VANCOUVER, BC / ACCESS Newswire / October 15, 2025 / KALO GOLD CORP. (TSXV:KALO) ("Kalo" or the "Company") reports results from the 2025 Phase 1 drilling program, comprising eleven diamond drill holes totaling 2,436.7 metres completed across the Qiriyaga Complex and Namalau Trend within the Aurum Epithermal Field. The program has intersected bonanza-grade gold mineralization in VA25-DH11 at target QC1, Qiriyaga Complex on Kalo's 100%-owned Vatu Aurum Project in Fiji, confirming the presence of a high-temperature epithermal system and validating the Company's diatreme model (see news release dated October 1, 2025).

Qiriyaga Complex Drilling (Target QC1)

Drilling at QC1 has delivered bonanza-grade gold mineralization from the first hole testing the interpreted diatreme margin, validating Kalo's geological model for the Qiriyaga Complex.

22.12 m @ 12.80 g/t Au from 43.48 m depth - VA25-DH11 (true width of 20.70 m)

including 10.05 m @ 25.10 g/t Au

including 7.00 m @ 35.01 g/t Au

including 1.00 m @ 83.30 g/t Au

Geophysics and structural interpretation indicate that QC1 extends to 395 m depth, originating near the intersection of the Namalau and Buca Faults.

