A large majority of creditors and shareholders have voted in favor of the draft safeguard plan

This plan includes a 70% reduction in debt, from €40 million to €12 million, with a payment schedule over 10 years and a fundraising of at least €5 million.

Regulatory News:

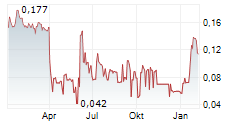

Mauna Kea Technologies (Euronext Growth: ALMKT):

Webinar for shareholders and investors

|

Mauna Kea Technologies (Euronext Growth: ALMKT), inventor of Cellvizio, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today announced the results of the vote by the classes of affected parties, including shareholders, holders of securities giving access to capital, and creditors of Mauna Kea Technologies, on the draft safeguard plan.

A majority of the classes of affected parties voted in favor of the draft safeguard plan, and the voting results allow the Company to request the Paris Commercial Court (the "Court") to approve its draft safeguard plan.

Sacha Loiseau, Ph.D., Chairman and CEO of Mauna Kea Technologies, commented: "This is a key milestone we have reached today. The favorable vote from a majority of the affected parties demonstrates their confidence in our vision and our outlook. I want to sincerely thank them. The next step is the presentation of the draft safeguard plan to the Court, including the debt reduction as voted and the refinancing of the Company. On this second point, the prospect of a healthier financial structure, coupled with the reduction of our operating loss and our commercial momentum in the US, has allowed us to have very positive discussions with numerous investors. We are now very confident in our ability to raise the necessary funds to support the company's commercial development until it reaches profitability."

Results of the Vote of the Classes of Affected Parties

Maître Aurélia Perdereau of SELARL Thévenot Partners, in her capacity as judicial administrator, has provided Mauna Kea Technologies with the results of the vote of all classes of affected parties on the draft safeguard plan.

The voting results are as follows:

Summary | Total expressed | For | Against | Participation | Adoption of the plan |

Class 1 (Secured bank claims) | €0.00 | 0.00% | 0.00% | 0.00% | Abstention |

Class 2 (Privileged tax and social security or similar claims) | €1,050,236.00 | 100.00% | 0.00% | 79.22% | YES |

Class 3 (Landlord's claims) | €136,867.01 | Agreement | 100.00% | YES | |

Class 4 (Essential suppliers' claims) | €122,723.34 | 100.00% | 0.00% | 87.59% | YES |

Class 5 Strategic suppliers' claims | €227,513.12 | 100.00% | 0.00% | 76.29% | YES |

Class 6 (Unsecured claims with a State guarantee) | €2,351,630.40 | 0.00% | 100.00% | 100.00% | NO |

Class 7 (Unsecured claims held by suppliers of goods and services or replaceable partners) | €4,587,160.02 | 2.73% | 97.27% | 89.27% | NO |

Class 8 (Holders of securities giving access to capital) | 1,081,085 | 100.00% | 0.00% | 28.66% | YES |

Class 9 (Equity holders) | 25,015,371 | 99.99% | 0.01% | 28.95% | YES |

It follows from these results that six out of the nine classes of affected parties constituted have voted in favor of the draft safeguard plan by a two-thirds majority of the votes cast, representing a majority of the classes of affected parties, including two classes of affected parties holding claims with a higher rank than that of unsecured creditors.

Next Steps

As a result of these outcomes, in accordance with the provisions of Article L. 626-32 of the French Commercial Code, the Company will petition the Court to approve the draft safeguard plan and its cram-down application to the dissenting classes of affected parties.

The hearing before the Court is scheduled for October 27, 2025, and the decision on the draft safeguard plan is expected by mid-November 2025.

If the Court approves the draft safeguard plan, it will be binding on all parties, including any affected party that voted against it. This will allow Mauna Kea Technologies to implement its financial restructuring as soon as the plan is approved, as planned.

Overall, the plan aims to reduce the debt from €40.2 million to €12.1 million (excluding earn-out clauses for a maximum amount of approximately €3 million), representing a 70% reduction in existing debt, with the remaining balance to be repaid over 10 years. Apart from the conversion of a portion of the EIB's debt balance into capital as provided for in the draft safeguard plan, which will result in the EIB holding 10% of the capital following the capital increase, no other debt-for-equity swaps are planned under this plan.

The terms of the draft safeguard plan are detailed in the press releases issued by the Company on its website on September 12, 2025, and September 22, 2025. It is reminded that the draft safeguard plan is available on the Company's website under the "Investors Safeguard Plan" section. It details the technical modalities of the capital transactions and includes a summary of the expert work carried out in the context of the safeguard procedure. Readers are encouraged to review it.

The Board of Directors approved the consolidated financial statements on September 26, 2025. The complete unaudited financial statements of Mauna Kea are available on the website www.maunakeatech.com.

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer

This press release and the safeguard plan contains forward-looking statements about Mauna Kea Technologies, its business and the progress of the safeguard proceedings initiated for the benefit of the Company. All statements other than statements of historical fact included in this press release and the safeguard plan, including, but not limited to, statements regarding Mauna Kea Technologies' financial condition, business, strategies, plans and objectives for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given that the expectations expressed in these forward-looking statements will be achieved. These forward-looking statements are subject to numerous risks and uncertainties, including those described in Chapter 2 of Mauna Kea Technologies' 2024 Annual Report filed with the Autorité des marchés financiers (AMF) on April 30, 2025, which is available on the Company's website (www.maunakeatech.fr), as well as the risks associated with changes in economic conditions, financial markets and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release and the safeguard plan are also subject to risks that are unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not currently consider material. The occurrence of some or all of these risks could cause the actual results, financial condition, performance or achievements of Mauna Kea Technologies to differ materially from those expressed in the forward-looking statements. This press release and the information contained herein do not constitute an offer to sell or subscribe for, or the solicitation of an order to buy or subscribe for, shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The distribution of this press release may be restricted in certain jurisdictions by local law. Persons into whose possession this document comes are required to comply with all local regulations applicable to this document.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251005691683/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu