Highlights of Mineral Resource estimate

3.17 million inferred ounces gold at 0.89 gram per tonne (gpt or g/t) gold 1.01 million indicated ounces gold at 0.98 gpt gold using long term gold price of US$2500/oz (see Table 1 and note 1)

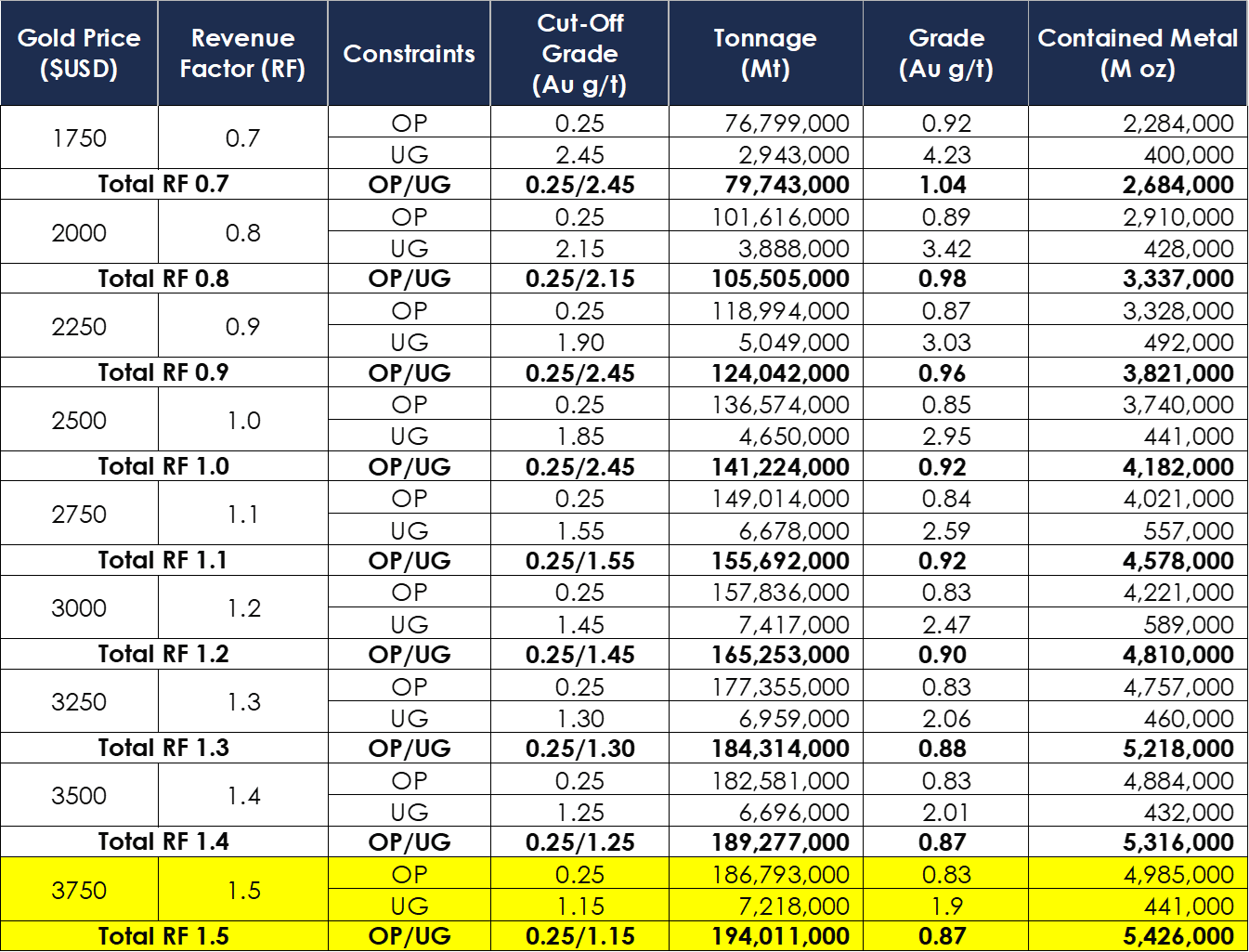

Resource Sensitivities at US $3750/oz gold yield 5.42 million ounces at 0.87 gpt gold contained in 194 Million tonnes (see Table 2 and note 1)

