VANCOUVER, British Columbia, Oct. 28, 2025 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. ("West Red Lake Gold" or "WRLG" or the "Company") (TSXV: WRLG) (OTCQB: WRLGF) is pleased to announce the commencement of a fully funded infill and conversion drilling program at its 100% owned Rowan Project located in the Red Lake Gold District of Northwestern Ontario, Canada.

HIGHLIGHTS:

- West Red Lake Gold announced results for a Preliminary Economic Assessment ("PEA") for the Rowan Project on July 8, 2025 which demonstrates robust preliminary economics for an underground mine at Rowan producing an average of 35,230 ounces ("oz") per year over a 5-year mine life at an average grade of 8.0 grams per tonne gold (a copy of this news release can be viewed HERE1).

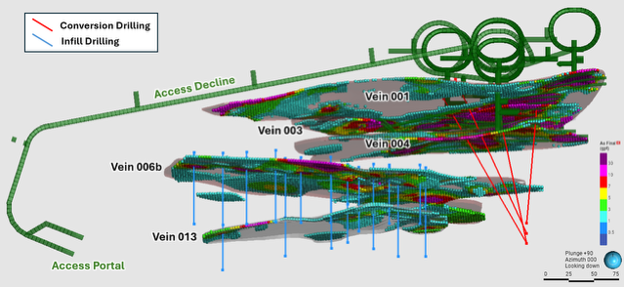

- The drill program at Rowan (Figure 1) will consist of 5,000 metres ("m") of HQ diameter diamond drilling including infill drilling on Veins 001 and 004 to support the potential upgrade of Inferred resources to Indicated2 and conversion-focused drilling on Veins 006b and 013 to provide data that may enable mine design consideration ahead of a planned combined Pre-Feasibility Study ("PFS") for the Madsen Mine and Rowan projects. This planned study will evaluate the potential for developing the two projects using shared infrastructure and integrated mine planning, with the goal of identifying possible operational and economic synergies3.

- Conversion drilling2 at Rowan will be focused on Veins 001 and 004, with the objective to bring Inferred resources to an Indicated category. These veins account for the majority of PEA production tonnes. Approximately 63% of the tonnes and 72% of the ounces were already in the Indicated category in the Rowan PEA.

- Infill drilling will be focused on Veins 006b and 013 to provide data for potential inclusion in the planned combined PFS. Integration of Veins 006b and 013 could not only extend mine life at Rowan, but may also allow for ore extraction to begin approximately 6 months sooner due to closer proximity to the access portal. Accessing and mining mineralization earlier at Rowan has the potential to positively impact the net present value ("NPV") of the project. Inclusion of Veins 006b and 013 in future mine plans and the impact such inclusion could have is subject to the results of the drill program and the outcome of the combined PFS as reviewed by a Qualified Person.

- Further geotechnical, metallurgical and engineering studies are also planned at Rowan to inform the planned PFS. These studies will be conducted in conjunction with ongoing permitting efforts to advance Rowan towards Advanced Exploration status, which is required for bulk sample extraction. Permits to support Advanced Exploration activities, including underground mine development, are targeted for 2027, subject to regulatory review and consultation.

- The Advanced Exploration permit is targeted for approval in 2027, a timeline supported by the recent launch of the One Project, One Process mine permitting framework in Ontario that aims to cut review times within the mine permitting process in half for Designated Projects, a status the Company is pursuing at Rowan.4

Shane Williams, President and CEO, stated, "It's very exciting to have a drill turning again at Rowan. The Rowan project, according to the PEA, is projected to produce 35,000 ounces of gold a year. Success in advancing Rowan through permitting and development could position WRLG to target a combined production rate of up to 100,000 ounces per year gold5 in Red Lake in the coming years. The drilling at Rowan not only aims to increase confidence in the existing mineral resource but will also provide the physical core material needed to complete advanced metallurgical and geotechnical studies ahead of the planned combined PFS.

"With gold prices continuing to trade around all time highs we anticipate strong economics in the combined PFS, which is expected to be completed by Q3 2026. This study will be a significant milestone for WRLG, establishing a valuation benchmark for our total Red Lake assets. The study will also inform our permit applications; based on our discussions with permitting authorities in Ontario, we are encouraged that the new One Project, One Process permitting framework has potential to truly expedite permitting of projects like Rowan."

Figure 1. Plan view showing Rowan Veins 001, 003, 004, 006b and 013 with proposed infill and conversion drilling and current PEA underground mine design [1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled "Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada", prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company's website and on SEDAR+ at www.sedarplus.ca.

DISCUSSION

There are multiple opportunities to potentially expand and upgrade the resource and mine plan at Rowan.

The Rowan resource comprises 26 domains that capture multiple parallel veins. Three of those veins - 001, 003 and 004 - are mined in the PEA. A fourth vein with strong gold grades, called 006b, is the third largest contributor of tonnes and ounces in the current mineral resource estimate ("MRE") but was not included in the PEA mine plan because its data stems largely from historic drilling, which suffers from unsampled intervals.. Vein 013 runs adjacent and sub-parallel to Vein 006b and may demonstrate similar resource upgrade potential, subject to confirmation drilling and subsequent resource estimation by a Qualified Person.

Historic operators often only sampled and assayed drill core with quartz veining containing visible gold. Surrounding rock, including vein margins, narrow gaps between veins, and adjacent wall rock, was typically not sampled. During the MRE estimation process those unsampled intervals were assigned a value of half detection limit equal to 0.0025 grams per tonne ("gpt") gold ("Au"). This excessively diluted those areas in the resource model, which was constructed on 2-metre minimum composites for longhole stoping design consideration. During the 2023 drill campaign, WRLG demonstrated that gold mineralization regularly persists into the altered wall rock adjacent to high-grade gold veins. Selective sampling would have missed mineralization of this type. Additionally, most of the drilling on Veins 006b and 013 is from the 1980's utilizing very small 27-millimeter diameter AQ drill core with no existing competent historic core available for resampling. The 2025 drilling program will be completed with 63.5-millimeter diameter HQ drill core and will aim to infill the gaps in the historic analytical data set on Veins 006b and 013 with the goal of bringing these veins back into consideration for mine design.

