WASHINGTON (dpa-AFX) - Grindr's top shareholders are considering taking the LGBTQ+ dating app private after a steep decline in its stock caused them to experience personal financial difficulties.

In 2020, Grindr was purchased for more than $600 million by its two majority owners, James Lu, a Chinese American tech executive who had previously worked at Amazon and Baidu, and Raymond Zage, a former hedge fund manager based in Singapore.

Through a SPAC merger, they subsequently went public with the company in 2022. Although Zage and Lu jointly own more than 60 percent of Grindr, almost all of their stock was pledged as security for personal loans from Temasek, a division of Singapore's sovereign wealth fund.

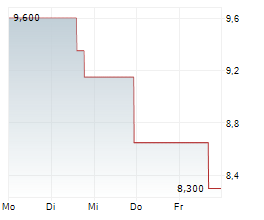

The loans lost value when Grindr's stock started to decline late last month, so the Temasek unit had to take control of and sell some of its shares to make up the difference.

Even though the stock has dropped sharply, Grindr's business is doing well; in the second quarter, profits increased by 25 percent. However, pressure has increased due to investor concerns about declining margins and leadership turnover.

According to reports, Zage and Lu are currently negotiating with Fortress Investment Group, which is supported by Abu Dhabi's Mubadala Investment Company, in order to obtain funding for a takeover that would be valued at about $3 billion, or $15 per share.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News