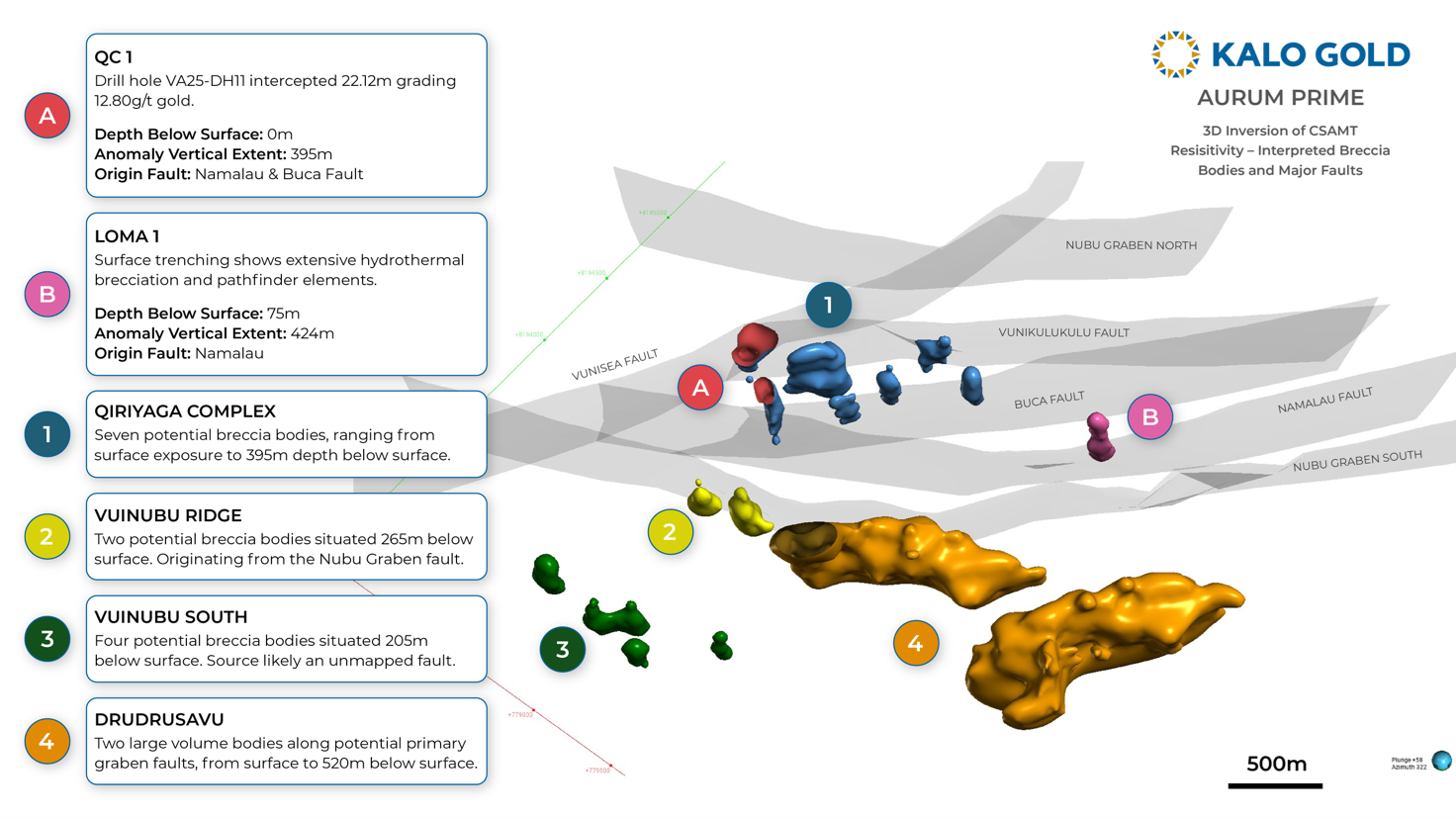

Sixteen similar high-resistivity diatreme anomalies identified within the Qiriyaga Complex, Vuinubu Ridge, Vuinubu South, Drudrusavu, and Loma highlight strong potential for multiple and repeated diatreme centers (Figure 1).

NEXT STEPS AND DISTRICT-SCALE POTENTIAL

Phase 2 drilling is underway to expand the high-grade zone at QC1.

Sixteen additional interpreted diatremes within the Aurum Epithermal Field are being tested using the same geological model (Figure 1).

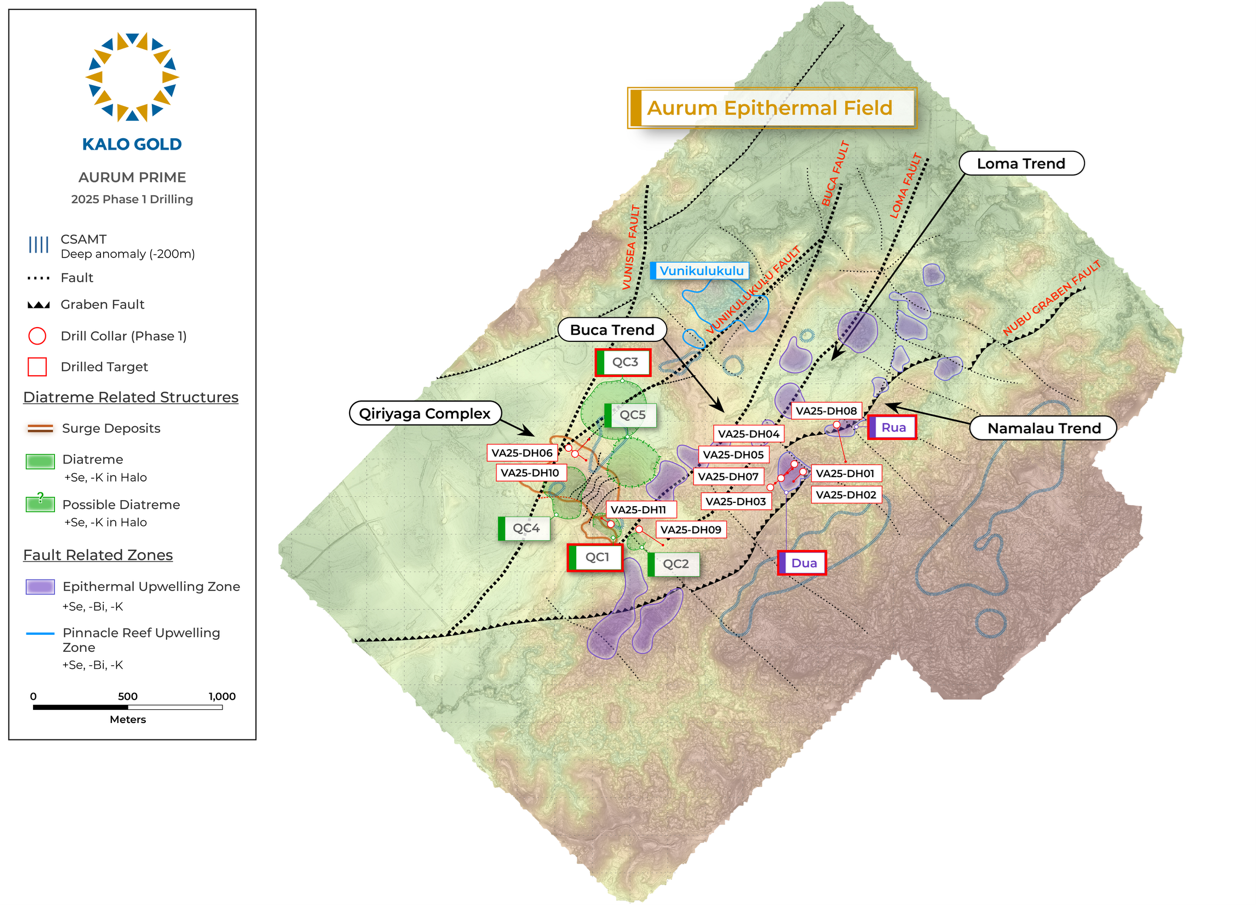

Drill targets along the Namalau, Loma, and Buca Trends-which collectively host eighteen identified epithermal upwelling zones (Figure 2)-will be tested to refine vectors toward the main gold zones prior to deeper step-out drilling.

To date, only four targets have been drill tested, yet bonanza grades at QC1 and successful vectoring at Namalau validate Kalo's systematic epithermal- and diatreme-targeting model.

Multiple exploration fronts are advancing simultaneously, including diatreme-margin drilling within the Qiriyaga Complex, while regional programs at Wainikoro and Coqeloa continue to progress.

Figure 1. Aurum Epithermal Field - Geophysical Resistivity Model (3D-CSAMT) and Structural Interpretation. Three-dimensional model showing sixteen high-resistivity anomalies interpreted as breccia bodies within the Qiriyaga Complex (1) and surrounding structural corridors (2-4 and B). Seven potential breccia bodies are delineated at Qiriyaga Complex, extending from surface to 395 m depth, including QC1 (A) where VA25-DH11 intersected 22.12 m @ 12.80 g/t Au. Additional targets are defined at Vuinubu Ridge (2), Vuinubu South (3), and Drudrusavu (4), extending to depths of 200-520 m along the Nubu Graben, Vunisea, Loma (B) and Buca fault intersections. These zones are interpreted as diatreme or hydrothermal breccia conduits representing key fluid pathways within a vertically extensive epithermal system.

MANAGEMENT COMMENTARY

"VA25-DH11 represents a significant step forward in our understanding of the Vatu Aurum system," said Terry L. Tucker, P.Geo., President & CEO. "The 22.12-metre intersection averaging 12.80 g/t gold, with higher-grade zones up to 83.30 g/t Au, validates our diatreme-margin targeting model and confirms that we are operating within a high-temperature epithermal environment. This hole is the first to test the interpreted QC1 diatreme margin-one of more than sixteen similar geophysical signatures identified. Importantly, the same structural controls and geochemical indicators occur across the broader Aurum Epithermal Field, where systematic testing has only just begun. Our immediate focus is threefold: step-out drilling at QC1 to define the geometry of the mineralized zone, testing additional diatremes using the same geological framework, and continuing surface work along the Namalau, Loma, and Buca Trends to establish subsurface drill vectors. We are taking a systematic, data-driven approach to what we believe represents genuine district-scale potential."

Figure 2: Aurum Epithermal Field - 2025 Phase 1 Drilling - Map showing the distribution of major structural corridors and epithermal upwelling features within the Aurum Epithermal Field. Phase 1 drilling tested two of eighteen identified epithermal upwelling zones - Dua and Rua - within the Namalau, Loma and Buca Trends, and the QC1 diatreme at the Qiriyaga Complex.

