Original-Research: HORNBACH Holding AG & Co. KGaA - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to HORNBACH Holding AG & Co. KGaA

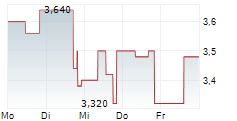

Q3-25/26: adj. EBIT below last year Based on preliminary figures for Q3 2025/26 (September 1, 2025 to November 30, 2025), HORNBACH Holding anticipates a decline in earnings compared with the same quarter of the previous year due to weaker sales growth. Net sales rose by 2.2% to EUR 1,538.7m in this period (Q3 2024/25: EUR 1,505.1m) and were weaker than expected. This means that the increase in costs could not be fully offset by sales growth. Adjusted EBIT therefore fell by 21.0% to EUR 27.3m (Q3 2024/25: EUR 34.6m). The original forecast from May 21, 2025 has been confirmed: The group continues to expect net sales in the financial year 2025/26 at or slightly above (i.e. -2% to +6%) the previous year's level (EUR 6,200m) and adjusted EBIT at the level (i.e. -5% to +5%) of the 2024/25 financial year (EUR 269.5m). However, from a current perspective, adjusted EBIT in the upper half of the projected range is not excluded but is no longer the most likely scenario. Based on its prel. Q3 2025/26 results, we marginally reduce our estimate for its adjusted EBIT. However, the company is in excellent financial health. As a result, we confirm our Buy recommendation and the EUR 110 TP. You can download the research here: HORNBACH20251208 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2241742 08.12.2025 CET/CEST

© 2025 EQS Group