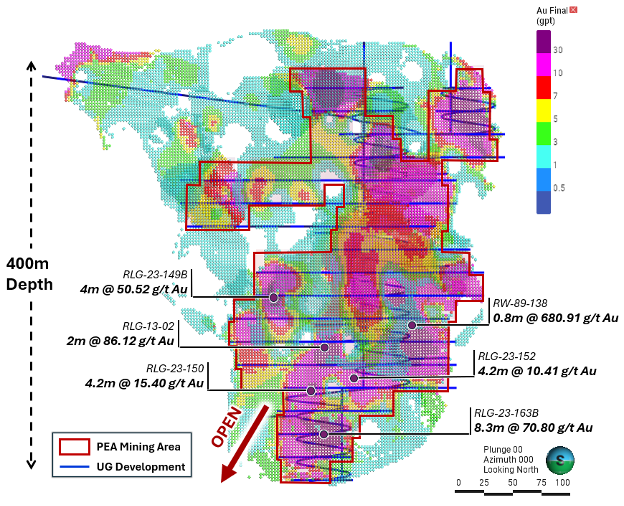

The next layer of opportunity at Rowan is based on expanding the deposit. Notably, the highest-grade intercept ever drilled at Rowan was achieved during the 2023 drill campaign when hole RLG-23-163B returned 70.8 g/t gold over 8.3 metres (interval reported as core length; true width is unknown). This intercept came from the deeper portion of Vein 001 and indicates potential for mineralization to continue at depth. The Rowan vein system has only been defined down to approximately 400 metres and remains wide open for expansion at depth (Figure 2). The Rowan deposit also remains open along strike to the east and west.

Figure 2. Long section of Rowan block model at 1 gpt Au cutoff showing PEA mine design (blue) and outline of areas planned for long hole stoping on Veins 001, 003 and 004 (red outline). Notable assay intercepts have been highlighted to indicate the strength of gold mineralization and expansion potential at depth. [Intercepts are reported as core length unless otherwise stated; true widths are estimated where available.] [2].

[2] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled "Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada", prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company's website and on SEDAR+ at www.sedarplus.ca.

________________________

1 The PEA is preliminary in nature; it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves; there is no certainty that the PEA results will be realized.

2 There can be no assurance that drilling at Rowan will result in the conversion of Inferred resources to Indicated; any such upgrade will depend on the results of the drill program and subsequent resource estimation by a Qualified Person.

3 There can be no assurance that the planned combined PFS will support the development of the Madsen Mine and Rowan projects as a single operation or using common infrastructure. Any such determination will depend on the outcome of such PFS and subsequent technical and economic studies.

4 https://news.ontario.ca/en/release/1006621/ontario-implements-one-project-one-process-to-build-mines-faster

5 The Rowan project production projection is based on the PEA for Rowan. The Madsen Mine is supported by a Pre-Feasibility Study technical report, effective January 7, 2025, prepared in accordance with NI 43-101 and available on SEDAR+. The PEA is preliminary in nature; it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA results will be realized. Any reference to a combined or target production rate for Rowan and Madsen is show for illustrative purposes only; no combined economic analysis or production schedule has been prepared. The Rowan PEA and Madsen Pre-Feasibility Study are separate studies prepared to different levels of confidence, and their results should not be blended or considered as a single project scenario. There can be no assurance that the projects will be developed using common infrastructure or as a single operation, or that such a rate will be achieved. Any such determination will depend on the outcome of the planned combined PFS and receipt of all necessary approvals.

QUALITY ASSURANCE/QUALITY CONTROL

The Rowan Mine deposit presently hosts a National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") Indicated resource of 478,707 tonnes containing 196,747 ounces ("oz") of gold grading 12.78 g/t Au and an Inferred resource of 421,181 tonnes containing 118,155 oz of gold grading 8.73 g/t Au. Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled "Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada", prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company's website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101. Mr. Robinson is not independent of WRLG. The PEA and Mineral Resource disclosure summarized herein is derived from the independent technical report prepared by Fuse Advisors Inc.

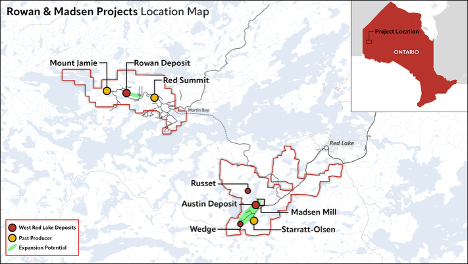

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a gold miner development company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world's richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines - Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

"Shane Williams"

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company's website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as "anticipate", "expect", "estimate", "forecast", "planned", and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to results of the drill program at Rowan; completion and results of the geotechnical, metallurgical and engineering studies to prepare for the combined PFS; timing and receipt of advanced exploration permit; anticipated timing and expected results in the combined PFS; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company's future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices; and changes in the Company's business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company's management's discussion and analysis for the year ended December 31, 2024, and the Company's annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management's current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8531e02-445b-49c2-905e-12e98fffd8a5

https://www.globenewswire.com/NewsRoom/AttachmentNg/191b54e8-08dd-4b1d-a468-acd30608531f

https://www.globenewswire.com/NewsRoom/AttachmentNg/658777b2-0c2c-475f-b72a-96e36712c982