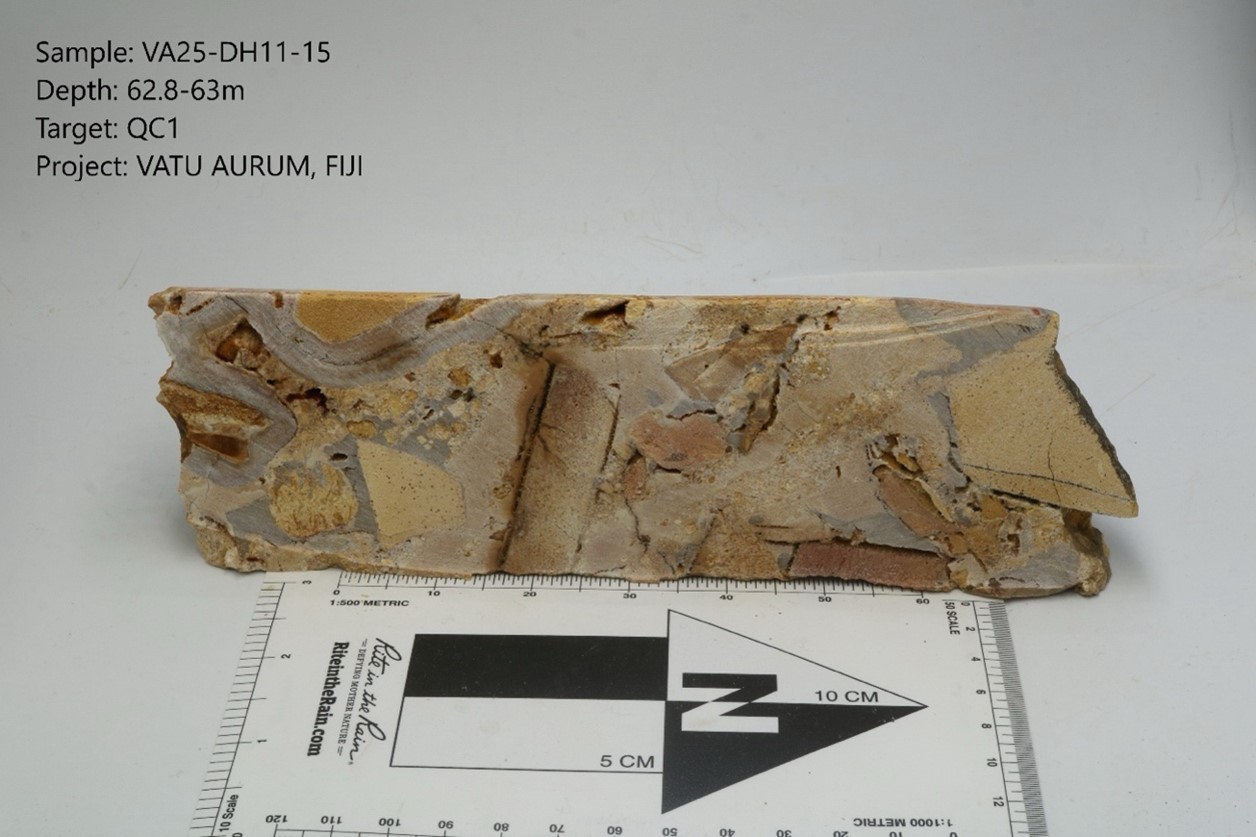

Image 1: VA25-DH11 (62.80-63.00 m depth - 18.10 g/t Au) showing chalcedonic quartz-cemented hydrothermal breccia.

