WASHINGTON (dpa-AFX) - Fifth Third Bancorp (FITB) and Comerica Incorporated (CMA) on Monday announced an agreement under which Fifth Third will acquire Comerica in an all-stock deal valued at $10.9 billion.

As per the deal, Comerica shareholders will receive 1.8663 Fifth Third shares for each Comerica share, valuing each Comerica share at $82.88 based on Fifth Third's closing price on October 3, 2025. The purchase price represents a 20% premium to Comerica's 10-day average stock price.

The merger combines two established banks to create the 9th largest U.S. bank with about $288 billion in assets. The combination is expected to be immediately accretive to shareholders; improve efficiency, return on assets, and return on tangible common equity; and provide a strong platform for sustainable long-term growth.

Upon closing, Fifth Third shareholders will hold roughly 73% and Comerica shareholders about 27% of the combined company.

The transaction is expected to be completed by the end of the first quarter of 2026.

'This combination marks a pivotal moment for Fifth Third as we accelerate our strategy to build density in high-growth markets and deepen our commercial capabilities,' said Tim Spence, Chairman, CEO and President of Fifth Third Bank. 'Comerica's strong middle market franchise and complementary footprint make this a natural fit. Together, we are creating a stronger, more diversified bank that is well-positioned to deliver value for our shareholders, customers, and communities - starting today, and over the long-term.'

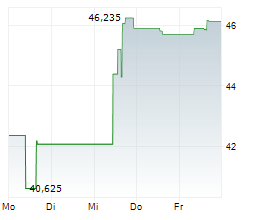

Comerica shares rose more than 10% in pre-market from Friday's closing price of $70.55, while Fifth Third stock fell 4% in pre-market trading, down from Friday's close of $44.41.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News