New underground resources defined to augment open pit resources

McFarlane applies for exploration permit at Juby

TORONTO, ON / ACCESS Newswire / October 7, 2025 / McFarlane Lake Mining Limited (CSE:MLM)(OTCQB:MLMLF) ("McFarlane Lake" or the "Company" or "McFarlane"), a Canadian gold exploration and development company, is pleased to announce the Mineral Resource Estimate ("MRE") of its recently purchased Juby Gold project (or "Juby") located approximately 15 kilometers west from Gowganda, Ontario and approximately 90 kilometers west from Temiskaming Shores, Ontario.

This MRE has been classified in accordance with CIM Definition Standards on Mineral Resources and Mineral Reserves (CIM, 2014) and follows the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (CIM, 2019). It is based on the review of existing geological data (drilling, assays, drill logs, etc.) and mineralization modelling. The MRE was independently prepared by Todd McCracken, P. Geo of the BBA E&C Inc., with technical staff primarily from their Sudbury, Ontario office. The full Technical Report, which is being prepared in accordance with NI-43-101 will be available on SEDAR (www.sedar.com) under the Corporation's issuer profile within 45 days of this news release.

Table 1 - Detail Mineral Resource Estimate within pit shell + underground shapes

(OP= Open Pit, UG= Underground, Mt= Millions tonnes, Moz= Millions Ounces, Au= Gold metal)

Resource Classification | Constraints | Cut-Off Grade | Tonnage | Grade | Contained Metal |

Indicated | OP | 0.25 | 30.78 | 0.94 | 0.93 |

Indicated | UG | 1.85 | 0.96 | 2.66 | 0.08 |

Total Indicated | OP/UG | 0.25/1.85 | 31.74 | 0.98 | 1.01 |

Inferred | OP | 0.25 | 105.79 | 0.83 | 2.81 |

Inferred | UG | 1.85 | 3.69 | 2.86 | 0.36 |

Total Inferred | OP/UG | 0.25/1.85 | 109.48 | 0.89 | 3.17 |

Note 1: Mineral Resource Statement Notes

CIM definition standards were followed for the resource estimate.

This Mineral Resource has an effective date of September 29, 2025.

The 2025 resource models used ordinary kriging (OK) grade estimation within a three-dimensional block model with mineralized domains defined by wireframe solids.

Mineral resources are constrained within pit shells (OP) and Underground Shapes (UG)

Open pit cut-off of 0.25 g/t Au milled is based on the cost/tonne ($USD/t) milled for incremental mining, processing, and G&A

Underground cut-off of 1.85 g/t Au milled is based on the cost/tonne ($USD/t) milled for incremental mining, processing, and G&A

The 0.25 g/t Au cut-off for OP and the 1.85 g/t Au cut-off for UG used for reporting is based on the

following:Long term Gold price of US$2,500/oz

Metallurgical recoveries are based on metallurgical testing recovery of 92%

Average Bulk density (specific gravity) was determined for each lithology and/or mineralized domain within the deposit

Processing costs of USD$11.00/t, G&A costs of USD$4.00/t, and Tailings Fee of USD$2.00/t milled

Dilution of 5% for OP, and 10% for UG

Overall Pit Slope angle of 47 degrees

Mineral Resources that are not mineral reserves do not have economic viability. Numbers may not add due to rounding.

The resource estimate was prepared by Todd McCracken, P.Geo, of BBA E&C Inc. in accordance with National Instrument 43-101 standards of Disclosure for Mineral Projects.

"We are delighted by the results of this Mineral Resource Estimate", says Mark Trevisiol CEO and Chairman of McFarlane Lake Mining, adding "this now puts McFarlane with some of the top gold resource properties in Ontario. Our team has reacted quickly to having this asset in our portfolio with application already registered with the Ministry of Mines for further exploration at Juby. We see significant potential to add more ounces at Juby. Our team has been on the ground reviewing existing drill core as well as studying geological models for the deposit. There are several areas we would like to target for additional gold resources; detail plans will be shared in the coming weeks".