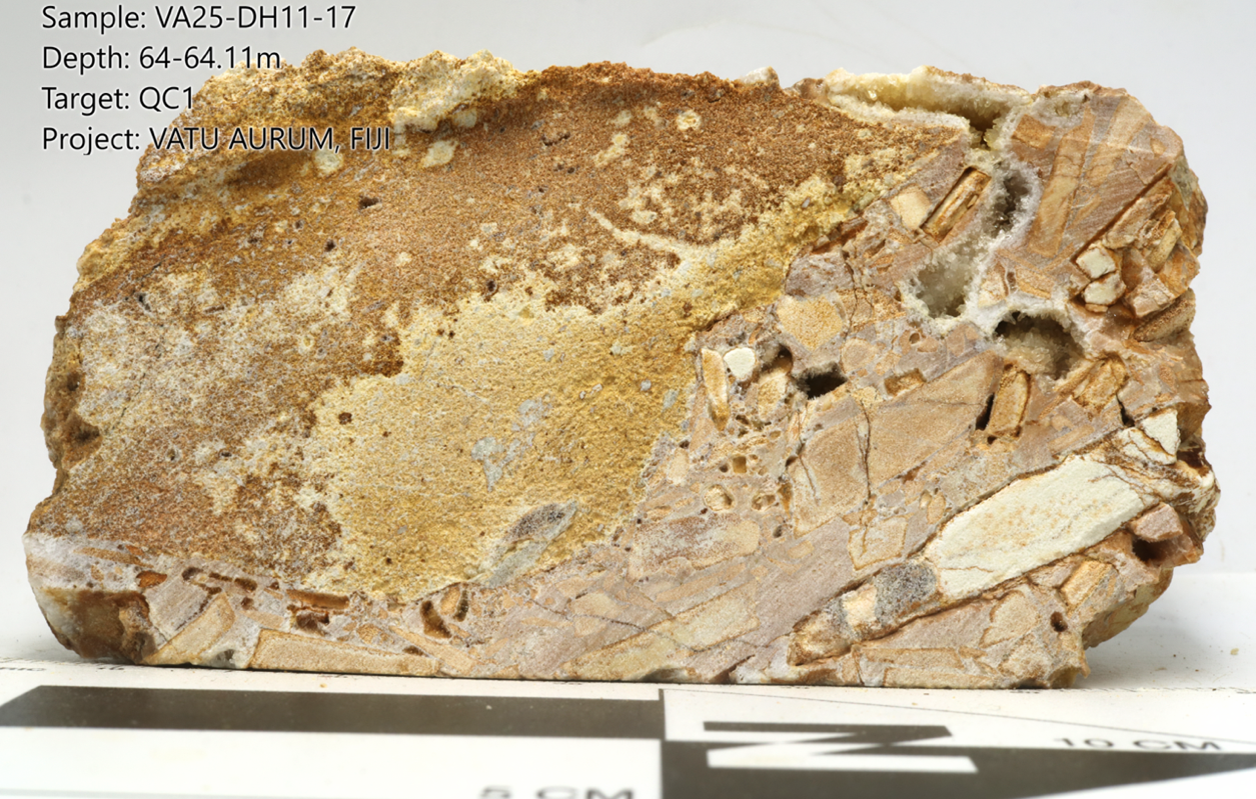

Image 2: VA25-DH11 (64.00-64.11 m depth - 83.30 g/t Au) showing chalcedonic quartz-cemented hydrothermal breccia.

DRILL RESULTS - QIRIYAGA COMPLEX (QC1)

VA25-DH11, the first to test the interpreted diatreme margin at QC1, intersected bonanza-grade gold mineralization, as summarized in Table 1 below. The high-grade intercept was returned from the first hole drilled to test the interpreted diatreme margin at QC1, confirming the effectiveness of Kalo's geological model and marking a key advancement in understanding the system's vertical extent.

From (m) | To (m) | Interval (m) | Au (g/t) |

|

|

43.48 | 65.60 | 22.12* | 12.80 |

|

|

|

| From (m) | To (m) | Interval (m) | Au (g/t) |

| Including | 55.55 | 65.60 | 10.05 | 25.10 |

| Including | 58.00 | 65.00 | 7.00 | 35.01 |

|

| 59.00 | 60.00 | 1.00 | 75.30 |

|

| 61.50 | 62.25 | 0.75 | 29.40 |

|

| 64.00 | 65.00 | 1.00 | 83.30 |

Table 1:VA25-DH11 drill results: *true width is 20.70 m, length-weighted composite

Intervals reported as downhole lengths. No top-cut has been applied. Composites are length-weighted and may include internal dilution.

