Organic growth with higher margin

The third quarter was marked by strong operational performance, with all three business areas reporting year-on-year organic growth and improved profitability. The results yielded the Group's strongest third quarter on record - both in terms of operating profit and margin.

Net sales increased 1 percent, with organic sales improving 4 percent compared with the preceding year. Acquisitions made a positive contribution of 3 percent, while exchange rate effects had a negative impact of 6 percent on sales. EBITA, excluding items affecting comparability, increased 5 percent and the corresponding margin amounted to 18.1 percent (17.3). Operating cash flow increased 23 percent, and the cash conversion ratio for the rolling 12-month period was a solid 92 percent. Earnings per share rose by 11 percent, driven by the improved result and the ongoing share repurchase program.

Trelleborg Industrial Solutions reported positive organic sales compared with the same period last year. Several market segments in diversified industrials performed well, while project sales to the oil & gas industry declined - mainly due to high comparison figures from the preceding year. Deliveries to the construction industry improved sequentially but remained below the level of the preceding year. Sales to the automotive industry increased, supported by robust demand in Asia.

Trelleborg Medical Solutions posted strong year-on-year organic sales growth, partly driven by major project deliveries that are not expected to be repeated in the next quarter. In Europe, sales to medtech customers developed positively, while deliveries to the smaller life sciences segment increased significantly.

Trelleborg Sealing Solutions recorded solid year-on-year organic sales growth. The Industrials segment performed well with growth in both Europe and Asia, while sales in North America remained weak. The Automotive segment showed an overall decline, mainly due to a softer aftermarket. However, Asia developed strongly. Sales to the aerospace industry continued to show strong global growth.

During the quarter, Trelleborg Sealing Solutions completed the acquisition of Masterseals, a Singapore-based company specializing in sealing solutions for the energy sector and industrial applications, further broadening our offering. We have completed ten bolt-on acquisitions since the third quarter of last year. It should be noted that many of these acquisitions initially have a dampening effect on profitability. A key part of our value creation lies in the focused integration of acquired companies, which over time leads to profitability levels in line with those of the Group.

Our rate of investment is higher than ever, with the establishment of operations in new countries, capacity increases and technological upgrades to current operations. In the fourth quarter, factory inaugurations are planned in Vietnam and Costa Rica, alongside expansions and upgrades of existing manufacturing units. These initiatives further strengthen our global presence and create conditions for future business opportunities. Several structural improvements in progress will help make the Group's earnings capacity even more robust.

Strong regional platforms and a focus on selected applications and market segments will enable us to build an even better Trelleborg. By combining global capabilities with local presence, we create considerable competitive advantages compared with our regional competitors. Combined with bolt-on acquisitions, this strengthens the Group's growth momentum and profitability over time.

Although market uncertainty remains, our assessment is that demand in the fourth quarter will be on a par with the third quarter.

Peter Nilsson,

President and CEO

Third quarter 2025

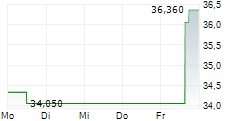

- Net sales for the quarter increased 1 percent to SEK 8,532 m (8,442). This was the highest net sales reported for a third quarter. Organic sales increased 4 percent compared with the preceding year, structural changes increased sales by 3 percent while translation of currency reduced sales by 6 percent compared with the preceding year.

- EBITA, excluding items affecting comparability, increased 5 percent to SEK 1,541 m (1,464). The exchange rate effect from the translation of foreign subsidiaries had a negative impact of SEK 90 m. The EBITA margin was 18.1 percent (17.3). This was the best earnings and highest margin for a third quarter.

- Items affecting comparability for the quarter totaled SEK -72 m (-73) and pertained to restructuring costs.

- EBITA, including items affecting comparability, amounted to SEK 1,469 m (1,391) for the quarter.

- Earnings per share, excluding items affecting comparability, amounted to SEK 4.20 (3.78), up

11 percent. - For the Group as a whole, earnings per share were SEK 3.94 (3.54).

- Operating cash flow amounted to SEK 1,741 m (1,419), up 23 percent. Cash flow was positively affected by the higher earnings generation as well as efficient working capital management.

- The cash conversion ratio for the most recent 12-month period was 92 percent (85).

Market outlook for the fourth quarter of 2025

Demand is expected to be on a par with the third quarter of 2025, adjusted for seasonal variations. Due to the geopolitical situation, the outlook is associated with continued uncertainty.

Market outlook from the interim report published on July 17, 2025, relating to the third quarter of 2025

Demand is expected to be somewhat higher compared with the second quarter of 2025, adjusted for seasonal variations. Due to the geopolitical situation, the outlook is associated with continued uncertainty.

This is a translation of the company's Interim Report in Swedish.

Contacts

Media: Vice President Communications Tobias Rydergren, +46 (0)410 67015, +46 (0)733 747015, tobias.rydergren@trelleborg.com

Investors/analysts: Vice President IR Christofer Sjögren, +46 (0)410 67068, +46 (0)708 665140, christofer.sjogren@trelleborg.com

About Us

Trelleborg leverages in-depth materials and applications expertise with early market insights, making the Group a world leader in engineered polymer solutions. We offer a unique portfolio covering a broad range of applications - even the most complex ones. In 2024, Trelleborg Group reported annual sales of approximately SEK 34 billion, with operations in around 40 countries. The Group comprises three business areas: Trelleborg Industrial Solutions, Trelleborg Medical Solutions, and Trelleborg Sealing Solutions. The Trelleborg share has been listed on the Stock Exchange since 1964 and is traded on Nasdaq Stockholm, Large Cap. www.trelleborg.com

This information is information that Trelleborg is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-10-24 07:45 CEST.