Fourth annual increase in quarterly dividend

DERBY, VT / ACCESS Newswire / October 21, 2025 / Community Bancorp., (OTCQX:CMTV) Community National Bank reported earnings for the third quarter ended September 30, 2025, of $4.7 million or $0.84 per share, a significant increase of $1.6 million or 52.42% compared to $3.1 million or $0.55 per share reported for the third quarter of 2024. Earnings for the nine months ended September 30, 2025, were $12.3 million, or $2.18 per share, also a significant increase of $3.7 million or 42.31% compared to $8.7 million or $1.55 per share in the same period in 2024.

Total assets for the Company on September 30, 2025, were $1.23 billion, a decrease of $22.8 million from year end 2024, but a year-over-year 4.15% increase of $49 million compared to $1.18 billion as of September 30, 2024. The year-to-date change primarily reflects the use of cash to pay off borrowings as well as maturities and amortization of securities in the investment portfolio. Contributing to the bank's year-over-year growth in assets is continued growth in the Company's loan portfolio of $49 million, or 5.39%, compared to the 2024 period. Deposit balances increased $78.7 million, or 8.47%, compared to the same period in 2024, and were $6.7 million higher, a 0.66% increase, since year end 2024. The year-over-year loan growth was primarily funded by cash along with an increase in core and brokered deposits.

The Company's securities portfolio totaled $152 million as of September 30, 2025, a 10.69% decrease compared to $170.5 million as of September 30, 2024. The portfolio is classified as available-for-sale and is required to be reported at fair market value with the unrealized loss, net of a deferred tax adjustment, as an adjustment to total equity. Such unrealized losses reflect the interest rate environment, as current rates remain below the coupon rates on the securities, resulting in a fair market value lower than current book values. As of September 30, 2025, the adjustment to equity was $10.5 million, an improvement from recent quarters due to the current rate environment; previous adjustments to equity were $15.8 million on December 31, 2024, and $12.4 million as of September 30, 2024.

Total net interest income for the third quarter ended September 30, 2025, increased $1.8 million, or 21.35%, to $10.5 million, compared to $8.7 million for the same quarter in 2024. The year-over-year improvement reflects an increase of $1.5 million, or 11.48%, in interest and fees on loans due to strong loan growth and higher yields, offset by only slightly higher interest on deposits expense of $89,026, or 2.42%, and on repurchase agreements of $40,605, or 20.91%. Net interest income for the nine months ended September 30, 2025, increased $4.7 million or 18.80%, to $29.8 million, compared to $25.1 million for the same period in 2024, reflecting the same trends.

The provision for credit losses for the third quarter ended September 30, 2025, was $258,753, compared to $460,745 for the same period in 2024. The year-to-date provision for credit losses was $990,853, compared to $1,105,906 for the same period in 2024. The $115,053 year-over-year decrease was driven primarily by a charge off of a larger commercial loan in 2024. The provision for credit losses for September 30, 2025, was determined under Accounting Standard No. 2016-13, Measurement of Credit Losses on Financial Instruments, commonly referenced as the Current Expected Credit Losses, or CECL.

Total non-interest income for the third quarter ended September 30, 2025, of $2.1 million increased $88,380, or 4.40%, compared to $2.0 million for the same period in 2024. Total non-interest income for the nine months ended September 30, 2025, grew to $5.7 million, compared to $5.4 million for the nine months ended September 30, 2024, an increase of $319,376, or 5.90% year over year. Total non-interest expenses increased only 1.30%, for the third quarter comparison period, and $684,135, or 3.59%, for the nine months period year over year.

Equity capital increased to $111.9 million, with a book value per share of $19.64, as of September 30, 2025, compared to equity capital of $98.0 million and a book value per share of $17.24 as of December 31, 2024, and $98.3 million and book value per share of $17.36 as of September 30, 2024. This change includes a decrease of $5.2 million in unrealized losses in the investment portfolio year to date and a decrease of $1.9 million year over year, due to changing bond rates, which increased the fair market value of the investment portfolio. The unrealized loss position is considered temporary and does not impact the Company's regulatory capital ratios.

President and CEO Christopher Caldwell commented on the Company's results: "Through three quarters this year, Community National Bank continues to deliver strong returns for our shareholders, both in higher earnings and increased equity capital and book value. We take pride that our solid results enabled us to once again increase our quarterly dividend as we return additional capital back to our shareholders. Our compelling performance this year reflects the exceptional service we provide our customers and communities, and our focused efforts to be the leading bank in our markets. Despite ongoing uncertainty in the macroeconomic landscape and increasing consolidation within our sector, our team remains dedicated to what we can control and to serving our clients effectively. As I stated last quarter, our robust earnings reflect our team's hard work as they continue to deliver on our commitment to our customers. That sentiment remains unchanged, as the dedicated bankers of Community National Bank generated significantly increased earnings and greater efficiency through their service to our communities and clients this quarter. As we move into the final quarter of 2025 and develop our 2026 budget, maintaining our strategic initiatives as our guiding principles will be essential. We take pride in the fact that 'community' is part of our name and that we excel as Vermont's Community Bank."

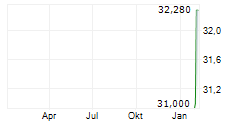

As previously announced, the Company declared a quarterly cash dividend of $0.25 per share payable November 1, 2025, to shareholders of record as of October 15, 2025, an increase of 4% from the previous quarterly cash dividend and the fourth annual increase since 2020.

About Community National Bank

Community National Bank is an independent bank that has been serving its communities since 1851, with retail banking offices located in Derby, Derby Line, Island Pond, Barton, Newport, Troy, St. Johnsbury, Montpelier, Barre, Lyndonville, Morrisville and Enosburg Falls as well as loan offices located in Burlington, Vermont and Lebanon, New Hampshire

Forward Looking Statements

This press release contains forward-looking statements, including, without limitation, statements about the Company's financial condition, capital status, dividend payment practices, business outlook and affairs. Although these statements are based on management's current expectations and estimates, actual conditions, results, and events may differ materially from those contemplated by such forward-looking statements, as they could be influenced by numerous factors which are unpredictable and outside the Company's control. Factors that may cause actual results to differ materially from such statements include, among others, the following: (1) general national or regional economic conditions, national fiscal or monetary policies, or national or international tariff or trade conditions result in a deterioration of the credit quality of our loan portfolio or diminished demand for the Company's products and services; (2) changes in laws or government rules, or the way in which courts interpret those laws or rules, adversely affect the financial industry generally or the Company's business in particular, or may impose additional costs and regulatory requirements; (3) interest rates change in such a way as to reduce the Company's interest margins and its funding sources; and (4) competitive pressures increase among financial services providers in the Company's northern New England market area or in the financial services industry generally, including pressures from nonbank financial service providers, from increasing consolidation and integration of financial service providers and from changes in technology and delivery systems, and other factors that are listed from time to time in our financial filings with the SEC, including our Forms 10Q and 10K. We disclaim any responsibility to update our forward-looking statements, which are valid only as of the date of this release, should circumstances change.

For more information, contact:

Investor Relations

ir@communitynationalbank.com

SOURCE: Community Bancorp. Inc Vermont

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/community-bancorp.-reports-significant-year-over-year-growth-in-thir-1089580