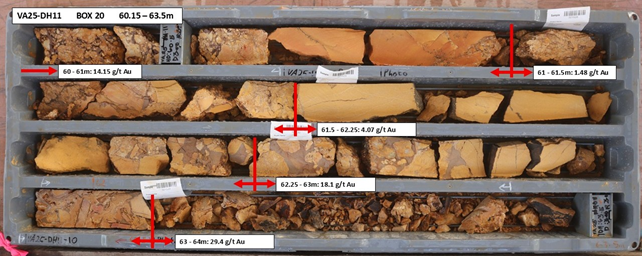

Image 3:VA25-DH11 (60.15-63.50 m depth) showing chalcedonic quartz-cemented hydrothermal breccia. (including 61.50-62.25 m depth - 29.40 g/t Au)

DRILL RESULTS - NAMALAU TREND (DUA AND RUA)

Drilling tested two of the eighteen identified upwelling zones (Dua and Rua) within the Aurum Epithermal Field (Figure 2). The maximum vertical depth tested was 212 metres.

Each hole intersected characteristic features of the upper horizon of a vertically intact epithermal system, including illite-dominated alteration, dolomite-replacement textures, and enrichment in pathfinder elements mercury (Hg), selenium (Se), arsenic (As), and antimony (Sb).

These features confirm that drilling intersected the shallow, preserved top of the epithermal system-as predicted by the geological model.

The alteration and geochemistry indicate limited erosion, suggesting that the higher-grade gold-bearing horizon remains intact and occurs deeper within the system, which will be a key focus of upcoming drilling.

"At Namalau, we've intersected the upper part of the system- where our model predicted," said Terry L. Tucker, P.Geo., President & CEO. "The alteration, textures, and pathfinder chemistry confirm a preserved epithermal system with the potential for a productive gold zone below the current level of drilling."

Drill Hole ID | Target | Easting | Northing | Elevation | Azimuth | Dip | Depth |

VA25-DH01 | Namalau - Dua | 780061 | 8194379 | 78 | 225 | -45 | 176.3 |

VA25-DH02 | Namalau - Dua | 780105 | 8194339 | 81 | 225 | -60 | 173.0 |

VA25-DH03 | Namalau - Dua | 779932 | 8194258 | 78 | 50 | -45 | 229.9 |

VA25-DH04 | Namalau - Dua | 779989 | 8194306 | 100 | 50 | -60 | 101.5 |

VA25-DH05 | Namalau - Dua | 779989 | 8194306 | 100 | 230 | -60 | 108.6 |

VA25-DH06 | Qiriyaga Complex (Vunisea Area) | 778876 | 8194462 | 49.5 | 125 | -60 | 248.5 |

VA25-DH07 | Namalau - Dua | 779989 | 8194306 | 100 | 50 | -80 | 303.8 |

VA25-DH08 | Namalau - Rua | 780271 | 8194584 | 56 | 165 | -55 | 369.6 |

VA25-DH09 | Qiriyaga Complex (Vunisea Area) | 779248 | 8194039 | 51 | 125 | -60 | 323.5 |

VA25-DH10 | Vunisea Fault | 778912 | 8194432 | 53 | 45 | -60 | 236.2 |

VA25-DH11 | Qiriyaga Complex (QC1 Structure) | 779096 | 8194062 | 62 | 305 | -70 | 204.5 |

Table 2: Drill collar location

VA25-DH01 through DH10 intersected epithermal alteration and provided important vectoring information; no significant gold intercepts were returned from these holes. VA25-DH11 delivered the bonanza-grade discovery reported above.