Sensitivities based on gold prices were also performed and listed in Table 2 below. McFarlane would like to highlight that at a gold price of $3750/oz approximately 5.42 million ounces was identified as gold resources. Gold prices on the New York Comex exchange have averaged over US$3850/oz in the last week.

Table 2 - Gold price sensitivity

Qualified Person

The technical contents of this news release have been reviewed and approved by Todd McCracken P.Geo of BBA E&C Inc. Mr. McCracken is a qualified person, as defined by NI 43-101 and is independent of the Company.

Mark Trevisiol, P.Eng. (ON), President and CEO of McFarlane Lake Mining and a Qualified Person as defined by National Instrument 43-101, has approved and verified the technical information used in this news release.

About McFarlane Lake Mining

McFarlane Lake is a gold exploration company focused on exploring and advancing the Juby Gold project near Gowganda, Ontario. The Juby Gold project has a (NI 43-101) inferred resource of 3.17 Million ounces of gold @ 0.89 gpt and Indicated resources 1.01 Million ounces of gold @ 0.98 gpt. These resources have an effective date of September 29, 2025. The full technical report on these resources will be issued within 45 days of the company's MRE announcement. The technical report will be issued by BBA E&C Inc., an independent organization from McFarlane Lake Mining. McFarlane is currently planning to perform exploration drilling on the Juby Gold Project as well as other study work to advance the development of the property.

McFarlane's other properties include and the past producing McMillan Gold Mine property and Mongowin gold property located 70 km west of Sudbury, Ontario. The exploration of the High Lake mineral property located immediately east of the Ontario-Manitoba border and the West Hawk Lake mineral property located immediately west of the Ontario-Manitoba border. In addition, McFarlane Lake owns the Michaud/Munro mineral properties 115 km east of Timmins. McFarlane Lake is a "reporting issuer" under applicable securities legislation in the provinces of Ontario, British Columbia and Alberta.

To learn more, visit: https://mcfarlanelakemining.com/

Additional information on McFarlane Lake can be found by reviewing its profile on SEDAR+ at www.sedarplus.com.

Cautionary Note Regarding Forward-Looking Information:

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. By their nature, statements referring to mineral reserves or mineral resources constitute forward-looking statements. Forward-looking statements in this news release include, but are not limited to statements with respect to the results (if any) of further exploration work to define and expand or upgrade mineral resources and reserves at Juby; the anticipated exploration, drilling, development, construction and other activities of the Company and the results of such activities; the Mineral Resource estimates of Juby (and the assumptions underlying such estimates); the ability of exploration work (including drilling) to accurately predict mineralization; the completion and timing for the filing of the technical report; the ability to realize upon mineralization in a manner that is economic; and any other information herein that is not a historical fact.

The Company believes the assumptions reflected in the forward-looking information in this news release are reasonable based on information currently available. However, such statements involve known and unknown risks, uncertainties and other factors, many beyond the Company's control, that may cause actual results to differ materially from those anticipated. These risks include, among others: changes in commodity prices and currency exchange rates; fluctuations or disruptions in securities markets; political, legislative or economic developments in Canada or other jurisdictions relevant to the Juby Project; changes to assumptions underlying the current mineral resource estimate; the need to obtain permits and comply with regulatory requirements; actual exploration or development results differing from expectations; accidents, equipment failures, labour disputes or other operational challenges; cost overruns or unforeseen expenses; and the inherent risks of mineral exploration and development.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of McFarlane Lake to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption "Risk Factors" in the Company's Annual Information Form dated as of November 27, 2024, which is available for view on SEDAR+ at www.sedarplus.com. Forward-looking statements contained herein are made as of the date of this press release and McFarlane Lake disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management's estimates or opinions should change, or otherwise.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

Further Information

For further information regarding McFarlane Lake, please contact:

Mark Trevisiol,

Chief Executive Officer, President and Director

McFarlane Lake Mining Limited

705 665 5087

mtrevisiol@mcfarlanelakemining.com

SOURCE: McFarlane Lake Mining Limited

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/mcfarlane-issues-ni-43-101-mineral-resource-estimate-on-its-juby-gold-project-1083788