation

For further information, visit the website at https://www.equitymetalscorporation.com; or contact us at 604.641.2759 or by email at corpdev@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Equity Metals Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267500

SOURCE: Equity Metals Corporation