NEW YORK and HELSINKI, Oct. 13, 2025 (GLOBE NEWSWIRE) -- FTAI Aviation Ltd. (NASDAQ: FTAI) has signed a multi-year Perpetual Power Agreement with Finnair Plc ("Finnair"), covering 36 CFM56-5B engines, to provide engine exchanges in lieu of shop visits to enhance flexibility, fleet reliability and maintenance cost predictability.

FTAI's innovative Perpetual Power Program provides airlines with bespoke solutions to manage their fleets by avoiding costly engine shop visits, reducing downtime, and adding flexibility to make fleet decisions on their own terms through guaranteed engine availability. Leveraging FTAI's extensive in-house maintenance capabilities to provide serviceable engines, the program supports Finnair targets for reliability and cost-efficiency in flight operations.

"Perpetual Power is about cost savings and flexibility," said David Moreno, Chief Operating Officer at FTAI Aviation. "Instead of being dependent on long, expensive overhauls, airlines can rely on FTAI for immediate engine exchange solutions that save money and keep their fleets operating at optimal utilization."

Christine Rovelli, Chief Revenue Officer at Finnair, said, "This agreement with FTAI strengthens our ability to adapt as our fleet evolves. By securing access to a flexible engine program, we can better manage maintenance costs, improve reliability, and continue to deliver a reliable product to our customers."

About FTAI Aviation Ltd.

FTAI is a leading provider of aftermarket power for the CFM56 and V2500 engines which fly on the world's most widely used commercial aircraft. FTAI's differentiated Maintenance, Repair and Exchange ("MRE") product offers cost savings and flexibility to airlines and asset owners through the lease, sale and exchange of refurbished serviceable engines and modules. In addition, FTAI manages and co-invests in on-lease narrowbody aircraft in partnership with institutional investors through its Strategic Capital Initiative.

About Finnair Plc

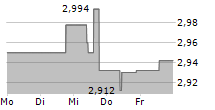

Finnair is a network airline, specialising in connecting passenger and cargo traffic between Asia, North America and Europe. Finnair is the only airline with year-round direct flights to Lapland. Customers have chosen Finnair as the Best Airline in Northern Europe in the Skytrax Awards for 15 times in a row. Finnair is a member of the oneworld alliance. Finnair Plc's shares are quoted on Nasdaq Helsinki.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to FTAI's expectations regarding FTAI's ability to help Finnair and other airlines avoid shop visits through the Perpetual Power Program, and to enhance operational efficiency and reduce maintenance downtime for their respective fleets. These statements are based on management's current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, many of which are beyond the Company's control. The Company can give no assurance that its expectations will be attained and such differences may be material. Accordingly, you should not place undue reliance on any forward-looking statements contained in this press release. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the Company's most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available on the Company's website (www.ftaiaviation.com). In addition, new risks and uncertainties emerge from time to time, and it is not possible for the Company to predict or assess the impact of every factor that may cause its actual results to differ from those contained in any forward-looking statements. Such forward-looking statements speak only as of the date of this press release. The Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with regard thereto or change in events, conditions or circumstances on which any statement is based. This release shall not constitute an offer to sell or the solicitation of an offer to buy any securities.

For further information, please contact:

Alan Andreini

Investor Relations

FTAI Aviation Ltd.

(646) 734-9414

aandreini@ftaiaviation.com

Media

Tim Lynch / Kelly Sullivan / Aaron Palash

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449