Significant Year-over-Year Growth in Patient Volume and Cash Collections

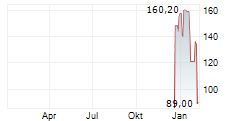

HOUSTON, Oct. 20, 2025 /PRNewswire/ -- Nutex Health Inc. ("Nutex Health" or the "Company") (NASDAQ: NUTX), a physician-led, integrated healthcare delivery system comprised of 24 state-of-the-art micro hospitals and hospital outpatient departments in 11 states and primary care-centric, risk-bearing physician networks, is providing a corporate update and select performance metrics for the third quarter of 2025, highlighting continued operational momentum and financial performance.

Key Preliminary Metrics for Q3 2025 (July - September, dollars in thousands):

| | Estimated Patient | Change YOY | Estimated Cash | Change YOY |

| 3rd Q 2024 | 41,668 | | 65,501 | |

| 3rd Q 2025 | 46,293 | 11.1 % | 235,003 | 258.8 % |

| YTD 2024 | 122,944 | | 197,202 | |

| YTD 2025 | 140,135 | 14.0 % | 546,003 | 176.9 % |

| 1. Represents estimated patient visits during the applicable period. |

Operational Highlights

- Patient Volume Growth: The third quarter of 2025 saw patient volumes rise 11.1% compared to the same period in 2024, supported by strategic facility expansion and increased demand for community-based acute care services.

- Cash Collections Surge: Total collections in the third quarter of 2025 grew 258.8%, compared to the same period in 2024, indicating enhanced revenue cycle management, payer mix, and higher patient acuity.

The preliminary estimated financial metrics included herein are management's current estimates based on information available as of the date hereof. These estimates are subject to change and should not be viewed as a substitute for our actual financial results. Our actual results for the quarter ended September 30, 2025 will not be available until we complete the preparation of our financial statements for that period, which will occur after the completion of the restatement of the Previously Issued Financial Statements (See "Audit Progress and Nasdaq Compliance" below). Actual metrics may differ materially from the preliminary estimates due to the completion of final accounting adjustments, the review of our financial statements by our independent registered public accounting firm, and any other developments that may arise between now and the time that our financial results for such period are finalized.

The preliminary estimated financial metrics presented herein have been prepared by, and are the responsibility of, our management. Please read "Forward-Looking Statements" below, which further describes factors that could cause actual metrics to differ from those presented herein.

Audit Progress and Nasdaq Compliance

As disclosed on August 21, 2025, the Company's Audit Committee, after consultation with management, determined that investors should no longer rely on the previously issued (i) unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2025 contained in the Form 10-Q for the period ended March 31, 2025 and the (ii) audited consolidated financial statements as of and for the year ended December 31, 2024 contained in the Form 10-K for the year ended December 31, 2024 (the "Previously Issued Financial Statements"),which resulted in a delay of the filing of the Company's Form 10-Q for the period ended June 30, 2025 and a non-compliance notice from Nasdaq. The Audit Committee's determination follows the identification of errors in the accounting treatment of certain non-cash obligations related to earn-out arrangements agreed upon in connection with the Company's April 1, 2022 merger.

On October 15, 2025, the Company submitted to Nasdaq a plan to regain compliance with Nasdaq Listing Rule 5250(c)(1) and requested an exception from the due date of its delinquent Form 10-Q for the period ended June 30, 2025 until December 12, 2025, which request was granted by Nasdaq on October 16, 2025.

Nutex is committed to meeting all ongoing requirements of Nasdaq's listing standards and is working diligently to complete and file its delinquent Form 10-Q, as well as all subsequent periodic reports. We anticipate filing our delinquent Form 10-Q for the period ended June 30, 2025 and our Form 10-Q for the period ended September 30, 2025 no later than the deadline specified in the Nasdaq Exception Notice. The Form 10-Q for the period ended September 30, 2025 is anticipated to be filed later than its due date, as it depends on the sequential completion and filing of the restated and delayed reports to ensure accurate comparative data and proper financial statement presentation.

About Nutex Health Inc.

Headquartered in Houston, Texas and founded in 2011, Nutex Health Inc. is a healthcare management and operations company with two divisions: a Hospital Division and a Population Health Management Division.

The Hospital Division owns, develops and operates innovative health care models, including micro-hospitals, specialty hospitals, and hospital outpatient departments. This division owns and operates 24 facilities in 11 states.

The Population Health Management division owns and operates provider networks such as Independent Physician Associations. Through our Management Services Organization, we provide management, administrative and other support services to our affiliated hospitals and physician groups.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including:

- statements regarding the anticipated impact of the error identified in the previously issued (i) unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2025 contained in the Form 10-Q for the period ended March 31, 2025 and the (ii) audited consolidated financial statements as of and for the year ended December 31, 2024 contained in the Form 10-K for the year ended December 31, 2024;

- the anticipated timing of the filing of the amendment to the 2024 Form 10-K, the amendment to the Form 10-Q for the first quarter of 2025 and the Forms10-Q for each the second quarter and third quarter of 2025;

- the remediation by management of the newly identified material weakness in internal control over financial reporting;

- the scope of the anticipated restatement as a result of the error;

- the Company's estimated patient volume and estimated cash collections for the period ended September 30, 2025;

- and any other statements regarding the Company's future expectations, beliefs, plans, objectives, financial condition, assumptions or future events or performance that are not historical facts.

When used in this press release, the words or phrases "will", "will likely result," "expected to," "will continue," "anticipated," "estimate," "projected," "intend," "goal," or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks, known and unknown, and uncertainties, many of which are beyond the control of the Company. In addition to the items listed above, such uncertainties and risks include, but are not limited to, our ability to successfully execute our growth strategy, to finalize the required amendments to and delinquent SEC filings in the anticipated time frame, to remediate the additional weakness in a timely manner, changes in laws or regulations, including the interim final and final rules implemented under the No Surprises Act, economic conditions, dependence on management, dilution to stockholders, lack of capital, the effects of rapid growth upon the Company and the ability of management to effectively respond to the growth and demand for products and services of the Company, newly developing technologies, the Company's ability to compete, conflicts of interest in related party transactions, regulatory matters, protection of technology, lack of industry standards, the effects of competition and the ability of the Company to obtain future financing. An extensive list of factors that can affect future results are discussed in our Current Report on Form 8-K filed with the SEC on August 21, 2025 in Item 8.01 thereof under the heading "Risk Factors," the Annual Report on Form 10-K for the year ended December 31, 2024, under the heading "Risk Factors" in Part II, Item IA thereof, and the risk factors and other cautionary statements contained in our other documents filed from time to time with the Securities and Exchange Commission. Such factors could materially adversely affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed within this press release.

SOURCE Nutex Health, Inc.