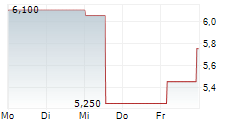

DJ Half Year Trading Update

Molten Ventures Plc (GROW)

Half Year Trading Update

23-Oct-2025 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

23 October 2025

Molten Ventures plc

("Molten Ventures", "Molten", or the "Company")

Half Year Trading Update

Continuing strong momentum with positive GPV and NAV per share growth, ongoing realisations, and delivering on capital

allocation policy

Molten Ventures (LSE: GROW), a leading venture capital firm investing in and developing high-growth digital technology

businesses, is pleased to provide an update on its Net Asset Value ('NAV') (unaudited) and Gross Portfolio Value

('GPV') (unaudited) along with performance highlights ahead of announcing its half year results for the six months

ended 30 September 2025 ('HY26') on 25 November 2025.

Overview

HY26 demonstrated further growth in both GPV (5.5%) and NAV per share (7.2%), supported by a combination of hands-on

portfolio management, improved market comparables, and the ongoing share buyback programme.

There was a strong level of GBP62m realisations in HY26, following on from the GBP135m of cash proceeds realised in FY25.

This underscores the maturity and depth of the portfolio, providing exposure to multiple growth themes across

technology.

Highlights

-- NAV per share (unaudited), expected to be up 7.2% to circa 719p (30 September 2024: 646p, 31 March 2025: 671p) with

the share buyback programme contributing 13p to the uplift since 31 March 2025.

-- GPV (unaudited) expected to be circa GBP1,425 million (30 September 2024: GBP1,343 million, 31 March 2025: GBP1,367

million).

-- GPV fair value uplift of GBP75 million (5.5%), excluding foreign exchange, for the first half of the year, driven by

strong performers in the Core portfolio and higher recent funding rounds with positive newsflow from portfolio

companies such as ICEYE, Revolut, Ledger and ISAR Aerospace.

-- Realisations generating cash proceeds of GBP62 million, with further potential realisations during FY26 being

actively worked on. HY26 realisation proceeds represent 4.5% of opening GPV, progressing in line with the internal

annual target of 10% through the cycle.

-- Exits delivering on average a 2.0x multiple on invested capital, with Freetrade (1.5x), Lyst (0.7x) and Revolut

(20.0x), all at or above holding values, continuing to validate the valuations of the portfolio.

-- GBP33 million deployed into investments (HY25: GBP51 million), with a further GBP11 million from the managed EIS and VCT

funds. Deals in the period included new investments in Duel (enterprise brand advocacy platform) and General Index

(energy and commodity pricing data provider), and a secondary investment in Speedinvest Continuation Fund I. We

continue to see a good pipeline of exciting investment opportunities both within the existing portfolio and the

wider market.

-- Portfolio remains robust and resilient, both in terms of funding requirements and revenue growth, with the Core

portfolio demonstrating strong growth and profitability metrics.

-- To date total of GBP38 million now returned to shareholders via the share buyback programme commenced in July 2024,

significantly exceeding the capital allocation policy guidance of a minimum of 10% of realisation proceeds,

recognising the NAV per share accretive effect of these buybacks.

-- With improving visibility on further realisations we are now committing an additional GBP10 million to buybacks to

support the ongoing focus on narrowing the share price discount to NAV, while maintaining our balanced capital

allocation policy to continue to invest in exciting new opportunities and support the continued growth of the

portfolio.

-- Robust capital base with total Group cash of GBP76 million as at 30 September 2025 plus GBP23 million of cash available

for investment from the managed EIS and VCT funds. Undrawn Revolving Credit Facility ('RCF') of up to GBP60 million

providing the Company with further flexibility.

-- Ongoing cost control and operating efficiencies to reduce operating expenses year-on-year, while maintaining focus

on actively hiring investment team talent to drive performance.

Ben Wilkinson, Chief Executive Officer, commented:

"I am confident in the good progress that we have made against the strategic priorities that I outlined in February.

"We have had a strong first half of the financial year continuing the recent upward trends in portfolio value and NAV

per share, supported by our focus on portfolio management and development, and our balanced capital allocation policy.

"We are also pleased that we have been able to deliver an ongoing strong level of realisations following on from last

year, which reflects the maturity, depth and breadth of our portfolio.

"We invest at the forefront of a generational shift in technology, with Molten's portfolio covering key subsectors such

as Fintech, Space, Cyber, AI, Climate, Quantum, Digital Health, and Crypto & Blockchain. The portfolio offers

considerable potential to deliver some of the category winners of the future.

"We continue to be highly active and focused on opportunities to drive further value and returns for shareholders."

GPV Movement Table

Six months to

Six months to

% change to opening % change to opening

31 March 2025 GPV GPV

30 September 2025

(unaudited)

unaudited)

GBP'million GBP'million

Opening Gross Portfolio Value 1,343 1,367

Investments 22 33

Realisations (59) (62)

Movement in Foreign Exchange 9 0.67% 11 0.83%

(a)

Movement in Fair Value (b) 52 3.87% 75 5.49%

Total Fair Value Movements 61 4.54% 86 6.32%

(a+b)

Closing Gross Portfolio Value 1,367 c. 1,425

Enquiries:

Molten Ventures plc

+44 (0)20 7931 8800

Ben Wilkinson (Chief Executive Officer)

ir@molten.vc

Andrew Zimmermann (Chief Financial Officer)

Deutsche Numis

Joint Financial Adviser and Corporate Broker

Simon Willis

+44 (0)20 7260 1000

Jamie Loughborough

Iqra Amin

Goodbody Stockbrokers

Joint Financial Adviser and Corporate Broker

Don Harrington

+44 (0) 20 3841 6202

Charlotte Craigie

Tom Nicholson

William Hall

Sodali

+44 (0)7970 246 725/

Public Relations

+44 (0)7443 648 021

Elly Williamson

molten@sodali.com

Sam Austrums

About Molten Ventures

Molten Ventures is a leading venture capital firm in Europe, developing and investing in high growth technology companies.

It invests across four sectors: Enterprise & SaaS; AI, Deeptech & Hardware; Consumer Technology; and Digital Health with highly experienced partners constantly looking for new opportunities in each.

Listed on the London Stock Exchange, Molten Ventures provides a unique opportunity for public market investors to access these fast-growing tech businesses, without having to commit to long term investments with limited liquidity. Since its IPO in June 2016, Molten has deployed over GBP1bn capital into fast growing tech companies and has realised more than GBP700m to 30 September 2025.

For more information, go to https://investors.moltenventures.com/investor-relations/plc

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BY7QYJ50 Category Code: TST TIDM: GROW LEI Code: 213800IPCR3SAYJWSW10 OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State Sequence No.: 405914 EQS News ID: 2217196 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2217196&application_name=news&site_id=dow_jones%7e%7e%7ebed8b539-0373-42bd-8d0e-f3efeec9bbed

(END) Dow Jones Newswires

October 23, 2025 02:00 ET (06:00 GMT)