Original-Research: Intershop Communications AG - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Intershop Communications AG

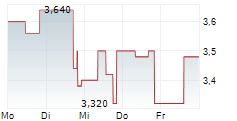

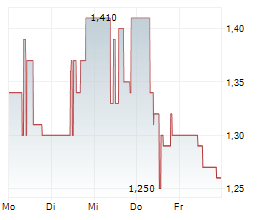

Cloud stable, services weigh down On October 22, 2025, Intershop released its 9M 2025 financial results and confirmed its guidance for FY 2025. Revenue development was soft (-15.2% yoy), but slightly exceeded our estimate by 1.0%. The decline was driven by lower service revenues due to the "Partner First" strategy and project delays, weaker license and maintenance sales following the non-recurrence of relicensing, subdued new customer activity in a challenging macro environment, contract expirations, negative FX effects. On the positive side, cloud revenues remained stable and increased in revenue share, underlining the importance of this segment. The EBIT margin declined from 2.0% to 5.6% in line with our estimate, impacted by restructuring expenses and project overruns, but supported by cost savings and stable cloud margins. Other important developments include the capital increase, which strengthened financial flexibility, and ongoing efficiency gains from headcount reductions. Guidance was confirmed, projecting a revenue decline of 10-15% yoy and an adjusted EBIT margin in the low single-digit negative range, in line with our expectations. With a stronger balance sheet, stable recurring cloud business and focus on AI investments, we see a solid mid-term positioning. We slightly decrease our target price to EUR 2.10 (previously EUR 2.30) and confirm our Buy recommendation. You can download the research here: INTERSHOP_COMMUNICATIONS_AG_20251027 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2219056 27.10.2025 CET/CEST

© 2025 EQS Group