QUALITY ASSURANCE / QUALITY CONTROL

Drill core samples were collected under the supervision of qualified geological personnel following industry-standard protocols. Samples were securely shipped to ALS Limited (Australia) for analysis. Gold was analyzed by Au-AA25 (Ore Grade 30g FA AA Finish - Instrument AAS). Multi-element geochemistry was analyzed by ME-MS61 (48 element four acid ICP-MS). The Company inserts certified reference materials, blank samples, and field duplicates into the sample stream as part of its QA/QC program.

QUALIFIED PERSON

The technical information in this news release was prepared, reviewed, and approved by Andrew Randell, P.Geo., principal of SGDS Hive, a qualified person as defined by National Instrument 43-101 of the Canadian Securities Administrators. Mr. Randell is independent of the Company and has verified the data disclosed, having conducted multiple site visits and direct supervision of the exploration program.

ABOUT KALO GOLD CORP.

Kalo Gold Corp. (TSXV:KALO) is a gold exploration company focused on low-sulphidation epithermal gold systems in Fiji. The 100%-owned Vatu Aurum Project spans 367 km² on Vanua Levu and is in a preserved volcanic back-arc setting with district-scale gold potential. Exploration is centered on the Aurum Epithermal Field, where drilling, trenching, and geochemistry have outlined multiple structurally controlled gold targets. Kalo's technical program is led by SGDS Hive.

On behalf of the Board of Directors

Terry L. Tucker, P.Geo.

President and Chief Executive Officer

Kevin Ma, CPA, CA

Executive Vice President, Capital Markets and Director

For more information: info@kalogoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of applicable securities laws. These statements reflect management's current expectations, strategic objectives, and exploration priorities at the time of this release. Forward-looking statements are not statements of historical fact and include, but are not limited to:

The Company's planned multi-phase exploration and drilling program, including the targeting of structurally controlled gold zones at Coqeloa, Aurum Prime, Namalau, Loma, and Buca Trends, and the Qiriyaga Complex.

Interpretations of geological features, mineralization continuity, and deposit potential, based on geophysical surveys, surface sampling, and historical drill data, which are subject to change as additional drilling and verification work is conducted.

The potential for district-scale gold mineralization, subject to further exploration, drilling, and independent verification.

All exploration results, including geochemical data and historical intercepts, are preliminary in nature and do not constitute a mineral resource estimate. Further exploration, including drilling, is required to confirm the continuity, grade, and extent of mineralization at the Vatu Aurum Project.

The Company's ability to secure sufficient financing, obtain necessary regulatory approvals, and establish strategic partnerships to advance exploration and development activities.

Exploration Risks & Uncertainties

Forward-looking statements are subject to geological, financial, and regulatory risks that may cause actual results to differ materially from those anticipated. These risks include, but are not limited to:

Exploration risk: There is no guarantee that current exploration activities will result in an economically viable mineral resource.

Drilling uncertainty: Trench and soil sampling results are not necessarily indicative of subsurface mineralization, and drilling is required to confirm continuity, grade, and extent.

Permit and regulatory risks: Exploration activities are subject to government approvals, environmental regulations, and permitting requirements.

Funding constraints: The Company's ability to execute exploration programs depends on market conditions and financing availability.

Commodity price volatility: Gold price fluctuations may impact the economic feasibility of any future discoveries.

Forward-looking statements contained in this news release are based on current expectations, estimates, forecasts, and projections about Kalo Gold Corp.'s business, as well as beliefs and assumptions made by the Company's management.

Readers are cautioned that forward-looking statements are based on assumptions that may not prove to be correct. Actual results may differ materially due to several known and unknown risks and uncertainties that are beyond the control of the Company.

Kalo Gold Corp. does not undertake any obligation to update or revise any forward-looking statements, except as required by applicable securities laws. Readers should not place undue reliance on forward-looking information contained in this release.

For a more detailed discussion of risks and uncertainties, please refer to Kalo Gold Corp.'s public filings on SEDAR+ at www.sedarplus.ca.

SOURCE: Kalo Gold Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/kalo-gold-drills-new-discovery-intersects-bonanza-grade-12.80-g%2ft-au-over-22.12-m-1087077